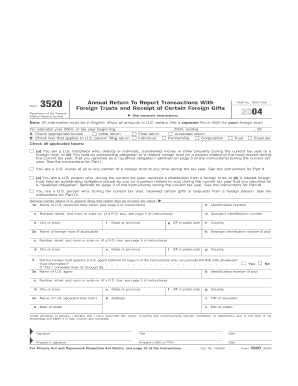

Form 3520

What is the Form 3520

The Form 3520 is a document required by the Internal Revenue Service (IRS) for reporting certain transactions with foreign trusts, as well as the receipt of certain foreign gifts. This form is crucial for U.S. taxpayers who have foreign financial interests, ensuring compliance with U.S. tax laws. It helps the IRS track foreign assets and income, which is essential for maintaining transparency in international financial dealings.

How to use the Form 3520

Using the Form 3520 involves several steps to ensure accurate reporting. Taxpayers must first determine if they are required to file the form based on their foreign transactions. If applicable, they should gather all necessary information regarding the foreign trust or gifts received. The form must be filled out completely, detailing the nature of the transactions and any relevant financial information. Once completed, it should be submitted to the IRS by the designated deadline.

Steps to complete the Form 3520

Completing the Form 3520 requires careful attention to detail. Here are the steps to follow:

- Determine your filing requirement based on foreign trusts or gifts.

- Gather necessary documentation, including details about the foreign entity or gift.

- Fill out the form accurately, providing all requested information.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the deadline, ensuring you keep a copy for your records.

Filing Deadlines / Important Dates

The deadline for filing Form 3520 typically coincides with the tax return due date, which is usually April fifteenth for most taxpayers. However, if you file for an extension on your tax return, the deadline for Form 3520 is also extended. It is essential to adhere to these deadlines to avoid penalties for late filing.

Penalties for Non-Compliance

Failure to file Form 3520 when required can result in significant penalties. The IRS imposes a penalty of five percent of the amount that should have been reported for each month the form is late, up to a maximum of twenty-five percent. In cases of willful neglect, penalties can be even more severe. Therefore, it is crucial for taxpayers to understand their obligations and file the form on time.

Required Documents

When preparing to file Form 3520, taxpayers must gather several documents to support their claims. This includes:

- Documentation of foreign gifts received, including the amount and source.

- Information about foreign trusts, including trust agreements and financial statements.

- Any correspondence with foreign entities related to the transactions.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Quick guide on how to complete form 3520

Accomplish Form 3520 effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It presents an optimal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents promptly without any delays. Manage Form 3520 on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and eSign Form 3520 with ease

- Locate Form 3520 and then click Obtain Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that task.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review the information and then click the Finish button to save your modifications.

- Choose how you would like to share your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Form 3520 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3520

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3520, and who needs to file it?

Form 3520 is an important document required by the IRS for reporting certain transactions with foreign trusts, gifts from foreign persons, and the receipt of foreign gifts. Individuals and businesses that engage in such transactions must file Form 3520 to avoid hefty penalties. Understanding this form is crucial to compliance, especially for expats and those involved in international business.

-

How can airSlate SignNow help with signing Form 3520?

airSlate SignNow offers a user-friendly platform for electronically signing Form 3520 securely and efficiently. With our robust eSignature features, you can easily upload, sign, and send this form without any hassles. Our solution ensures that you stay compliant while saving time and effort.

-

Are there any costs associated with using airSlate SignNow for Form 3520?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs for managing Form 3520 and other documents. Our pricing is transparent and competitive, designed to provide value for businesses looking to streamline their document signing process. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide to assist with Form 3520?

airSlate SignNow includes features such as templates, collaborative signing, and automated workflows which streamline the handling of Form 3520. These tools simplify the process of preparing and signing the form, making it easier for businesses to manage compliance. Additionally, our platform supports real-time tracking and notifications.

-

Is airSlate SignNow compliant with legal standards for Form 3520?

Yes, airSlate SignNow complies with electronic signature laws such as ESIGN and UETA, meaning that signatures on Form 3520 are legally binding. Our commitment to security ensures that your documents remain confidential and protected. Businesses can trust our platform to handle sensitive forms like Form 3520 safely.

-

Can I integrate airSlate SignNow with other software to manage Form 3520?

AirSlate SignNow offers integrations with various applications, making it easy to streamline your workflow for Form 3520. Whether you use CRM systems, cloud storage, or other productivity tools, you can seamlessly connect our platform to enhance document management. This integration capability allows for a more efficient process overall.

-

What are the benefits of using airSlate SignNow for Form 3520?

Using airSlate SignNow for Form 3520 provides numerous benefits, including increased efficiency and reduced turnaround time for document processing. With features designed to improve user experience, you can handle sensitive information securely while ensuring compliance. Moreover, the electronic signing process minimizes paper use, making it environmentally friendly.

Get more for Form 3520

Find out other Form 3520

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors