Loan Payment Schedule Fillible Form

What is the Loan Payment Schedule Fillible Form

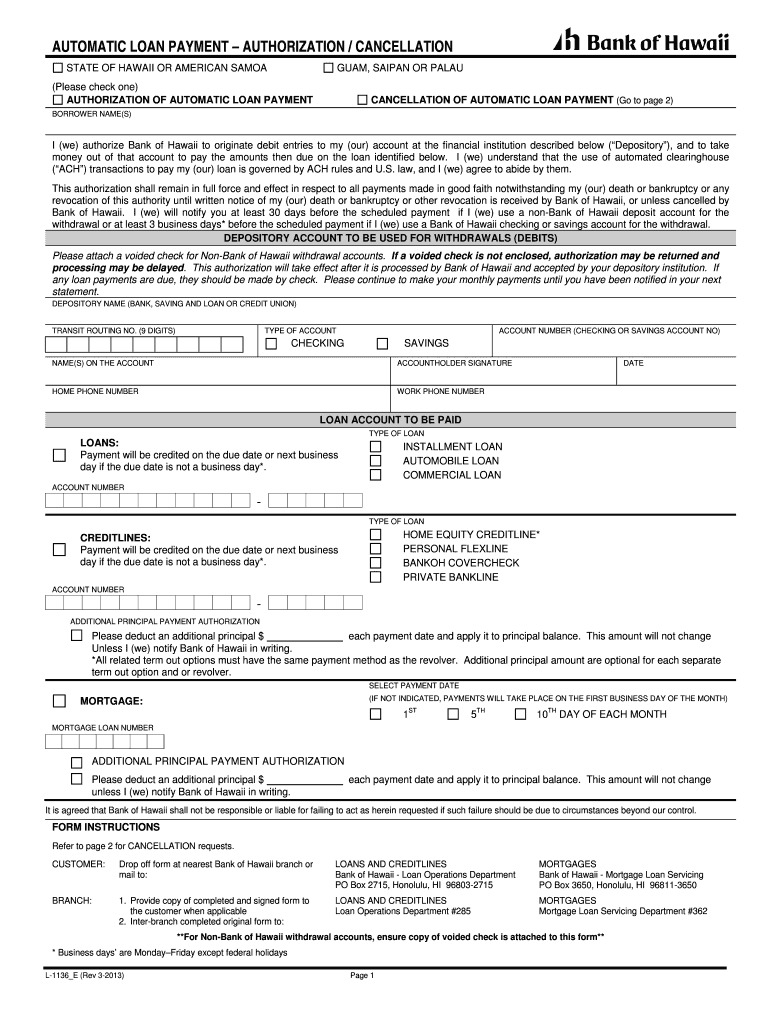

The Loan Payment Schedule Fillible Form is a crucial document used to outline the payment terms for loans. It provides a structured format for borrowers and lenders to agree on the repayment schedule, including the amount due, payment frequency, and total loan duration. This form is essential for maintaining clarity and accountability throughout the loan period. By using a fillable format, users can easily enter their specific loan details, making it convenient for both parties to review and sign.

How to use the Loan Payment Schedule Fillible Form

Using the Loan Payment Schedule Fillible Form involves several straightforward steps. First, download the form from a reliable source. Next, enter the loan details, such as the principal amount, interest rate, and payment frequency. It is important to ensure that all fields are accurately filled to avoid any misunderstandings. Once completed, both the borrower and lender should review the document for accuracy before signing. Finally, save the completed form securely for future reference.

Steps to complete the Loan Payment Schedule Fillible Form

Completing the Loan Payment Schedule Fillible Form requires careful attention to detail. Follow these steps:

- Download the fillable form from a trusted source.

- Fill in the borrower’s and lender’s names and contact information.

- Input the loan amount and specify the interest rate.

- Determine the payment schedule, including the frequency of payments (e.g., monthly, bi-weekly).

- Calculate the total payment amount and due dates for each installment.

- Review the completed form for any errors or omissions.

- Both parties should sign and date the form to finalize the agreement.

Legal use of the Loan Payment Schedule Fillible Form

The Loan Payment Schedule Fillible Form serves as a legally binding agreement between the borrower and lender when executed properly. To ensure its legal validity, both parties must sign the document, and it should comply with relevant state laws regarding loan agreements. The form should clearly outline all terms, including payment amounts and schedules, to avoid disputes. Utilizing a trusted eSignature platform can enhance the legal standing of the document by providing a digital certificate and maintaining compliance with eSignature regulations.

Key elements of the Loan Payment Schedule Fillible Form

Several key elements must be included in the Loan Payment Schedule Fillible Form to ensure its effectiveness:

- Borrower Information: Names and contact details of the borrower.

- Lender Information: Names and contact details of the lender.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage charged on the loan amount.

- Payment Schedule: Frequency and amount of payments due.

- Due Dates: Specific dates when payments are to be made.

- Signatures: Signatures of both parties to validate the agreement.

Examples of using the Loan Payment Schedule Fillible Form

The Loan Payment Schedule Fillible Form can be utilized in various scenarios. For instance, a small business owner may use it to outline repayment terms for a loan taken to expand operations. Alternatively, individuals might use the form for personal loans between family members or friends, ensuring that all parties are clear on repayment expectations. Each example highlights the form's versatility and importance in maintaining transparency and accountability in financial agreements.

Quick guide on how to complete loan payment schedule fillible form

Effortlessly Complete Loan Payment Schedule Fillible Form on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Loan Payment Schedule Fillible Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign Loan Payment Schedule Fillible Form Without the Hassle

- Obtain Loan Payment Schedule Fillible Form and click Get Form to begin.

- Use the tools available to fill out your document.

- Emphasize key sections of your documents or obscure sensitive data with features that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and errors that necessitate printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Loan Payment Schedule Fillible Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

Applying for PayPal adaptive payments, how to fill in the form?

Adaptive Accounts: is an API that allows you to provision creation of PayPal accounts through your application. You could collect all the user's profile information, call Adaptive Accounts API to create a PayPal account, and redirect the user to PayPal for them to setup their password and security information. Usually this API is highly vetted since you'll be collecting user's pii information. So unless you really need it don't select. 3rd Party Permissions - Request users grant you permission to make API calls on their behalf.: 3rd party permissions are when you need to do something on behalf of some one else. Collecting payments doesn't need 3rd party permissions since the end user explicitly approves the pre-approval in your case. But if you have a use case for your app to be able to issue refunds on behalf of your sellers, them yes you would need to use the permissions service to obtain approval from your sellers to issue refunds from their accounts.Testing Information: Basically the application review team wants to make sure they can verify the money flow. So if you can provide any information on how they can act both as a seller and also as a buyer that would help. It doesn't need to be in live - sandbox env should be more than enough. I've helped several go through this process - it's actually not that bad. But it could get frustrating when there is lack of complete information. So the more information you provide - presentations, mocks, flows, testing env/app, etc.. the better it would help the app review team understand what you're trying to use payments for. Money Aggregation and laundering are the biggest concerns they watch out for - so the more transparent your money trail is the better and quicker the process would be. Good luck!

Create this form in 5 minutes!

How to create an eSignature for the loan payment schedule fillible form

How to generate an eSignature for the Loan Payment Schedule Fillible Form in the online mode

How to create an electronic signature for the Loan Payment Schedule Fillible Form in Google Chrome

How to create an electronic signature for signing the Loan Payment Schedule Fillible Form in Gmail

How to make an eSignature for the Loan Payment Schedule Fillible Form from your smart phone

How to generate an electronic signature for the Loan Payment Schedule Fillible Form on iOS devices

How to create an electronic signature for the Loan Payment Schedule Fillible Form on Android

People also ask

-

What are fillible documents, and how does airSlate SignNow support them?

Fillible documents are interactive forms that allow users to enter information directly into designated fields. With airSlate SignNow, you can easily create and manage fillible documents, making it simple for recipients to complete and sign them online, thereby streamlining your workflow.

-

Is airSlate SignNow a cost-effective solution for creating fillible forms?

Yes, airSlate SignNow offers a variety of pricing plans designed to accommodate businesses of all sizes. By integrating fillible forms into your document workflow, you can save time and reduce administrative costs, making it a cost-effective choice for your eSignature needs.

-

What features does airSlate SignNow offer for fillible documents?

AirSlate SignNow provides robust features for fillible documents, including customizable templates, automated workflows, and real-time notifications. These features enable you to enhance your document management processes and ensure a smooth signing experience for all users.

-

Can I integrate airSlate SignNow with other tools for managing fillible forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Workspace, Salesforce, and more. This allows you to enhance your fillible form management with existing tools, ensuring a cohesive and efficient workflow.

-

How does airSlate SignNow enhance the security of fillible documents?

AirSlate SignNow employs advanced security measures to protect your fillible documents, including encryption, secure access controls, and audit trails. This ensures that your sensitive information remains confidential and complies with industry standards.

-

What are the benefits of using fillible documents for my business?

Using fillible documents can signNowly increase efficiency by eliminating manual data entry and reducing errors. With airSlate SignNow, you can streamline the completion and signing process, leading to quicker turnaround times and enhanced overall productivity.

-

Can I track the progress of my fillible documents in airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your fillible documents in real time. You can see when a document is opened, filled out, and signed, keeping you informed throughout the process.

Get more for Loan Payment Schedule Fillible Form

Find out other Loan Payment Schedule Fillible Form

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent