1513 0094 1231 for TTB USE ONLY DEPARTMENT of the TREASURY ALCOHOL and TOBACCO TAX and TRADE BUREAU Examined by Tax $ FEDERAL FI Form

Understanding the 1231 Form

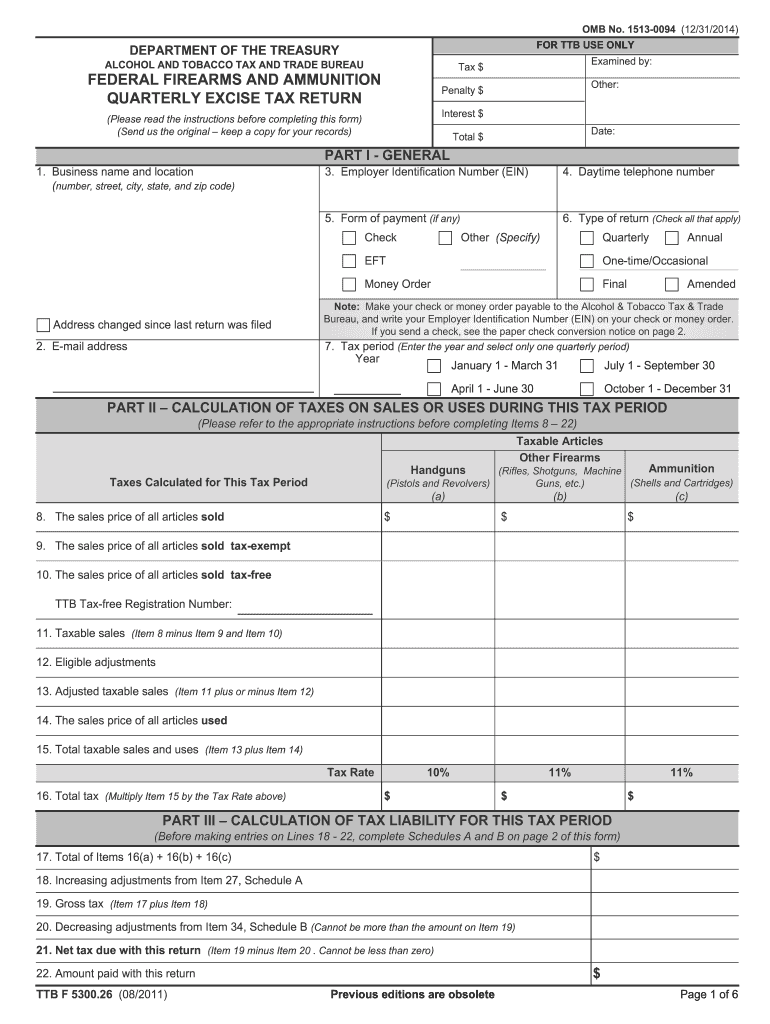

The 1231 form is specifically designated for use by the Alcohol and Tobacco Tax and Trade Bureau (TTB) under the Department of the Treasury. This form is essential for reporting quarterly excise taxes related to firearms and ammunition. It includes sections for detailing tax amounts, penalties, and interest, ensuring compliance with federal regulations. The TTB requires accurate completion of this form to maintain proper records and fulfill tax obligations.

Steps to Complete the 1231 Form

Completing the 1231 form involves several key steps:

- Gather all necessary financial records, including sales data and previous tax returns.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total excise tax owed, including any applicable penalties and interest.

- Review the form for accuracy before submission.

- Submit the form electronically or via mail, depending on your preference.

Legal Use of the 1231 Form

The 1231 form is legally binding when completed and submitted according to TTB regulations. To ensure its validity, it must be signed by an authorized individual within the organization filing the return. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws is necessary for electronic submissions.

Filing Deadlines for the 1231 Form

It is crucial to be aware of the filing deadlines associated with the 1231 form. Generally, this form must be submitted quarterly, with specific due dates set by the TTB. Late submissions may incur penalties, so keeping track of these deadlines is essential for compliance.

Required Documents for the 1231 Form

When preparing to fill out the 1231 form, it is important to have the following documents on hand:

- Sales records for the reporting period.

- Previous tax returns related to firearms and ammunition.

- Documentation of any penalties or interest incurred.

Digital vs. Paper Version of the 1231 Form

The 1231 form can be completed in both digital and paper formats. The digital version offers advantages such as ease of submission and reduced processing time. However, some may prefer the paper version for record-keeping purposes. Regardless of the format chosen, accurate completion is essential for compliance with TTB regulations.

Quick guide on how to complete 1513 0094 1231 for ttb use only department of the treasury alcohol and tobacco tax and trade bureau examined by tax federal

Effortlessly Prepare 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU Examined By Tax $ FEDERAL FI on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly substitute for traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Handle 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU Examined By Tax $ FEDERAL FI on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU Examined By Tax $ FEDERAL FI with Ease

- Locate 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU Examined By Tax $ FEDERAL FI and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about losing or misplacing files, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU Examined By Tax $ FEDERAL FI and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1513 0094 1231 for ttb use only department of the treasury alcohol and tobacco tax and trade bureau examined by tax federal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 1513 0094 1231 FOR TTB USE ONLY form?

The 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU Examined By Tax form is crucial for reporting quarterly excise taxes related to firearms and ammunition. Businesses must complete this form accurately to avoid any penalties and ensure compliance with federal regulations. It plays a signNow role in keeping your business in good standing with the TTB.

-

How does airSlate SignNow streamline the eSigning process for tax forms?

airSlate SignNow simplifies the eSigning process for documents like the 1513 0094 1231 FOR TTB USE ONLY form by allowing users to sign and send documents electronically. This ensures that all parties can quickly review and approve documents, enhancing efficiency and reducing turnaround times. With just a few clicks, you can complete your federal firearms and ammunition quarterly excise tax return.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, with options designed to be cost-effective while providing essential features. This includes the ability to manage documents such as the 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU form. Check our website for detailed pricing tiers that can fit your budget.

-

Can I integrate airSlate SignNow with other business tools?

Yes, airSlate SignNow can seamlessly integrate with a wide variety of popular business tools and applications. This includes accounting and compliance software that may involve the 1513 0094 1231 FOR TTB USE ONLY form. Integrations help streamline workflows, making it easier to manage your excise tax returns and all related documentation.

-

What features does airSlate SignNow offer for compliance?

airSlate SignNow includes robust compliance features that help businesses manage regulatory requirements, including the completion of the 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU form. Features like audit trails and secure cloud storage ensure that all your documents are properly managed and easily retrievable when needed.

-

How does airSlate SignNow ensure data security?

Data security is a top priority for airSlate SignNow. The platform employs industry-standard encryption and security protocols to protect sensitive information contained in documents such as the 1513 0094 1231 FOR TTB USE ONLY form. With airSlate SignNow, you can eSign and manage compliance documents with confidence, knowing that your data is secure.

-

What support options are available for airSlate SignNow users?

airSlate SignNow provides a variety of support options to assist users, including live chat, email support, and a comprehensive knowledge base. This ensures that any inquiries related to the 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU form can be promptly addressed. Our team is dedicated to helping you maximize the platform's potential.

Get more for 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU Examined By Tax $ FEDERAL FI

- Paraffin bath temperature form

- Discharge of chargemortgage form 3 land registration reform act

- Bond for salary paid during compulsory leave or involuntary personal leave form

- Pyt revenue sharing application with instructions pascua yaqui pascuayaqui nsn form

- Ontario building code data matrix saugeen shores form

- English 1202 june 2002 on veterans jean chretien form

- New outlook pioneers joe cleres memorial scholarship form

- Techshop guest profile and liability release portland ortop form

Find out other 1513 0094 1231 FOR TTB USE ONLY DEPARTMENT OF THE TREASURY ALCOHOL AND TOBACCO TAX AND TRADE BUREAU Examined By Tax $ FEDERAL FI

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors