Sample Closing Protection Letter Form

What is the Sample Closing Protection Letter

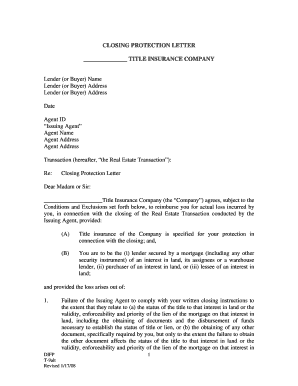

The sample closing protection letter is a crucial document used in real estate transactions, particularly during the closing phase. It serves to protect parties involved in the transaction, such as buyers and lenders, by ensuring that they are covered against potential losses resulting from fraud or misrepresentation by the closing agent. This letter is issued by a title insurance company and outlines the terms under which the protection is provided. It is essential for facilitating trust and security in the closing process, especially in transactions involving large sums of money.

How to Use the Sample Closing Protection Letter

Using the sample closing protection letter involves several steps to ensure its effectiveness and compliance with legal standards. First, parties involved should review the document carefully to understand the coverage it provides. Next, it should be completed accurately, including all necessary details such as the names of the parties, property information, and any specific terms related to the transaction. Once filled out, the letter must be signed by the relevant parties, and a copy should be retained for records. It is advisable to consult with a legal professional to confirm that all aspects of the letter meet state requirements.

Key Elements of the Sample Closing Protection Letter

Several key elements must be included in the sample closing protection letter to ensure its validity and effectiveness. These elements typically include:

- Identification of Parties: Clearly state the names and roles of all parties involved in the transaction.

- Property Description: Provide a detailed description of the property being purchased or financed.

- Scope of Coverage: Outline the specific protections offered, including any limitations or exclusions.

- Signatures: Ensure that all parties sign the document to validate the agreement.

- Effective Date: Indicate when the protection begins and under what conditions it remains valid.

Steps to Complete the Sample Closing Protection Letter

Completing the sample closing protection letter involves a series of methodical steps to ensure accuracy and compliance. The following steps should be followed:

- Gather Necessary Information: Collect all relevant details about the transaction, including the property address and the names of all parties.

- Fill Out the Document: Carefully enter the gathered information into the letter, ensuring clarity and completeness.

- Review for Accuracy: Double-check all entries for accuracy, as errors can lead to complications during the closing process.

- Obtain Signatures: Have all parties sign the document to confirm their agreement to the terms outlined.

- Distribute Copies: Provide copies of the signed letter to all parties involved and retain a copy for your records.

Legal Use of the Sample Closing Protection Letter

The legal use of the sample closing protection letter is governed by state laws and regulations. It is essential for the letter to comply with the legal requirements of the jurisdiction in which the property is located. This ensures that the protections offered are enforceable in a court of law. Additionally, the letter must be executed properly, with all necessary signatures and dates, to be considered legally binding. Consulting with a real estate attorney can help clarify any specific legal requirements that must be met.

How to Obtain the Sample Closing Protection Letter

Obtaining a sample closing protection letter typically involves contacting a title insurance company or a real estate attorney. Many title companies provide templates or samples of the letter that can be customized for specific transactions. Additionally, legal professionals can assist in drafting the letter to ensure it meets all necessary legal standards. It is advisable to use a reputable source to ensure the document's validity and compliance with state regulations.

Quick guide on how to complete sample closing protection letter

Effortlessly prepare Sample Closing Protection Letter on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents promptly without delays. Manage Sample Closing Protection Letter on any platform using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

Effortlessly modify and electronically sign Sample Closing Protection Letter

- Access Sample Closing Protection Letter and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors necessitating new document prints. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign Sample Closing Protection Letter and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample closing protection letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a closing protection letter?

A closing protection letter is a document that offers insurance protection in real estate transactions. It ensures that the funds are protected and that the closing process goes smoothly. By using a closing protection letter, you can mitigate risks associated with fraudulent activities during closings.

-

How do I obtain a closing protection letter?

To obtain a closing protection letter, you will need to request it from your title insurance company. They will require specific details about your transaction to issue the letter. Once provided, the letter can easily be incorporated into your overall closing documentation.

-

What are the benefits of using airSlate SignNow for closing protection letters?

Using airSlate SignNow for closing protection letters simplifies the signing and management of important documents. Our platform ensures that your closing documents are securely eSigned and stored, providing easy access for all parties involved. This streamlines the entire process and helps prevent any delays during your real estate transaction.

-

Are there any costs associated with obtaining a closing protection letter?

Yes, there may be fees associated with obtaining a closing protection letter, usually set by the title insurance company. It's important to consult your title company for specific pricing details, as these can vary. However, the cost is often minimal compared to the signNow protection it offers during a closing.

-

Can I integrate airSlate SignNow with my existing tools for closing protection letters?

Absolutely! airSlate SignNow offers integrations with various popular tools used in the real estate industry. This allows you to seamlessly incorporate our eSigning solution into your current workflow, making the management of closing protection letters and other documents more efficient.

-

How does a closing protection letter protect me?

A closing protection letter protects you by providing assurance that your funds will be disbursed correctly and that you are safeguarded against fraud. It serves as a safeguard should any issues arise during the closing process. This added layer of security can help ensure a smooth and successful transaction.

-

Is a closing protection letter required for all real estate transactions?

A closing protection letter is not required for all transactions, but it is highly recommended. It can provide peace of mind and protection for both buyers and lenders. Checking with your title insurance provider can help clarify whether it's necessary for your specific situation.

Get more for Sample Closing Protection Letter

Find out other Sample Closing Protection Letter

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document