Form W 1

What is the Form W-1

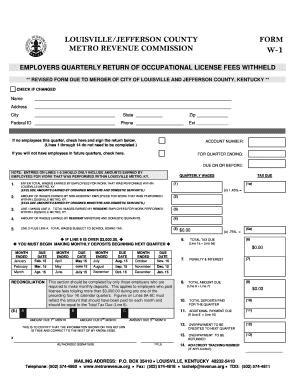

The Louisville Metro Revenue Commission Form W-1 is a crucial document used for reporting income earned within the Louisville Metro area. This form is primarily utilized by individuals and businesses to comply with local tax regulations. It serves to determine the appropriate tax obligations based on the income generated in the jurisdiction. Understanding the purpose of the Form W-1 is essential for ensuring accurate reporting and compliance with local tax laws.

How to use the Form W-1

To effectively use the Form W-1, individuals and businesses must first gather all necessary financial information, including income statements and previous tax returns. The form requires specific details about the taxpayer, such as name, address, and Social Security number or Employer Identification Number (EIN). Once the information is compiled, the taxpayer can fill out the form, ensuring that all sections are completed accurately. After completing the form, it should be submitted according to the guidelines provided by the Louisville Metro Revenue Commission.

Steps to complete the Form W-1

Completing the Form W-1 involves several key steps:

- Gather necessary documents, including income statements and identification numbers.

- Fill in personal information, including name, address, and Social Security number or EIN.

- Report total income earned within the Louisville Metro area accurately.

- Complete any additional sections as required by the form.

- Review the form for accuracy before submission.

Following these steps will help ensure that the Form W-1 is completed correctly and submitted on time.

Legal use of the Form W-1

The legal use of the Form W-1 is governed by local tax laws and regulations. It is essential for taxpayers to understand that submitting this form is not just a formality; it is a legal obligation. Failing to file the Form W-1 accurately and on time may result in penalties or legal repercussions. Therefore, ensuring compliance with all legal requirements is crucial for both individuals and businesses operating within the Louisville Metro area.

Form Submission Methods

There are several methods available for submitting the Form W-1 to the Louisville Metro Revenue Commission. Taxpayers can choose to file the form online through the commission's official website, which offers a convenient and efficient process. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated offices. Each submission method has its own guidelines, so it is important to follow the instructions carefully to ensure successful filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-1 are critical for compliance. Generally, the form must be submitted by a specific date each year, often coinciding with the federal tax filing deadline. It is advisable for taxpayers to stay informed about any changes to these deadlines, as late submissions can incur penalties. Keeping a calendar of important dates related to tax filings can help ensure timely compliance with the Louisville Metro Revenue Commission.

Quick guide on how to complete form w 1

Effortlessly Complete Form W 1 on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form W 1 on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Form W 1 without hassle

- Obtain Form W 1 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form W 1 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisville Metro Revenue Commission Form W-1?

The Louisville Metro Revenue Commission Form W-1 is a tax form used to report employee earnings and withholdings for local taxes in Louisville. It is essential for ensuring compliance with local tax regulations and is typically required by employers operating within the Louisville metro area.

-

How can airSlate SignNow help with the Louisville Metro Revenue Commission Form W-1?

airSlate SignNow streamlines the process of filling and submitting the Louisville Metro Revenue Commission Form W-1. With our eSigning capabilities, you can easily send the form for signature and ensure quick and secure completion, reducing paperwork and delays.

-

Is the airSlate SignNow solution cost-effective for handling the Louisville Metro Revenue Commission Form W-1?

Yes, airSlate SignNow offers a cost-effective solution for managing the Louisville Metro Revenue Commission Form W-1. Our pricing plans are designed to fit various budgets while providing comprehensive features to simplify document handling and eSigning.

-

What features does airSlate SignNow provide for the Louisville Metro Revenue Commission Form W-1?

airSlate SignNow includes features such as customizable templates, real-time tracking, and mobile access that can enhance how you handle the Louisville Metro Revenue Commission Form W-1. Additionally, our integration capabilities allow seamless connection with other tools you might be using.

-

Can airSlate SignNow integrate with other software for processing the Louisville Metro Revenue Commission Form W-1?

Absolutely! airSlate SignNow offers integrations with various software solutions that can help automate and streamline processes related to the Louisville Metro Revenue Commission Form W-1. This ensures that your workflow remains efficient and synchronized across platforms.

-

How does airSlate SignNow ensure the security of the Louisville Metro Revenue Commission Form W-1?

airSlate SignNow prioritizes security with advanced encryption protocols and compliance standards, ensuring that your Louisville Metro Revenue Commission Form W-1 is protected throughout the signing process. Your documents are securely stored, and access is controlled to prevent unauthorized viewing.

-

What are the benefits of using airSlate SignNow for the Louisville Metro Revenue Commission Form W-1?

Using airSlate SignNow for the Louisville Metro Revenue Commission Form W-1 provides numerous benefits, including faster turnaround times, reduced paper usage, and enhanced team collaboration. Our platform simplifies the entire process, making it easy to manage your tax forms effectively.

Get more for Form W 1

- 45 hour driving log 7 1 08 sbo nn k12 va form

- Supplements 1 3 reagent chemicals 10th edition pubs acs form

- Lummi nation unmet needs form

- Cg 5549pdf notice of federal interest uscg form

- Healthy pharms inc revised information siting profile 1 rmd applicants mass

- Summons free divorce papers and divorce forms

- Free app ocp dc form

- Rule 17 200form 212 joint statement on legal parent

Find out other Form W 1

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast