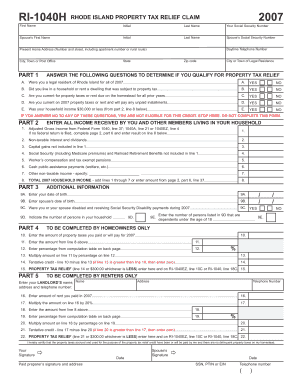

Ri 1040h Form

What is the Ri 1040h Form

The Ri 1040h form is a specific tax document used by residents of Rhode Island to report their income and determine their state tax liability. This form is essential for individuals who need to file their state tax returns and is designed to capture various income types, deductions, and credits applicable to Rhode Island taxpayers. Understanding this form is crucial for ensuring compliance with state tax regulations and for accurately calculating tax obligations.

How to use the Ri 1040h Form

To use the Ri 1040h form effectively, individuals should first gather all necessary financial documents, including W-2s, 1099s, and records of any other income. Once the required information is compiled, taxpayers can begin filling out the form, ensuring that all sections are completed accurately. It is important to follow the instructions provided with the form closely to avoid errors that could lead to delays or penalties. After completing the form, taxpayers can submit it electronically or via mail, depending on their preference.

Steps to complete the Ri 1040h Form

Completing the Ri 1040h form involves several key steps:

- Gather all relevant tax documents, including income statements and receipts for deductions.

- Begin filling out the form by entering personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any applicable deductions and tax credits to reduce taxable income.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form electronically through a secure platform or mail it to the appropriate state tax office.

Legal use of the Ri 1040h Form

The Ri 1040h form must be used in accordance with Rhode Island tax laws to ensure its legal validity. This includes providing accurate information and adhering to filing deadlines. Failing to comply with these regulations can result in penalties or legal repercussions. It is essential for taxpayers to understand their obligations and rights under state law when using this form.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Ri 1040h form to avoid late fees and penalties. Typically, the deadline for filing state tax returns in Rhode Island is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates on filing dates each tax year to ensure timely submission.

Required Documents

When completing the Ri 1040h form, taxpayers need to gather several key documents to support their income claims and deductions. These documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Receipts for deductible expenses, such as medical costs or charitable contributions

Having these documents ready will facilitate a smoother and more accurate filing process.

Quick guide on how to complete ri 1040h form

Complete Ri 1040h Form with ease on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage Ri 1040h Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to adjust and eSign Ri 1040h Form effortlessly

- Locate Ri 1040h Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign option, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Modify and eSign Ri 1040h Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri 1040h form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ri 1040h and how does it relate to eSigning documents?

The ri 1040h is a specific tax form in Rhode Island that allows for certain property tax relief for qualifying homeowners. airSlate SignNow can help simplify the process by allowing you to eSign the ri 1040h form digitally, ensuring that your information is securely transmitted and processed without unnecessary delays.

-

How does airSlate SignNow help with completing the ri 1040h form?

With airSlate SignNow, you can easily upload and fill out the ri 1040h form digitally. Our platform lets you add signatures, initials, and any other necessary information seamlessly, making tax filing easier and more efficient.

-

Is airSlate SignNow cost-effective for individuals needing to file the ri 1040h?

Yes, airSlate SignNow offers a cost-effective solution for individuals needing to file the ri 1040h. Our pricing plans are designed to cater to a variety of users, from individuals to businesses, ensuring you receive value without compromising on features.

-

What features does airSlate SignNow provide for users of the ri 1040h?

airSlate SignNow provides robust features for users of the ri 1040h, including secure eSigning, document storage, and the ability to customize templates. These features not only expedite the filing process but also enhance organization and compliance.

-

Can airSlate SignNow integrate with other software when filing the ri 1040h?

Yes, airSlate SignNow offers integrations with various software applications to streamline the filing of the ri 1040h. You can connect it with popular accounting and document management tools for a smoother workflow.

-

What are the benefits of using airSlate SignNow for the ri 1040h?

Using airSlate SignNow for the ri 1040h has multiple benefits, including faster turnarounds, reduced paperwork, and enhanced security for your sensitive information. Our user-friendly interface also means you can complete your filings with ease.

-

Is it secure to eSign the ri 1040h with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to protect your data when eSigning the ri 1040h, ensuring that your information remains confidential and secure throughout the process.

Get more for Ri 1040h Form

Find out other Ri 1040h Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors