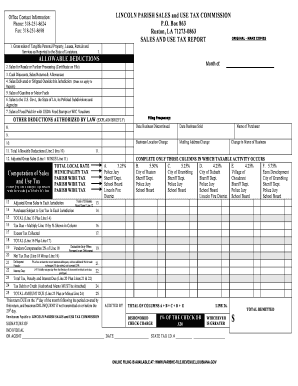

Lincoln Parish Sales Tax Form

What is the Lincoln Parish Sales Tax

The Lincoln Parish sales tax is a local tax imposed on the sale of goods and services within Lincoln Parish, Louisiana. This tax is collected by businesses at the point of sale and is typically added to the purchase price. The revenue generated from this tax is used to fund various public services and infrastructure projects in the parish. Understanding this tax is crucial for both consumers and businesses operating in the area.

How to use the Lincoln Parish Sales Tax

Using the Lincoln Parish sales tax involves understanding how it applies to your purchases. When you buy goods or services, the sales tax will be calculated based on the total sale price. Businesses must ensure they are collecting the correct amount of tax from customers and remitting it to the appropriate tax authorities. It is important for consumers to be aware of the tax rate to understand the total cost of their purchases.

Steps to complete the Lincoln Parish Sales Tax

To complete the Lincoln Parish sales tax process, follow these steps:

- Determine the applicable sales tax rate for your transaction.

- Calculate the sales tax based on the total purchase price.

- Add the calculated sales tax to the total amount due.

- Collect the total amount from the customer at the point of sale.

- Remit the collected sales tax to the Lincoln Parish tax authority by the designated deadline.

Legal use of the Lincoln Parish Sales Tax

The legal use of the Lincoln Parish sales tax requires compliance with local and state regulations. Businesses must register with the appropriate tax authority and obtain a sales tax permit. It is essential to maintain accurate records of all sales transactions and the corresponding sales tax collected. Failure to comply with these regulations can result in penalties and fines.

Filing Deadlines / Important Dates

Filing deadlines for the Lincoln Parish sales tax are critical for businesses to avoid late fees. Typically, sales tax returns must be filed monthly or quarterly, depending on the volume of sales. It is advisable to check with the Lincoln Parish tax authority for specific deadlines and ensure timely submission of all required documents.

Penalties for Non-Compliance

Non-compliance with Lincoln Parish sales tax regulations can lead to various penalties. Businesses may face fines for late payments, underreporting sales, or failing to collect the appropriate tax. Additionally, repeated non-compliance can result in the loss of the sales tax permit, affecting the ability to operate legally within the parish.

Quick guide on how to complete lincoln parish sales tax

Effortlessly Prepare Lincoln Parish Sales Tax on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the correct template and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to swiftly create, amend, and electronically sign your documents without any holdups. Handle Lincoln Parish Sales Tax on any device using the airSlate SignNow applications for Android or iOS, and streamline your document-related processes today.

The easiest way to modify and electronically sign Lincoln Parish Sales Tax effortlessly

- Find Lincoln Parish Sales Tax and then click Get Form to initiate.

- Utilize the resources we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes only moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you choose. Edit and electronically sign Lincoln Parish Sales Tax to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lincoln parish sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the current Lincoln Parish sales tax rate?

The current Lincoln Parish sales tax rate is a combination of state and local taxes, typically totaling around 9.75%. This rate can vary depending on specific local ordinances, so it's essential to verify with local authorities for the most accurate updates.

-

How does the Lincoln Parish sales tax rate impact my business?

The Lincoln Parish sales tax rate affects how businesses price their products and services. Understanding this rate is crucial for compliance and ensuring that you are collecting the correct amount from customers.

-

Are there tools to help calculate the Lincoln Parish sales tax rate?

Yes, there are several online tools and resources available that can help you calculate the Lincoln Parish sales tax rate. Utilizing eSignature solutions like airSlate SignNow can also facilitate document workflows and ensure accurate tax handling.

-

How can businesses benefit from understanding the Lincoln Parish sales tax rate?

Having a clear understanding of the Lincoln Parish sales tax rate allows businesses to manage their invoices and pricing strategies effectively. This knowledge helps prevent any compliance issues and can improve customer trust by ensuring accurate billing.

-

Does airSlate SignNow integrate with accounting software for tax calculations?

Yes, airSlate SignNow offers integrations with various accounting software solutions that can help businesses manage their finances, including calculating the Lincoln Parish sales tax rate. This integration streamlines document management and ensures that all financial documents are accurate.

-

What features does airSlate SignNow offer to assist with sales tax documentation?

airSlate SignNow provides features like templates, cloud storage, and secure eSigning, which help businesses manage documents related to the Lincoln Parish sales tax rate efficiently. These tools simplify tax documentation processes, allowing for quick and easy updates.

-

Is airSlate SignNow a cost-effective solution for handling Lincoln Parish sales tax documents?

Absolutely, airSlate SignNow is a cost-effective solution for handling all sorts of documentation, including those related to the Lincoln Parish sales tax rate. With its competitive pricing and robust features, it’s an ideal choice for businesses looking to save time and resources.

Get more for Lincoln Parish Sales Tax

- Isscr 2016 attendee letter of invitation san franciscopdf sky nankai edu form

- Parrot in the oven leonaqsielacom form

- Inductive reasoning worksheet with answer key form

- Parenting plan fulton county superior court form

- Application for garage policy rechaixinsurancecom form

- Form rp11

- 1700 44 youth programs activity plan and after action cyp form

- Esthetician client intake form pdf bbiketexbizb

Find out other Lincoln Parish Sales Tax

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast