Audreturns Gtcounty Org Form

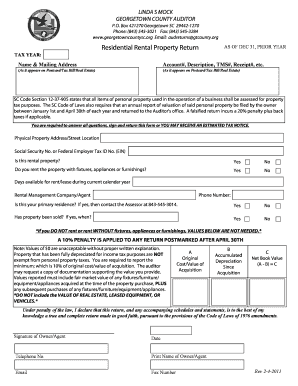

What is the Georgetown County Residential Rental Property Return

The Georgetown County Residential Rental Property Return is a specific form designed for property owners in Georgetown County to report rental income and expenses associated with residential properties. This form is essential for ensuring compliance with local tax regulations and provides the necessary information for the county to assess property taxes accurately. It captures details such as the property's address, rental income received, and any applicable deductions or expenses related to property management.

Steps to Complete the Georgetown County Residential Rental Property Return

Completing the Georgetown County Residential Rental Property Return involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including rental agreements, income statements, and expense receipts.

- Fill out the form with accurate information regarding the property, including its location and rental income.

- Detail any deductions or expenses related to property maintenance, repairs, and management fees.

- Review the completed form for accuracy, ensuring all figures and information are correct.

- Submit the form by the designated deadline, either online or through traditional mail.

Legal Use of the Georgetown County Residential Rental Property Return

The Georgetown County Residential Rental Property Return must be completed in accordance with local laws and regulations governing rental properties. This includes adhering to guidelines set forth by the county's tax authority. Properly filing this return not only helps avoid penalties but also ensures that property owners are accurately reporting their rental income, which is essential for tax purposes. Failure to comply with these regulations can result in fines or other legal repercussions.

Filing Deadlines / Important Dates

It is crucial for property owners to be aware of the filing deadlines associated with the Georgetown County Residential Rental Property Return. Typically, these returns are due annually, and specific dates may vary based on local regulations. Property owners should mark their calendars for these important dates to ensure timely submission and avoid potential penalties for late filings.

Required Documents

To accurately complete the Georgetown County Residential Rental Property Return, property owners must gather several key documents:

- Rental agreements outlining terms and conditions of rental arrangements.

- Income statements detailing total rental income received during the reporting period.

- Receipts for any expenses related to property maintenance, repairs, and management.

- Previous tax returns that may provide context for current reporting.

Form Submission Methods

The Georgetown County Residential Rental Property Return can be submitted through various methods to accommodate different preferences. Property owners may choose to file the form online via the county's tax authority website, which often provides a streamlined process. Alternatively, the form can be mailed directly to the appropriate office or submitted in person at designated locations. Each method has its own advantages, so property owners should select the one that best suits their needs.

Quick guide on how to complete audreturns gtcounty org

Effortlessly prepare Audreturns Gtcounty Org on any device

Digital document management has become increasingly popular among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily access the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Audreturns Gtcounty Org on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

Steps to alter and eSign Audreturns Gtcounty Org effortlessly

- Find Audreturns Gtcounty Org and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal significance as an ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Change and eSign Audreturns Gtcounty Org to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the audreturns gtcounty org

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a Georgetown County residential rental property return?

To file a Georgetown County residential rental property return, you need to gather all relevant income and expenses related to your rental property. Using airSlate SignNow, you can easily eSign and send your completed documents. Ensure all information is accurate to avoid delays in processing.

-

What documents do I need for the Georgetown County residential rental property return?

For the Georgetown County residential rental property return, you typically need rental income statements, expense receipts, and property ownership documents. Utilizing airSlate SignNow allows you to compile and sign these documents digitally, streamlining the return process.

-

Are there any fees associated with filing my Georgetown County residential rental property return?

Yes, there may be fees for filing your Georgetown County residential rental property return, depending on property value and local regulations. With airSlate SignNow, you can save costs by eSigning and submitting your documents online, eliminating traditional mailing expenses.

-

How can airSlate SignNow help me with my Georgetown County residential rental property return?

airSlate SignNow provides a cost-effective solution for managing your Georgetown County residential rental property return. Its user-friendly interface allows for quick document preparation, eSigning, and secure submission, making the filing process efficient and hassle-free.

-

Can I integrate other tools with airSlate SignNow for my Georgetown County residential rental property return?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that can assist you in managing your Georgetown County residential rental property return, such as accounting software and property management systems. This ensures a seamless workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for my Georgetown County residential rental property return?

Using airSlate SignNow for your Georgetown County residential rental property return allows you to streamline document management, reduce turnaround times, and improve accuracy. Its cost-effective pricing and user-friendly features make it a top choice for property owners.

-

How secure is the process of filing my Georgetown County residential rental property return through airSlate SignNow?

Security is a priority with airSlate SignNow, particularly when filing your Georgetown County residential rental property return. The platform employs advanced encryption and security measures to protect your sensitive information throughout the entire eSigning and submission process.

Get more for Audreturns Gtcounty Org

Find out other Audreturns Gtcounty Org

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation