Form 1040 Schedule C Irs

What is the Form 1040 Schedule C Irs

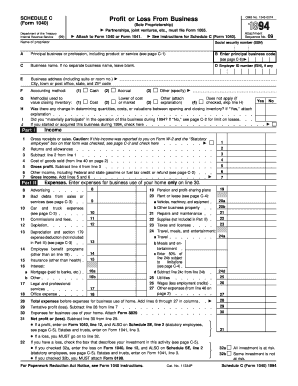

The Form 1040 Schedule C is a tax form used by self-employed individuals to report income and expenses from their business activities. This form is part of the individual income tax return process and is filed with the IRS as an attachment to Form 1040. It is essential for sole proprietors, freelancers, and independent contractors to accurately report their earnings and claim deductions related to their business operations.

How to use the Form 1040 Schedule C Irs

To use the Form 1040 Schedule C, individuals must first gather all relevant financial information pertaining to their business. This includes income statements, receipts for expenses, and any other documentation that supports the figures reported. The form requires detailed entries, including gross receipts, cost of goods sold, and various business expenses. After completing the form, it must be submitted along with the main Form 1040 during the tax filing process.

Steps to complete the Form 1040 Schedule C Irs

Completing the Form 1040 Schedule C involves several key steps:

- Gather all necessary financial documents, including income records and expense receipts.

- Fill out the identification section, providing your name, Social Security number, and business name.

- Report your gross income from the business, including all sales and services provided.

- Calculate the cost of goods sold if applicable, detailing inventory and production costs.

- List all business expenses, categorizing them into appropriate sections such as advertising, utilities, and travel.

- Calculate your net profit or loss by subtracting total expenses from gross income.

- Review the completed form for accuracy before submitting it with your Form 1040.

Legal use of the Form 1040 Schedule C Irs

The Form 1040 Schedule C is legally binding when completed accurately and submitted to the IRS. It is essential to ensure that all information provided is truthful and supported by documentation. Misreporting income or expenses can lead to penalties, audits, or legal consequences. Using electronic signature solutions can enhance the legitimacy of the submission by providing a secure and verifiable method of signing the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule C align with the standard tax filing dates in the United States. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, self-employed individuals may need to make estimated tax payments quarterly, with deadlines occurring in April, June, September, and January of the following year.

Required Documents

To complete the Form 1040 Schedule C, certain documents are required:

- Income records, including invoices, sales receipts, and bank statements.

- Expense receipts for all business-related costs, such as utilities, rent, and supplies.

- Previous tax returns, which can provide a reference for income and deductions.

- Any relevant business licenses or permits that may be required by local or state authorities.

Quick guide on how to complete form 1040 schedule c irs

Effortlessly prepare Form 1040 Schedule C Irs on any device

Managing documents online has become increasingly common for businesses and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed forms, as you can easily find the appropriate template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without any hold-ups. Manage Form 1040 Schedule C Irs on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and electronically sign Form 1040 Schedule C Irs with ease

- Locate Form 1040 Schedule C Irs and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information using tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or mistakes that necessitate reprinting copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 1040 Schedule C Irs to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule c irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 Schedule C Irs, and why do I need it?

Form 1040 Schedule C Irs is a tax form used by self-employed individuals to report income or loss from their business activities. It is essential for accurately calculating your taxable income and ensuring compliance with IRS regulations. By using airSlate SignNow, you can easily manage and eSign your Schedule C, streamlining the filing process.

-

How can airSlate SignNow help me with Form 1040 Schedule C Irs?

airSlate SignNow offers a user-friendly platform to prepare, send, and eSign your Form 1040 Schedule C Irs. Our solution simplifies document management and enhances collaboration, enabling you to collect signatures quickly and efficiently. This feature is particularly beneficial during tax season when time is of the essence.

-

What are the pricing options for using airSlate SignNow for Form 1040 Schedule C Irs?

airSlate SignNow provides various pricing plans to suit different business needs, starting at a cost-effective rate. Our plans include features specifically designed for managing tax documents like Form 1040 Schedule C Irs. Check our website for the latest pricing updates and to find a plan that best fits your requirements.

-

Is airSlate SignNow secure for storing my Form 1040 Schedule C Irs?

Yes, airSlate SignNow prioritizes the security of your documents, including Form 1040 Schedule C Irs. We employ industry-standard encryption and data protection measures to safeguard your sensitive information. With our platform, you can confidently store and manage your tax documents in a secure environment.

-

Can I integrate airSlate SignNow with other applications for managing Form 1040 Schedule C Irs?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and accounting software. This allows you to centralize your document management, including Form 1040 Schedule C Irs, in one place and enhances your overall efficiency during tax preparation.

-

What features does airSlate SignNow offer for completing Form 1040 Schedule C Irs?

airSlate SignNow offers a range of features tailored for completing Form 1040 Schedule C Irs, including customizable templates, easy eSigning, and automated workflows. These tools help you maintain accuracy and speed in your tax document processes. Our platform's intuitive design ensures you can focus on your business while we handle the paperwork.

-

How does airSlate SignNow improve the efficiency of filing Form 1040 Schedule C Irs?

By utilizing airSlate SignNow, you enhance the efficiency of filing Form 1040 Schedule C Irs through quick document creation, streamlined eSigning, and convenient sharing capabilities. Our platform minimizes delays often experienced with traditional methods, ensuring you meet your tax deadlines effectively. Enjoy a smoother filing experience with our user-friendly tools.

Get more for Form 1040 Schedule C Irs

- Instructions moving party must complete all information requested below

- The undersigned affiant applying for an order of attachment and being first duly sworn says that an action has been or form

- Order of attachm ent form

- Check only boxes that apply and fill in blanks form

- Complaint and motion for domestic violence protective order form

- Circuit court district division new hampshire judicial branch form

- To the defendant named above form

- Andor on behalf of minor family members list name and dob form

Find out other Form 1040 Schedule C Irs

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile