13614 C Form

What is the 13614 C?

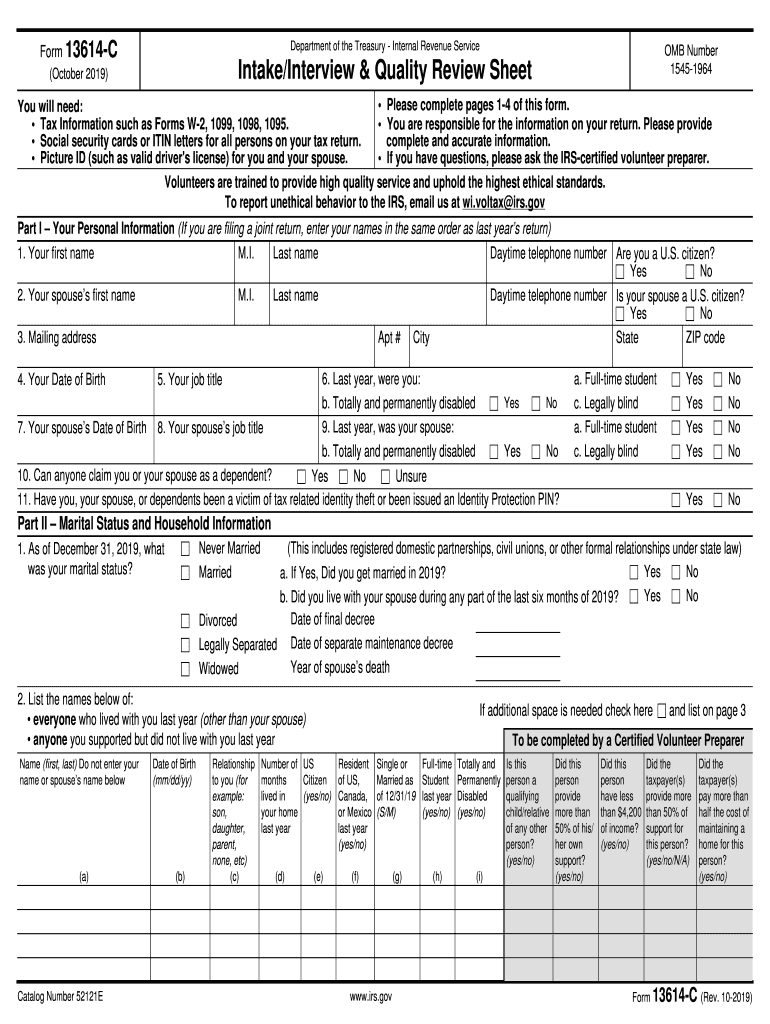

The 13614 C form is an essential document used in the tax preparation process, specifically designed for individuals seeking assistance with their tax returns. This form is utilized by the IRS to gather necessary information from taxpayers, ensuring that all relevant details are captured for accurate filing. The 13614 C includes sections for personal identification, income sources, deductions, and credits, making it a comprehensive tool for tax preparers and filers alike.

How to use the 13614 C

Using the 13614 C form involves several steps to ensure that all required information is accurately provided. Taxpayers should first gather relevant documents, such as W-2s, 1099s, and any other income statements. Once these documents are ready, individuals can fill out the form, providing details about their personal information, income, and deductions. It is important to review the completed form for accuracy before submission, as any errors may delay processing or lead to complications with the IRS.

Steps to complete the 13614 C

Completing the 13614 C form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and previous tax returns.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately, including wages, self-employment income, and other earnings.

- Detail any deductions or credits you may qualify for, such as education credits or mortgage interest deductions.

- Review the completed form for accuracy and completeness.

Legal use of the 13614 C

The 13614 C form is legally binding when filled out accurately and submitted in accordance with IRS regulations. It serves as a formal declaration of the information provided by the taxpayer. To ensure its legal standing, it is crucial that all information is truthful and complete. Any discrepancies or false information may lead to penalties or legal issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 13614 C form align with the general tax filing deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to be aware of these dates to avoid late filing penalties and ensure timely processing of their tax returns.

Required Documents

When completing the 13614 C form, several documents are required to provide accurate information. Taxpayers should have the following documents ready:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductible expenses

- Previous year’s tax return for reference

Quick guide on how to complete 13614 c

Effortlessly Prepare 13614 C on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a great eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle 13614 C on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign 13614 C with Ease

- Locate 13614 C and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign 13614 C and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 13614 c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 13614 c 2019 in the context of electronic signatures?

The term 13614 c 2019 refers to important legal standards for electronic signatures that businesses must adhere to. Understanding these regulations ensures that your documents signed via airSlate SignNow are legally binding and compliant. With airSlate SignNow, you can confidently utilize e-signatures in alignment with 13614 c 2019 guidelines.

-

How does airSlate SignNow support compliance with 13614 c 2019?

airSlate SignNow is designed to comply with various legal standards, including 13614 c 2019. It includes features like audit trails and secure storage that increase the legitimacy of your e-signed documents. This compliance helps businesses reduce legal risks associated with digital signatures.

-

Is airSlate SignNow a cost-effective solution for businesses looking to meet 13614 c 2019 standards?

Yes, airSlate SignNow is a highly cost-effective solution, allowing businesses to manage their e-signature needs while ensuring compliance with 13614 c 2019. Our flexible pricing plans cater to the needs of different businesses, providing access to necessary features without breaking the bank. This makes it easier for you to implement a legally compliant e-signature process.

-

What features does airSlate SignNow offer that relate to 13614 c 2019 compliance?

airSlate SignNow offers a range of features that enhance compliance with 13614 c 2019, such as customizable templates, secure e-signature options, and detailed audit logs. These features ensure that every document is tracked and stored securely, adhering to the legal requirements necessary for compliance. By using airSlate SignNow, you can ensure your e-signature practices align with industry standards.

-

Can airSlate SignNow integrate with other platforms while maintaining 13614 c 2019 compliance?

Absolutely! airSlate SignNow can easily integrate with various CRM and document management systems, ensuring that your entire workflow remains compliant with 13614 c 2019. These integrations allow for seamless document handling and e-signature processes, ensuring that your business operations are both efficient and legally compliant. You can enjoy a streamlined experience across different platforms.

-

What are the benefits of using airSlate SignNow for documents governed by 13614 c 2019?

Using airSlate SignNow provides several benefits for documents governed by 13614 c 2019, including enhanced security, compliance assurance, and time-saving features. The platform enables quick turnaround on essential documents while ensuring that every e-signature meets legal requirements. This leads to increased efficiency and reduced delays in your business processes.

-

How can I ensure that my team uses airSlate SignNow correctly to comply with 13614 c 2019?

To ensure your team uses airSlate SignNow correctly in compliance with 13614 c 2019, we recommend conducting training sessions and utilizing the platform's help center. These resources provide guidelines and best practices for e-signing documents, ensuring that everyone understands compliance requirements. Additionally, our customer support team is always available to assist with any questions.

Get more for 13614 C

Find out other 13614 C

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document