Mra Vat Lucky Draw Form

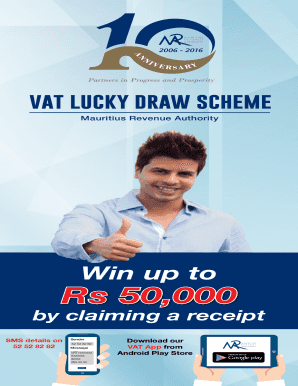

What is the Mra Vat Lucky Draw

The Mra Vat Lucky Draw is a promotional initiative designed to encourage compliance with Value Added Tax (VAT) regulations. Participants enter the draw by submitting their VAT invoices, which are then entered into a lottery system. This program aims to foster a culture of tax compliance while rewarding taxpayers for their contributions. The lucky draw not only incentivizes proper documentation but also enhances the overall transparency of the tax system.

How to use the Mra Vat Lucky Draw

Using the Mra Vat Lucky Draw involves a straightforward process. First, ensure that you have valid VAT invoices from your purchases. Next, complete the required online form, which typically includes personal information and details about the invoices you are submitting. Once the form is filled out, submit it electronically. Keep a copy of your submission for your records, as it may be needed for verification purposes.

Steps to complete the Mra Vat Lucky Draw

Completing the Mra Vat Lucky Draw is simple and can be broken down into several key steps:

- Gather all relevant VAT invoices.

- Access the Mra Vat Lucky Draw online form.

- Fill in your personal information accurately.

- Enter the details of your VAT invoices as required.

- Review your submission for accuracy.

- Submit the form electronically.

- Retain a copy of your submission for future reference.

Legal use of the Mra Vat Lucky Draw

The Mra Vat Lucky Draw is legally sanctioned as a promotional activity under the relevant tax laws. Participants must ensure that their submissions comply with the established regulations regarding VAT documentation. This includes providing legitimate invoices and adhering to the guidelines set forth by the tax authorities. Legal compliance not only protects participants but also upholds the integrity of the draw.

Eligibility Criteria

To participate in the Mra Vat Lucky Draw, individuals must meet certain eligibility criteria. Typically, participants must be registered taxpayers who have valid VAT invoices. Additionally, there may be restrictions based on the type of goods or services purchased, as well as the geographical location of the transaction. It is essential to review the specific eligibility requirements outlined by the tax authority to ensure compliance.

Required Documents

When entering the Mra Vat Lucky Draw, participants must provide specific documentation to validate their entries. The primary document required is a valid VAT invoice, which must include details such as the seller's information, transaction date, and the total amount paid. Participants may also need to submit identification documents to verify their identity and tax registration status. Ensuring that all required documents are accurate and complete is crucial for a successful entry.

Form Submission Methods

The Mra Vat Lucky Draw form can typically be submitted through various methods, primarily online. The online submission process is designed to be user-friendly, allowing participants to complete their entries quickly and efficiently. In some cases, there may be options for submitting forms via mail or in person, though these methods may vary based on local regulations. It is advisable to check the specific submission guidelines to ensure compliance with the requirements.

Quick guide on how to complete vat invoice lucky draw

Prepare vat invoice lucky draw seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to generate, modify, and electronically sign your documents swiftly without delays. Manage mra vat lucky draw on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to alter and electronically sign vat invoice lucky draw effortlessly

- Find lucky draw online form and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign mra vat lucky draw and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mra vat lucky draw

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask lucky draw online form

-

What is the mra vat lucky draw feature in airSlate SignNow?

The mra vat lucky draw feature in airSlate SignNow allows users to seamlessly integrate VAT registration processes with eSigning capabilities. This feature ensures that businesses can manage their VAT-related documentation easily while participating in the draw. By combining these functionalities, businesses can save time and reduce administrative burdens.

-

How does airSlate SignNow enhance participation in the mra vat lucky draw?

Using airSlate SignNow, participants can quickly prepare and send their entry documents for the mra vat lucky draw. The eSigning feature ensures that all necessary documents are signed and sent securely, making participation straightforward. This enhances user experience while ensuring compliance with VAT regulations.

-

What are the pricing plans for using airSlate SignNow for the mra vat lucky draw?

airSlate SignNow offers competitive pricing plans that cater to various business sizes. Choosing a plan enables you to access features necessary for participating in the mra vat lucky draw. Additionally, all plans include robust support and unlimited document signing, ensuring great value for your investment.

-

Can I integrate airSlate SignNow with other applications for mra vat lucky draw processes?

Yes, airSlate SignNow provides integration capabilities with a range of applications to streamline your mra vat lucky draw processes. Integrating with other tools helps in managing your submissions, tracking entries, and ensuring compliance. This flexibility makes it easier for businesses to use existing systems alongside airSlate SignNow.

-

What benefits does airSlate SignNow provide for managing mra vat lucky draw documentation?

Using airSlate SignNow for managing mra vat lucky draw documentation offers multiple benefits. It simplifies the documentation process with easy eSigning, reduces turnaround time, and ensures enhanced security for your documents. This means you can focus on your business while we handle the paperwork.

-

How secure is the information shared during the mra vat lucky draw with airSlate SignNow?

AirSlate SignNow prioritizes security, implementing advanced encryption and compliance protocols for all information shared during the mra vat lucky draw. This protects sensitive data, ensuring that document integrity is maintained throughout the signing process. Your peace of mind is essential, and we take it seriously.

-

Is it easy to use airSlate SignNow for first-time participants in the mra vat lucky draw?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it easy for first-time participants in the mra vat lucky draw. Comprehensive tutorials and support resources are available to help guide users through the document preparation and signing process quickly and effectively.

Get more for mra vat lucky draw

- Ohio employee enrollmentchange form 51 100 eligible aetna

- Ohio employee enrollmentchange form for groups with aetna

- Ohio medicaid sterilization forms

- Odm 06723 form

- Medicare consent to release medical records form

- Infusion order oregon medical group form

- Or medical exception prior authorization form oregon pharmacy prior authorizationprecertification request form

- Pennhip form

Find out other vat invoice lucky draw

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later