Ptw Ext Form

What is the Ptw Ext

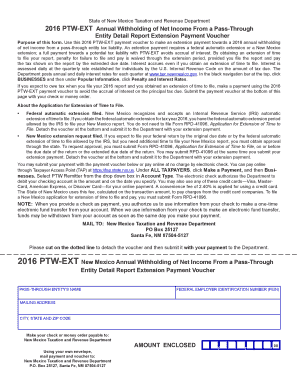

The Ptw Ext form is a specialized document used primarily in the context of certain regulatory or compliance requirements. It serves as a declaration or application for specific permissions or exemptions, depending on the context in which it is utilized. Understanding its purpose is essential for individuals and businesses looking to navigate legal or administrative processes effectively.

How to use the Ptw Ext

Using the Ptw Ext form involves several key steps to ensure it is completed accurately and submitted appropriately. Begin by gathering all necessary information related to the form's requirements. This may include personal identification details, relevant financial information, or any other data pertinent to the application. Once you have all the required information, fill out the form carefully, ensuring that each section is completed as instructed. After completing the form, review it for accuracy before submission.

Steps to complete the Ptw Ext

Completing the Ptw Ext form requires a systematic approach. Follow these steps to ensure thoroughness:

- Review the instructions accompanying the form to understand all requirements.

- Gather necessary documentation and information needed to fill out the form.

- Fill out the form, ensuring clarity and accuracy in each section.

- Double-check all entries for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Ptw Ext

The legal use of the Ptw Ext form is governed by specific regulations that outline its applicability and requirements. It is crucial to ensure that the form is used in compliance with these regulations to avoid any legal repercussions. Proper completion and submission of the form can help establish its validity in legal contexts, making it essential for users to understand the legal framework surrounding its use.

Required Documents

When completing the Ptw Ext form, certain documents may be required to support the application. These documents can vary based on the specific purpose of the form but often include:

- Identification documents, such as a driver's license or passport.

- Financial statements or tax documents relevant to the application.

- Any additional forms or declarations that may be specified in the instructions.

Form Submission Methods

The Ptw Ext form can typically be submitted through various methods, ensuring flexibility for users. Common submission methods include:

- Online submission through designated platforms or portals.

- Mailing the completed form to the appropriate agency or office.

- In-person submission at specified locations, if applicable.

Quick guide on how to complete ptw ext

Easily Prepare Ptw Ext on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without issues. Handle Ptw Ext on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to Alter and eSign Ptw Ext Effortlessly

- Locate Ptw Ext and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Alter and eSign Ptw Ext and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptw ext

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ptw ext. in airSlate SignNow?

The ptw ext. feature in airSlate SignNow allows users to streamline the process of sending and signing documents electronically. This functionality enhances efficiency by enabling real-time collaboration and quick document turnaround, making it ideal for businesses looking to simplify their workflows.

-

How does ptw ext. enhance document security?

With ptw ext., airSlate SignNow employs advanced encryption measures to ensure the security of your documents during transmission and storage. This ensures that sensitive information is protected, giving users confidence in the integrity and safety of their documents.

-

What are the pricing options for ptw ext.?

airSlate SignNow offers several pricing plans that cater to different business needs for ptw ext. These plans are designed to be cost-effective and flexible, allowing businesses of any size to choose an option that fits their budget while leveraging the full capabilities of the platform.

-

Can ptw ext. be integrated with other software?

Absolutely! The ptw ext. feature integrates seamlessly with a variety of applications, including CRM systems and cloud storage services. This integration capability enhances workflow efficiency by allowing users to manage their documents from their preferred tools without any hassle.

-

What benefits does ptw ext. offer for remote teams?

The ptw ext. feature is particularly beneficial for remote teams as it allows them to collaborate on documents in real-time from anywhere. This flexibility helps maintain productivity and ensures that all team members can contribute to document preparations without geographical restrictions.

-

Is there a mobile app for ptw ext.?

Yes, airSlate SignNow offers a mobile app that supports the ptw ext. feature, allowing users to send and eSign documents on the go. This convenience means that you can manage your documents anytime, anywhere, ensuring that you never miss an opportunity to finalize important agreements.

-

What types of documents can be managed with ptw ext.?

With ptw ext., users can manage a variety of document types, including contracts, agreements, and consent forms. This versatility makes it a great solution for numerous industries, from real estate to legal, ensuring that businesses can handle all their signing needs seamlessly.

Get more for Ptw Ext

- 2013baparentformspdf ocean institute

- Form 10 7959f 1

- Arizona aids drug assistance program new applicant eligibility form azdhs

- Us department of labor duty status report blm form

- Transport permit application colorado form

- Nuvali sticker requirements form

- Mga sagot sa pagkilala sa simuno at panaguri 1 samut samot form

- Complaint to enforce a foreign decreejudgment bristol county form

Find out other Ptw Ext

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online