51A158 7 08 FARM EXEMPTION CERTIFICATE Form

What is the 51A158 7 08 FARM EXEMPTION CERTIFICATE

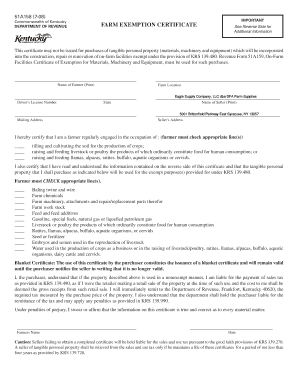

The 51A158 7 08 FARM EXEMPTION CERTIFICATE is a crucial document used in the United States to exempt certain purchases related to agricultural operations from sales tax. This certificate allows qualifying farmers and agricultural producers to avoid paying sales tax on items that are directly used in farming activities. The certificate is essential for ensuring compliance with state tax regulations while also providing financial relief to those in the agricultural sector.

Key elements of the 51A158 7 08 FARM EXEMPTION CERTIFICATE

Several key elements define the 51A158 7 08 FARM EXEMPTION CERTIFICATE. These include:

- Identification of the purchaser: The certificate must clearly state the name and address of the farmer or agricultural producer.

- Description of the items: A detailed list of the items being purchased under the exemption should be included.

- Purpose of the purchase: The form must specify how the items will be used in farming operations.

- Signature of the purchaser: The certificate requires the signature of the individual claiming the exemption, affirming the accuracy of the information provided.

How to obtain the 51A158 7 08 FARM EXEMPTION CERTIFICATE

To obtain the 51A158 7 08 FARM EXEMPTION CERTIFICATE, individuals typically need to contact their state’s tax authority or department of revenue. Most states provide the form online, allowing farmers to download and print it for completion. In some cases, farmers may also need to provide proof of their agricultural status, such as a farm identification number or other relevant documentation.

Steps to complete the 51A158 7 08 FARM EXEMPTION CERTIFICATE

Completing the 51A158 7 08 FARM EXEMPTION CERTIFICATE involves several straightforward steps:

- Download the form from your state’s tax authority website.

- Fill in your personal information, including your name and address.

- List the items you are purchasing that qualify for the exemption.

- Indicate the purpose of the purchase in relation to your farming activities.

- Sign and date the form to certify its accuracy.

Legal use of the 51A158 7 08 FARM EXEMPTION CERTIFICATE

The legal use of the 51A158 7 08 FARM EXEMPTION CERTIFICATE is governed by state tax laws. Farmers must ensure that the items purchased with this certificate are indeed used for agricultural purposes to maintain compliance. Misuse of the certificate can lead to penalties, including back taxes and fines. It is important for farmers to keep accurate records of their purchases and the corresponding uses of the items to defend their exemption claims if questioned by tax authorities.

Eligibility Criteria

Eligibility for using the 51A158 7 08 FARM EXEMPTION CERTIFICATE typically requires that the individual or business is engaged in farming or agricultural production. This can include:

- Individuals operating a farm.

- Corporations or partnerships engaged in agricultural activities.

- Businesses that produce agricultural products for sale.

Each state may have specific criteria regarding the types of purchases that qualify for exemption, so it is essential to consult local regulations.

Quick guide on how to complete 51a158 7 08 farm exemption certificate

Effortlessly Prepare 51A158 7 08 FARM EXEMPTION CERTIFICATE on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without unnecessary delays. Handle 51A158 7 08 FARM EXEMPTION CERTIFICATE on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven workflow today.

Steps to Edit and Electronically Sign 51A158 7 08 FARM EXEMPTION CERTIFICATE with Ease

- Find 51A158 7 08 FARM EXEMPTION CERTIFICATE and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you prefer to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and electronically sign 51A158 7 08 FARM EXEMPTION CERTIFICATE while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 51a158 7 08 farm exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 51A158 7 08 FARM EXEMPTION CERTIFICATE?

The 51A158 7 08 FARM EXEMPTION CERTIFICATE is a legal document that allows eligible farmers to purchase certain products without paying sales tax. This certificate can help reduce costs for agricultural businesses, making it an essential tool for those in the farming industry.

-

How can I obtain a 51A158 7 08 FARM EXEMPTION CERTIFICATE?

To obtain a 51A158 7 08 FARM EXEMPTION CERTIFICATE, you typically need to fill out an application form and provide proof of your farming operation, such as business licenses or tax documentation. Once approved, you can use the certificate for eligible purchases.

-

What features does airSlate SignNow offer for managing the 51A158 7 08 FARM EXEMPTION CERTIFICATE?

airSlate SignNow provides features like secure eSigning, document templates, and automated workflows, specifically designed to streamline the management of important documents such as the 51A158 7 08 FARM EXEMPTION CERTIFICATE. These tools help you manage forms efficiently, reducing paperwork and saving time.

-

Is airSlate SignNow cost-effective for managing the 51A158 7 08 FARM EXEMPTION CERTIFICATE?

Yes, airSlate SignNow is a cost-effective solution for managing the 51A158 7 08 FARM EXEMPTION CERTIFICATE and other documents. Our pricing plans are designed to fit various business sizes, allowing you to take advantage of powerful features without breaking the bank.

-

What are the benefits of using airSlate SignNow for farm exemption certificates?

Using airSlate SignNow for farm exemption certificates like the 51A158 7 08 FARM EXEMPTION CERTIFICATE offers benefits like enhanced security, ease of use, and faster processing times. You can eliminate the hassle of physical signatures and streamline your workflow, improving overall efficiency.

-

How does airSlate SignNow integrate with other tools for farm management?

airSlate SignNow integrates seamlessly with a variety of popular business tools, enhancing its functionality for managing the 51A158 7 08 FARM EXEMPTION CERTIFICATE. Whether you use CRM systems, accounting software, or cloud storage services, integration ensures a smoother operation in managing your farm-related documents.

-

Can multiple users access the 51A158 7 08 FARM EXEMPTION CERTIFICATE on airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to access and collaborate on the 51A158 7 08 FARM EXEMPTION CERTIFICATE simultaneously. This collaborative feature is ideal for teams, enabling all relevant stakeholders to stay informed and contribute effectively.

Get more for 51A158 7 08 FARM EXEMPTION CERTIFICATE

Find out other 51A158 7 08 FARM EXEMPTION CERTIFICATE

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple