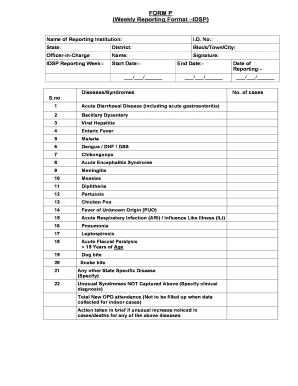

Form P

What is the Form P

The Form P is a specific document utilized in various administrative and legal processes. It serves as a formal request or declaration, often required by governmental or regulatory bodies. Understanding the purpose and requirements of the Form P is essential for ensuring compliance and facilitating smooth processing. This form may be necessary for applications, registrations, or other official transactions.

How to use the Form P

Using the Form P involves several key steps. First, ensure that you have the correct version of the form, as there can be updates or variations. Next, gather all necessary information and documents required to complete the form accurately. When filling out the form, pay close attention to each section, providing clear and precise information. After completion, review the form for any errors or omissions before submission.

Steps to complete the Form P

Completing the Form P requires a systematic approach. Follow these steps:

- Obtain the latest version of the Form P from the appropriate source.

- Read the instructions carefully to understand the requirements.

- Gather all necessary personal or business information needed for the form.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any mistakes or missing information.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form P

The legal use of the Form P is crucial for its acceptance by authorities. To ensure that the form is legally binding, it must be completed in accordance with specific regulations and guidelines. This includes providing accurate information, signing where required, and adhering to any submission deadlines. Failure to comply with these legal standards may result in delays or rejection of the form.

Required Documents

When preparing to submit the Form P, certain documents may be required to support your application. These documents can include identification, proof of residency, or other relevant paperwork that substantiates the information provided in the form. It is important to check the specific requirements associated with the Form P to ensure that all necessary documents are included with your submission.

Form Submission Methods

The Form P can typically be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate address.

- In-person submission at a designated office or agency.

Choosing the correct submission method is essential for timely processing and compliance with regulations.

Quick guide on how to complete form p

Complete Form P effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can acquire the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form P on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to edit and eSign Form P with ease

- Locate Form P and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form P and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dphodisha nic in and how does it relate to airSlate SignNow?

dphodisha nic in is an essential platform for document management in Odisha. By utilizing airSlate SignNow, users can seamlessly eSign documents and manage their transactions efficiently, ensuring compliance with local regulations. This integration enhances the overall experience for businesses needing reliable solutions.

-

What pricing options does airSlate SignNow offer for users related to dphodisha nic in?

airSlate SignNow offers competitive pricing plans tailored for all types of users, whether you are a startup or an established business. For those interested in dphodisha nic in processes, the plans are structured to ensure cost-effectiveness while providing access to essential features. You can check their official site for specific pricing related to your needs.

-

What features does airSlate SignNow provide to enhance document signing for dphodisha nic in?

airSlate SignNow includes a variety of powerful features such as customizable templates, bulk sending, and automatic reminders, which cater well to users needing dphodisha nic in functionalities. These features make it easy to automate your document workflows, saving time in processing and managing paperwork. Additionally, security is prioritized to protect sensitive information.

-

How can airSlate SignNow benefit businesses using dphodisha nic in?

By integrating airSlate SignNow into their operations, businesses can signNowly streamline their document signing processes related to dphodisha nic in. This efficiency leads to faster turnaround times, enhanced productivity, and improved customer satisfaction due to quicker service delivery. Plus, the affordability of airSlate SignNow makes it accessible for all business sizes.

-

Are there integrations available with airSlate SignNow for dphodisha nic in?

Yes, airSlate SignNow offers various integrations with popular applications and platforms that are crucial for businesses dealing with dphodisha nic in. These integrations facilitate seamless data transfer and enhance workflow efficiency, allowing users to connect their document processes with existing business systems easily. Check the integration section on their site for specifics.

-

Is there customer support available for users of airSlate SignNow related to dphodisha nic in?

Absolutely! airSlate SignNow provides robust customer support to assist users with their queries, especially those focused on dphodisha nic in. Their support team is dedicated to ensuring users fully understand how to utilize the platform effectively. Support options include live chat, email, and a comprehensive help center.

-

Can airSlate SignNow be used for managing compliance related to dphodisha nic in?

Yes, airSlate SignNow is designed to help businesses maintain compliance with regulations related to dphodisha nic in. The platform ensures that all eSignatures are legally binding and secure. Furthermore, its audit trails provide documentation of all actions taken on a document, which is vital for compliance purposes.

Get more for Form P

Find out other Form P

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy