Form for Declaration of Release of SRS Fund by Product Provider IRAS

What is the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS

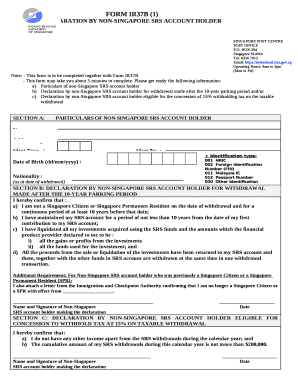

The Form For Declaration Of Release Of SRS Fund By Product Provider IRAS is a specific document used to request the release of funds from the Supplementary Retirement Scheme (SRS) by a product provider. This form is essential for individuals who wish to access their SRS funds for various purposes, such as retirement planning or investment opportunities. It serves as an official declaration that the individual is entitled to the funds and outlines the necessary details required for processing the request.

Steps to Complete the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS

Completing the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS involves several key steps:

- Gather necessary personal information, including your SRS account number and identification details.

- Clearly state the purpose for which you are requesting the release of funds.

- Provide accurate financial details, including the amount you wish to withdraw.

- Sign and date the form, ensuring that your signature matches the one on file with your product provider.

- Submit the completed form to your product provider through the designated method, whether online or by mail.

Legal Use of the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS

The Form For Declaration Of Release Of SRS Fund By Product Provider IRAS is legally binding when completed and submitted according to the guidelines set forth by the Internal Revenue Authority of Singapore (IRAS). It must be filled out accurately to ensure compliance with relevant regulations governing the release of SRS funds. Failure to adhere to these guidelines may result in delays or denial of the request.

Key Elements of the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS

Several key elements are essential for the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS:

- Personal Information: This includes the individual's name, contact details, and SRS account number.

- Purpose of Withdrawal: A clear statement regarding why the funds are being requested.

- Withdrawal Amount: The specific amount of money being requested for release.

- Signature: The individual’s signature, which verifies the authenticity of the request.

How to Obtain the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS

The Form For Declaration Of Release Of SRS Fund By Product Provider IRAS can typically be obtained directly from the website of the product provider or the IRAS. It may also be available at financial institutions that manage SRS accounts. Ensuring you have the most current version of the form is crucial for a smooth application process.

Form Submission Methods (Online / Mail / In-Person)

Once the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS is completed, it can be submitted through various methods:

- Online Submission: Many product providers offer an online portal for submitting forms electronically.

- Mail Submission: The completed form can be mailed to the product provider’s designated address.

- In-Person Submission: Some individuals may prefer to submit the form in person at the product provider’s office.

Quick guide on how to complete form for declaration of release of srs fund by product provider iras

Manage Form For Declaration Of Release Of SRS Fund By Product Provider IRAS effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Form For Declaration Of Release Of SRS Fund By Product Provider IRAS on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to modify and electronically sign Form For Declaration Of Release Of SRS Fund By Product Provider IRAS with ease

- Acquire Form For Declaration Of Release Of SRS Fund By Product Provider IRAS and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent parts of your documents or obscure sensitive information with specialized tools provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal significance as a conventional ink signature.

- Verify the information and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Adjust and electronically sign Form For Declaration Of Release Of SRS Fund By Product Provider IRAS and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form for declaration of release of srs fund by product provider iras

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS?

The Form For Declaration Of Release Of SRS Fund By Product Provider IRAS is a document that individuals need to complete to access their Supplementary Retirement Scheme (SRS) funds. This form facilitates the process of releasing funds held by product providers under SRS regulations, ensuring compliance with IRAS guidelines.

-

How can airSlate SignNow help with the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS?

airSlate SignNow streamlines the process of completing and eSigning the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS. Our platform provides a user-friendly interface that simplifies document management and allows for quick submission, ensuring you can access your funds without hassle.

-

What are the pricing options for using airSlate SignNow to complete this form?

airSlate SignNow offers flexible pricing plans to cater to various needs, including a free trial for new users. Subscription plans are competitively priced and designed to provide valuable features while ensuring that you can easily manage your Form For Declaration Of Release Of SRS Fund By Product Provider IRAS without breaking the bank.

-

Is it secure to use airSlate SignNow for the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS?

Yes, using airSlate SignNow is secure. Our platform incorporates robust security measures, including encryption and secure cloud storage, to protect your sensitive information while processing the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS. You can trust us to keep your data safe during the eSigning process.

-

What features does airSlate SignNow offer for handling the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS?

airSlate SignNow offers a range of features that enhance the experience of managing the Form For Declaration Of Release Of SRS Fund By Product Provider IRAS, including customizable templates, automated workflows, and real-time tracking of document status. These tools help ensure efficiency and transparency in the eSigning process.

-

Can I integrate airSlate SignNow with other applications for handling my SRS funds?

Absolutely! airSlate SignNow integrates seamlessly with various applications and services, enabling you to manage your Form For Declaration Of Release Of SRS Fund By Product Provider IRAS alongside your existing tools. Integrations with popular software allow for a cohesive workflow that enhances productivity.

-

What benefits can I expect from using airSlate SignNow for my SRS fund release process?

By using airSlate SignNow for your Form For Declaration Of Release Of SRS Fund By Product Provider IRAS, you can expect improved efficiency, faster turnaround times, and enhanced collaboration. Our intuitive platform simplifies the eSigning process, helping you access your SRS funds with minimal delays.

Get more for Form For Declaration Of Release Of SRS Fund By Product Provider IRAS

- V39idoc ica gov form

- Arizona form 836 annual financial report for bingo license class a azdor

- Value adjustment board late file petition request hillsclerk form

- Roller coaster physics mdriscollpbworkscom form

- Withdrawal form fixed annuity forethought life insurance

- Self assessment questionnaire p2pe form

- 2015 blumey awards participation form

- Amendment real estate purchase contract form

Find out other Form For Declaration Of Release Of SRS Fund By Product Provider IRAS

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now