Fatca Form Meezan Bank

What is the FATCA Form Meezan Bank

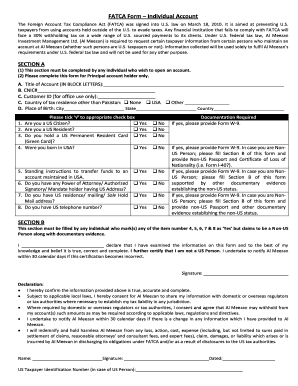

The FATCA form, specifically in the context of Meezan Bank, is designed to comply with the Foreign Account Tax Compliance Act (FATCA). This U.S. legislation requires foreign financial institutions to report information about financial accounts held by U.S. taxpayers. The form is essential for individuals and entities to disclose their foreign financial assets to ensure compliance with U.S. tax laws. It serves as a tool for the bank to collect necessary information from its clients to report to the Internal Revenue Service (IRS).

How to Use the FATCA Form Meezan Bank

Using the FATCA form at Meezan Bank involves a straightforward process. Clients must first obtain the form from the bank's official website or branch. After acquiring the form, individuals should fill it out accurately, providing all requested information regarding their financial accounts. Once completed, the form can be submitted either in person at the bank or through designated online channels. It is crucial to ensure that all information is correct to avoid any compliance issues.

Steps to Complete the FATCA Form Meezan Bank

Completing the FATCA form requires careful attention to detail. Here are the steps to follow:

- Download or request the FATCA form from Meezan Bank.

- Fill in your personal details, including your name, address, and taxpayer identification number.

- Disclose information about your foreign financial accounts, including account numbers and balances.

- Review the completed form for accuracy and completeness.

- Submit the form to Meezan Bank through the preferred submission method.

Legal Use of the FATCA Form Meezan Bank

The FATCA form is legally binding and must be completed truthfully to comply with U.S. tax regulations. Failing to provide accurate information can lead to penalties, including fines or legal action from the IRS. The form serves as a declaration of your financial status and is used by Meezan Bank to ensure compliance with FATCA requirements. Therefore, it is essential to understand the legal implications of the information provided on the form.

Key Elements of the FATCA Form Meezan Bank

Several key elements must be included in the FATCA form to ensure its validity:

- Personal Information: Full name, address, and taxpayer identification number.

- Account Information: Details of foreign financial accounts, including account types and balances.

- Signature: A signature confirming the accuracy of the information provided.

- Date of Submission: The date when the form is completed and submitted.

Required Documents

When completing the FATCA form at Meezan Bank, certain documents may be required to support the information provided. These documents can include:

- Proof of identity, such as a passport or driver's license.

- Taxpayer identification number documentation.

- Statements or records of foreign financial accounts.

Quick guide on how to complete fatca form meezan bank

Effortlessly Prepare Fatca Form Meezan Bank on Any Device

The management of online documents has gained signNow traction among both organizations and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly and without delays. Manage Fatca Form Meezan Bank on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign Fatca Form Meezan Bank with Ease

- Find Fatca Form Meezan Bank and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, be it via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled papers, tedious form searching, or errors that require reprinting new document versions. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Fatca Form Meezan Bank to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatca form meezan bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FATCA full form?

The FATCA full form is the Foreign Account Tax Compliance Act. This U.S. law requires foreign financial institutions to report information about financial accounts held by U.S. taxpayers, helping to combat tax evasion. Understanding the FATCA full form is crucial for businesses engaging in international transactions.

-

How does airSlate SignNow help with FATCA compliance?

airSlate SignNow assists businesses in achieving FATCA compliance by providing a secure platform for electronic signatures and document management. Users can ensure that all necessary documentation, including FATCA-related forms, is signed and stored securely. This streamlines compliance processes and reduces the risk of errors.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs, ensuring an economical solution for document signing. While discussing the pricing, it's essential for businesses to consider the benefits of streamlined documentation and compliance with regulations like FATCA. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, making it easier to manage documents. These features enhance compliance efforts, especially in relation to regulations like the FATCA full form. This all-in-one solution simplifies the eSignature process for businesses.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various software platforms, enhancing your workflow efficiency. Whether you use CRM software or project management tools, these integrations can help ensure that all documents related to FATCA compliance are easily accessible. This capability makes SignNow both versatile and powerful for businesses.

-

What are the benefits of using airSlate SignNow for businesses?

Using airSlate SignNow provides signNow benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies processes such as signing FATCA-related documents, which can help businesses maintain compliance while saving time and resources. Overall, it empowers companies to work smarter.

-

Is airSlate SignNow suitable for all business sizes?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, from startups to large enterprises. By utilizing its features for managing documents related to the FATCA full form, companies can scale their operations effectively while ensuring compliance. Its user-friendly interface makes it accessible for everyone.

Get more for Fatca Form Meezan Bank

Find out other Fatca Form Meezan Bank

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now