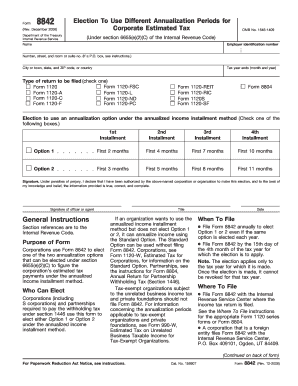

Form 8842

What is the Form 8842

The Form 8842, officially known as the IRS Form 8842, is a tax document used by certain taxpayers to claim a tax benefit related to the election of a foreign corporation to be treated as a domestic corporation. This form is essential for those who qualify under specific criteria, allowing them to potentially reduce their tax liabilities. Understanding the purpose and implications of this form is crucial for compliance with IRS regulations.

How to use the Form 8842

Using the Form 8842 involves several steps to ensure accurate completion and submission. Taxpayers must first determine their eligibility based on the criteria outlined by the IRS. Once eligibility is confirmed, the form should be filled out with precise information regarding the taxpayer's identity, the foreign corporation's details, and any relevant tax information. After completing the form, it must be submitted according to IRS guidelines, either electronically or via mail.

Steps to complete the Form 8842

Completing the Form 8842 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including taxpayer identification numbers and details about the foreign corporation.

- Fill out the form accurately, ensuring all sections are completed to prevent delays.

- Review the form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Form 8842

The legal use of the Form 8842 is governed by IRS regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the IRS regarding eligibility and submission. Proper use of the form can lead to significant tax benefits, but misuse or errors can result in penalties or audits. It is essential to understand the legal implications of filing this form to maintain compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8842 are crucial for taxpayers to observe. Typically, the form must be filed by the due date of the tax return for the year in which the election is made. Missing the deadline can lead to complications, including the loss of eligibility for certain tax benefits. It is advisable to keep track of these important dates and plan accordingly to ensure timely submission.

Required Documents

When completing the Form 8842, several documents may be required to support the claims made on the form. These documents can include:

- Taxpayer identification numbers for both the individual and the foreign corporation.

- Financial statements or records related to the foreign corporation.

- Any prior correspondence with the IRS regarding the foreign corporation.

Having these documents ready can streamline the process and ensure compliance with IRS requirements.

Quick guide on how to complete form 8842

Complete Form 8842 effortlessly on any device

Online document management has gained immense traction among businesses and individuals alike. It offers an impeccable environmentally-friendly substitute to conventional printed and signed paperwork, as you can easily locate the appropriate form and safely keep it online. airSlate SignNow equips you with all the necessary tools to generate, edit, and eSign your documents quickly without any hindrance. Manage Form 8842 from any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The optimal way to amend and eSign Form 8842 seamlessly

- Find Form 8842 and then select Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8842 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8842

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8842 and why is it important?

Form 8842 is an essential IRS document that allows certain foreign entities to claim an exemption from complying with specific requirements. It ensures that businesses are aware of their tax obligations and helps streamline their filing process. Understanding how to properly utilize form 8842 can save businesses time and money.

-

How can airSlate SignNow assist with filling out form 8842?

airSlate SignNow provides an intuitive platform that makes filling out form 8842 simple and efficient. Users can easily input their information into the form and securely eSign it within the same interface. This seamless process reduces errors and simplifies document management.

-

What features does airSlate SignNow offer for managing form 8842 submissions?

With airSlate SignNow, users can track the status of their form 8842 submissions in real-time and receive notifications once their documents are viewed or signed. Additionally, it offers customizable templates and automatic reminders, ensuring timely submission and compliance with IRS guidelines.

-

Is airSlate SignNow affordable for small businesses needing form 8842?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to suit the needs of small businesses requiring form 8842. The platform provides a range of subscription options, ensuring that even startups can access essential eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for filing form 8842?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, such as CRM and document management software. This allows businesses to enhance their workflow and efficiently manage their form 8842 submissions from one central hub.

-

What are the benefits of using airSlate SignNow for form 8842?

Using airSlate SignNow for form 8842 streamlines the filing process, reduces paper usage, and ensures a more eco-friendly approach to document management. Its user-friendly interface helps users complete forms quickly and eSign them securely, providing peace of mind and efficiency.

-

How secure is airSlate SignNow for sensitive documents like form 8842?

airSlate SignNow prioritizes security with advanced encryption and authentication measures to protect sensitive documents such as form 8842. Users can be confident that their data is safe and secure while enjoying a compliant and efficient eSigning experience.

Get more for Form 8842

- Bank_ggp_am_bau 0609 22853 form

- South washington county schools employee incident report form sowashco k12 mn

- Bcdlb a contract bformb metro driving school

- Rti handbook 20 21 form

- Army letter of introduction example form

- Form 1040 nr sp u s nonresident alien income tax return spanish version 794097201

- Form 1040 sr sp

- Schedule c form 1040 794130625

Find out other Form 8842

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile