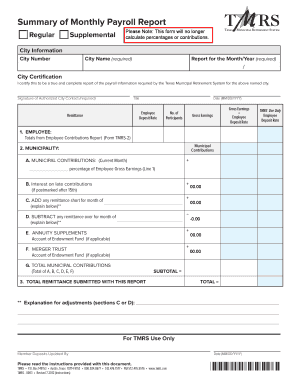

Monthly Payroll Report Form

What is the Monthly Payroll Report

The monthly payroll report is a comprehensive document that summarizes an organization's payroll activities for a given month. It typically includes details such as total wages paid, deductions for taxes and benefits, and the number of employees compensated. This report serves as a critical tool for businesses to track payroll expenses, ensure compliance with tax regulations, and maintain accurate financial records.

Key Elements of the Monthly Payroll Report

A well-structured monthly payroll report includes several key components:

- Employee Information: Names, identification numbers, and positions of all employees paid during the month.

- Total Gross Pay: The total amount earned by employees before any deductions.

- Deductions: Itemized deductions for federal and state taxes, Social Security, Medicare, and other benefits.

- Net Pay: The final amount that employees receive after all deductions have been applied.

- Employer Contributions: Any contributions made by the employer towards benefits like health insurance or retirement plans.

Steps to Complete the Monthly Payroll Report

Completing the monthly payroll report involves several important steps:

- Gather Employee Data: Collect information on all employees who received payment during the month.

- Calculate Gross Pay: Determine the total earnings for each employee, including overtime and bonuses.

- Apply Deductions: Calculate the necessary deductions for taxes, benefits, and other withholdings.

- Determine Net Pay: Subtract total deductions from gross pay to find the net pay for each employee.

- Compile the Report: Organize all collected data into a structured format, ensuring accuracy and clarity.

How to Obtain the Monthly Payroll Report

Businesses can obtain the monthly payroll report through various methods:

- Payroll Software: Many organizations utilize payroll software that automatically generates the report based on input data.

- Manual Calculation: For smaller businesses, the report can be compiled manually using spreadsheets or templates.

- Consulting Payroll Services: Outsourcing payroll to specialized firms can ensure accurate and timely report generation.

Legal Use of the Monthly Payroll Report

The monthly payroll report is not only a financial tool but also a legal document. It must comply with federal and state regulations regarding payroll reporting. This includes accurate reporting of wages, taxes withheld, and timely submission to relevant authorities. Failure to comply can result in penalties or legal repercussions, making it essential for businesses to maintain precise records and adhere to legal requirements.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for payroll reporting, including the necessary forms and deadlines. Employers must ensure that all payroll reports align with IRS regulations to avoid issues such as audits or fines. Familiarity with IRS guidelines helps businesses maintain compliance and manage their payroll processes effectively.

Quick guide on how to complete monthly payroll report 100257196

Prepare Monthly Payroll Report effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly replacement for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Monthly Payroll Report on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and electronically sign Monthly Payroll Report without hassle

- Locate Monthly Payroll Report and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it directly to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Monthly Payroll Report while ensuring excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly payroll report 100257196

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payroll report template?

A payroll report template is a structured document used to streamline payroll processing, summarizing employee earnings, deductions, and taxes. By using a payroll report template, businesses can ensure accuracy and compliance in their payroll practices. airSlate SignNow offers customizable templates that can be tailored to meet your specific payroll needs.

-

How can I create a payroll report template with airSlate SignNow?

Creating a payroll report template with airSlate SignNow is easy. Simply choose from our library of customizable templates and modify the fields to fit your payroll requirements. You can add specific details such as employee information, pay periods, and totals, making it a seamless process to generate payroll reports.

-

Are there any costs associated with using the payroll report template in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to accommodate different business sizes. Each plan includes access to features like the payroll report template along with eSigning capabilities. It's cost-effective and designed to save you time and money on document management.

-

What features does the payroll report template in airSlate SignNow offer?

The payroll report template in airSlate SignNow comes with several features to enhance your payroll process. These include easy customization options, electronic signatures, secure storage, and the ability to collaboratively edit documents. This makes the payroll report template not only functional but also user-friendly.

-

Can I automate payroll reports using airSlate SignNow's payroll report template?

Absolutely! airSlate SignNow allows you to automate the creation of payroll reports using our payroll report template. By integrating with other systems and utilizing advanced features, you can set up automated workflows that generate and send payroll reports on a scheduled basis, saving you valuable time.

-

Is the payroll report template compatible with other accounting software?

Yes, airSlate SignNow’s payroll report template can seamlessly integrate with various accounting software solutions. This allows for easy data sharing and synchronization between platforms, ensuring that your payroll information is consistent across all systems. This compatibility enhances efficiency and accuracy in your payroll management.

-

What are the benefits of using airSlate SignNow's payroll report template?

Using airSlate SignNow's payroll report template offers several benefits, including increased accuracy, improved efficiency, and cost savings. The template simplifies the payroll process, reduces the risk of errors, and enables easy collaboration among team members. Additionally, the secure eSigning feature ensures that your payroll documents are verified and legally binding.

Get more for Monthly Payroll Report

Find out other Monthly Payroll Report

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word