TAXPAYERS NOTICE to INITIATE an APPEAL Co Steuben in Form

What is the TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In

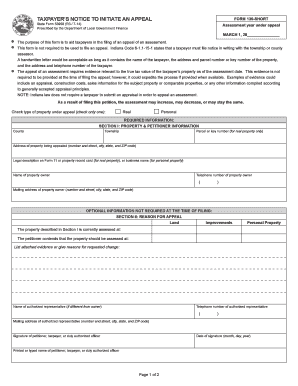

The TAXPAYERS NOTICE TO INITIATE AN APPEAL in Steuben County is a formal document used by taxpayers to contest decisions made by local tax authorities. This notice serves as the initial step in the appeal process, allowing individuals to express their disagreement with property assessments, tax liabilities, or other tax-related issues. It is crucial for taxpayers to understand the specific grounds for their appeal, as this will influence the outcome of their case.

Steps to complete the TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In

Completing the TAXPAYERS NOTICE TO INITIATE AN APPEAL involves several important steps:

- Gather necessary information: Collect all relevant documents, including tax bills, assessment notices, and any supporting evidence that justifies your appeal.

- Fill out the form: Accurately complete the notice, ensuring all required fields are filled out. Include your personal information, property details, and the specific reasons for your appeal.

- Review for accuracy: Double-check all entries for correctness to avoid delays in processing your appeal.

- Submit the notice: Follow the submission guidelines provided by the local tax authority, which may include options for online submission, mailing, or in-person delivery.

Legal use of the TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In

The legal use of the TAXPAYERS NOTICE TO INITIATE AN APPEAL is governed by state and local tax laws. This form must be submitted within specific deadlines to be considered valid. It is important to ensure compliance with all legal requirements, as failure to do so may result in the dismissal of your appeal. The notice becomes a part of the official record and can be used in hearings or court proceedings related to your tax dispute.

Filing Deadlines / Important Dates

Filing deadlines for the TAXPAYERS NOTICE TO INITIATE AN APPEAL vary by jurisdiction. In Steuben County, it is essential to submit your notice within the timeframe specified by local tax regulations. Typically, deadlines may align with the tax assessment calendar, so taxpayers should stay informed of any important dates to ensure their appeal is filed on time.

Required Documents

When submitting the TAXPAYERS NOTICE TO INITIATE AN APPEAL, certain documents are typically required to support your case. These may include:

- Copy of the tax bill or assessment notice

- Evidence supporting your claim, such as comparable property values or photographs

- Any previous correspondence with tax authorities regarding the assessment

Providing complete documentation enhances the credibility of your appeal and aids in the review process.

Who Issues the Form

The TAXPAYERS NOTICE TO INITIATE AN APPEAL is typically issued by the local tax authority or assessor's office in Steuben County. This office is responsible for managing property assessments and resolving disputes related to tax valuations. Taxpayers should contact this office for guidance on obtaining the form and understanding the appeal process.

Quick guide on how to complete taxpayers notice to initiate an appeal co steuben in

Prepare TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In easily on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Handle TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In on any device with airSlate SignNow apps for Android or iOS and streamline any document-centric task today.

The easiest way to modify and electronically sign TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In effortlessly

- Locate TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal weight as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about missing or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and electronically sign TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In and ensure excellent communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayers notice to initiate an appeal co steuben in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In?

The TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In is an official document used to formally contest property tax assessments in Steuben County. It provides taxpayers with a structured process to challenge valuations, ensuring they have a fair chance to present their case.

-

How can airSlate SignNow assist in sending the TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In?

With airSlate SignNow, you can easily create, send, and eSign the TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In electronically. Our platform streamlines the document handling process, allowing you to reduce time and avoid the hassle of manual signatures.

-

What are the pricing options for using airSlate SignNow for my TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. You can choose between individual and business subscriptions, ensuring you have cost-effective solutions for managing your TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In documents.

-

What features does airSlate SignNow offer for managing the TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In?

Our platform comes with various features, including document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to prepare and manage your TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for my appeal documents?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and various CRM systems. This enables you to streamline your workflow when handling the TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In alongside your existing tools.

-

What benefits can I expect from using airSlate SignNow for my appeal process?

Using airSlate SignNow enhances your efficiency and saves you time when dealing with the TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In. Our intuitive interface and automated processes make it simpler to manage appeals and reduce the risk of errors.

-

Is the process of creating a TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In straightforward on SignNow?

Absolutely! Creating your TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In on airSlate SignNow is user-friendly. You can quickly fill out necessary fields, customize the document, and send it out for signatures in just a few clicks.

Get more for TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In

- Table of contents ra defense form

- Breakthrough principals pdf form

- Portsmouth veterinary clinic new client form portsmouth veterinary clinic new client form

- National competitive bidding form

- Early decision agreement ed whitman college form

- Dds 1206 488224082 form

- The ultimate cuckold contract form

- Hoyer lift training checklist form

Find out other TAXPAYERS NOTICE TO INITIATE AN APPEAL Co Steuben In

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple