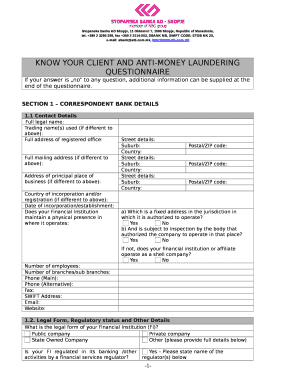

KNOW YOUR CLIENT and ANTI MONEY LAUNDERING QUESTIONNAIRE Form

What is the Know Your Client and Anti Money Laundering Questionnaire

The Know Your Client and Anti Money Laundering Questionnaire is a crucial document used by financial institutions and businesses to identify and verify their clients' identities. This form is designed to assess the risk of money laundering and other financial crimes by gathering essential information about the client. It typically includes personal details, financial history, and information related to the client's business activities. By completing this questionnaire, businesses can ensure compliance with regulatory requirements and protect themselves from potential legal issues.

How to Use the Know Your Client and Anti Money Laundering Questionnaire

Using the Know Your Client and Anti Money Laundering Questionnaire involves several straightforward steps. First, ensure that you have the most current version of the form. Next, gather all necessary information, including personal identification details and financial records. Carefully fill out the questionnaire, being truthful and thorough in your responses. Once completed, review the form for accuracy and sign it digitally to ensure it is legally binding. This process not only helps in compliance but also establishes a transparent relationship with your clients.

Steps to Complete the Know Your Client and Anti Money Laundering Questionnaire

Completing the Know Your Client and Anti Money Laundering Questionnaire can be simplified by following these steps:

- Obtain the latest version of the questionnaire from a reliable source.

- Collect necessary documentation, such as identification and financial statements.

- Fill out the questionnaire, ensuring all fields are completed accurately.

- Review your answers for completeness and correctness.

- Sign the document electronically to validate it.

- Submit the completed questionnaire according to your organization’s procedures.

Legal Use of the Know Your Client and Anti Money Laundering Questionnaire

The legal use of the Know Your Client and Anti Money Laundering Questionnaire is governed by various regulations aimed at preventing financial crimes. This form must be completed in accordance with the Bank Secrecy Act and other relevant laws. When used correctly, it provides a legal framework for verifying client identities and assessing risks associated with money laundering. Ensuring compliance with these regulations not only protects the business but also contributes to the integrity of the financial system.

Key Elements of the Know Your Client and Anti Money Laundering Questionnaire

Key elements of the Know Your Client and Anti Money Laundering Questionnaire typically include:

- Client identification information, such as name, address, and date of birth.

- Details regarding the nature of the client's business or occupation.

- Financial information, including sources of income and assets.

- Risk assessment questions to evaluate potential money laundering risks.

- Signature and date to confirm the accuracy of the information provided.

Examples of Using the Know Your Client and Anti Money Laundering Questionnaire

Examples of using the Know Your Client and Anti Money Laundering Questionnaire can be found across various sectors. For instance, banks often require this form during account opening processes to ensure compliance with federal regulations. Investment firms may use it to evaluate new clients before processing transactions. Additionally, real estate agencies may implement this questionnaire to verify the identities of buyers and sellers, thereby mitigating risks associated with property transactions.

Quick guide on how to complete know your client and anti money laundering questionnaire

Complete KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, alter, and electronically sign your documents swiftly without delays. Handle KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE on any gadget with airSlate SignNow Android or iOS applications and simplify any document-driven task today.

The easiest method to alter and electronically sign KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE with ease

- Obtain KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE and click Get Form to initiate.

- Utilize the tools we offer to submit your document.

- Highlight pertinent sections of the documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form: via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, laborious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your needs in document management with just a few clicks from any device you choose. Modify and electronically sign KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the know your client and anti money laundering questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE feature in airSlate SignNow?

The KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE feature in airSlate SignNow allows businesses to easily create and manage essential client onboarding documents. This feature helps ensure compliance with legal regulations by gathering necessary information from clients, streamlining the KYC and AML processes.

-

How does airSlate SignNow help with compliance using the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE?

airSlate SignNow provides templates and customizable forms for the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE, ensuring that all necessary data is collected efficiently. This helps businesses stay compliant with financial regulations and reduces risks associated with money laundering.

-

Is there a cost associated with the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE feature?

airSlate SignNow offers flexible pricing plans that include access to features like the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE. Depending on your chosen plan, you can benefit from this feature at a competitive price, providing excellent value for your compliance needs.

-

Can I integrate the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE with other applications?

Yes, airSlate SignNow provides numerous integration options for the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE feature. You can seamlessly connect with various CRM systems and other tools that your business uses, making client onboarding and compliance processes more efficient.

-

What are the benefits of using the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE in airSlate SignNow?

Utilizing the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE in airSlate SignNow enhances your business operations by automating client data collection and ensuring compliance. This leads to improved accuracy, faster onboarding times, and reduced administrative burdens.

-

How can I customize the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE in airSlate SignNow?

airSlate SignNow allows users to easily customize the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE to meet their specific needs. You can adjust questions, add fields, and tailor the design to reflect your brand while ensuring that all compliance requirements are met.

-

Is the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE secure?

Yes, airSlate SignNow prioritizes security, ensuring that the KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE data is protected. We utilize industry-leading encryption and secure data storage to keep your clients' sensitive information safe and compliant with regulatory standards.

Get more for KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE

Find out other KNOW YOUR CLIENT AND ANTI MONEY LAUNDERING QUESTIONNAIRE

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU