Cra Form B243

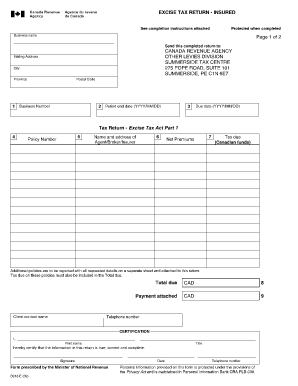

What is the CRA Form B243?

The CRA Form B243, also known as the Excise Tax Return, is a crucial document for businesses in the United States that are required to report and pay excise taxes. This form is utilized by various entities, including corporations and partnerships, to declare their excise tax obligations to the Internal Revenue Service (IRS). The form captures essential information about the types of goods or services subject to excise tax, ensuring compliance with federal regulations.

How to Use the CRA Form B243

Using the CRA Form B243 involves several steps to ensure accurate reporting and compliance. First, gather all necessary financial records and documentation related to your excise tax liabilities. Next, fill out the form with precise information regarding your business operations, including sales figures and applicable tax rates. After completing the form, review it for accuracy before submission. It's essential to keep a copy for your records, as this will help in future filings and audits.

Steps to Complete the CRA Form B243

Completing the CRA Form B243 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including sales records and previous tax returns.

- Identify the specific excise taxes applicable to your business activities.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check calculations and information for any discrepancies.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the CRA Form B243

The CRA Form B243 must be used in accordance with federal tax laws to ensure its legal validity. This includes adhering to the guidelines set forth by the IRS regarding the reporting of excise taxes. Proper use of the form not only helps in fulfilling tax obligations but also protects businesses from potential legal issues related to non-compliance. Utilizing a reliable platform for electronic submission can further enhance the legal standing of the document.

Filing Deadlines / Important Dates

Filing deadlines for the CRA Form B243 can vary based on the specific tax period and the type of excise tax being reported. Generally, businesses must submit the form by the last day of the month following the end of the tax period. It is crucial to stay informed about these deadlines to avoid late fees and penalties. Marking important dates on your calendar can help ensure timely submissions.

Penalties for Non-Compliance

Failure to file the CRA Form B243 on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines based on the amount of tax owed, and repeated non-compliance can lead to more severe consequences, including audits or legal action. Businesses should prioritize accurate and timely filing to mitigate these risks and maintain compliance with tax regulations.

Quick guide on how to complete cra form b243

Complete Cra Form B243 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your papers swiftly without any hold-ups. Manage Cra Form B243 on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to alter and eSign Cra Form B243 without any hassle

- Obtain Cra Form B243 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Stop worrying about lost or misplaced files, tedious form hunting, or errors that necessitate printing new document versions. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your preference. Edit and eSign Cra Form B243 and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cra form b243

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CRA Form B243 and why is it important?

The CRA Form B243 is a critical document for businesses and individuals dealing with various tax obligations. It ensures that the correct information is reported to the Canada Revenue Agency, helping to avoid penalties. Understanding how to properly fill out and submit the CRA Form B243 is essential for compliance and streamlined processes.

-

How can airSlate SignNow help with the CRA Form B243?

AirSlate SignNow simplifies the process of completing and eSigning the CRA Form B243. With its user-friendly interface, you can easily fill out the form, add necessary details, and securely send it to the required parties. This reduces the chances of errors and speeds up the submission process.

-

What features does airSlate SignNow offer for handling the CRA Form B243?

AirSlate SignNow offers features like customizable templates, in-app collaboration, and secure eSigning specifically tailored for documents like the CRA Form B243. These tools make it convenient to manage and track your forms, ensuring that important tax documents are accurately completed and submitted on time.

-

Is airSlate SignNow cost-effective for managing the CRA Form B243?

Yes, airSlate SignNow is a cost-effective solution for managing the CRA Form B243 and other documents. With flexible pricing plans, businesses of all sizes can find a suitable option that fits their budget while leveraging powerful features. Investing in airSlate SignNow can save you time and money by streamlining your document management processes.

-

Can I integrate airSlate SignNow with other software for the CRA Form B243?

Absolutely! AirSlate SignNow offers seamless integrations with multiple platforms such as CRM systems and cloud storage solutions. This makes it easy to manage your data and documents, including the CRA Form B243, within your existing workflows, enhancing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for eSigning the CRA Form B243?

Using airSlate SignNow for eSigning the CRA Form B243 provides several benefits, including enhanced security, reduced turnaround time, and increased accessibility. With cloud-based technology, documents can be signed from anywhere, making it easier for users to remain compliant with tax regulations without delays.

-

How does airSlate SignNow ensure the security of the CRA Form B243?

AirSlate SignNow prioritizes security with advanced encryption and authentication protocols. This ensures that your CRA Form B243 and other sensitive documents are secure and only accessible to authorized users. With these features, you can have peace of mind knowing your documents are protected.

Get more for Cra Form B243

- San antonio independent school district critical incident form

- Graduate perspective form aka

- Black death worksheetdoc form

- Clinical certification request form ct cta mri mra

- Book dd form 2977 deliberate risk assessment worksheet pdf

- Virtual reality waiver amp release of liability form read carefully

- Application for consent to transfer property or other interest of form

- Lesson 4 skills practice somerset silver palms middlehigh somersetsilverpalms form

Find out other Cra Form B243

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF