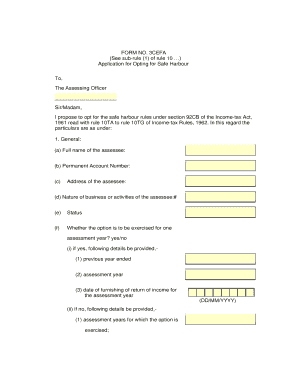

Form 3cefa

What is the Form 3cefa

The Form 3cefa is a specific document used primarily for compliance and reporting purposes within various sectors. It serves as an official declaration or application that captures essential information required by regulatory bodies. Understanding its purpose is crucial for individuals and businesses to ensure proper adherence to legal obligations.

How to use the Form 3cefa

Using the Form 3cefa involves several straightforward steps. First, gather all necessary information and documents that pertain to the form's requirements. Next, fill out the form accurately, ensuring that all fields are completed as per the guidelines. Once filled, review the document for any errors or omissions before submission. This careful approach helps in preventing delays or complications in processing.

Steps to complete the Form 3cefa

Completing the Form 3cefa requires a methodical approach:

- Gather necessary documents such as identification, financial records, or any other relevant information.

- Access the form through the appropriate channels, whether online or via a physical copy.

- Fill in the required fields with accurate and truthful information.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified guidelines, ensuring you keep a copy for your records.

Legal use of the Form 3cefa

The legal use of the Form 3cefa is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be completed in accordance with applicable laws and guidelines. This includes obtaining necessary signatures and ensuring that all information provided is accurate. Compliance with these legal standards is essential to avoid potential disputes or penalties.

Key elements of the Form 3cefa

Several key elements are vital to the Form 3cefa, including:

- Identification details of the individual or entity submitting the form.

- Specific data fields that capture the purpose of the form.

- Signature lines that validate the information provided.

- Instructions for submission and any associated deadlines.

Form Submission Methods

The Form 3cefa can typically be submitted through various methods, including:

- Online submission via designated platforms, which often provides instant confirmation.

- Mailing a physical copy to the appropriate agency, ensuring it is sent well before deadlines.

- In-person submission at designated offices, which may offer immediate feedback or assistance.

Quick guide on how to complete form 3cefa

Complete Form 3cefa seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 3cefa on any device using airSlate SignNow's apps for Android or iOS and streamline any document-based process today.

How to edit and eSign Form 3cefa effortlessly

- Locate Form 3cefa and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form - via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 3cefa to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3cefa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3cefa and how does it work?

Form 3cefa is a digital document designed for electronic signatures. It allows users to easily fill out and sign documents online, streamlining the signing process. With airSlate SignNow, you can quickly send form 3cefa to recipients and receive signed copies in record time.

-

How much does airSlate SignNow cost for using form 3cefa?

The pricing for airSlate SignNow varies based on the plan you choose. However, using form 3cefa is included in all subscription tiers, making it a cost-effective solution for businesses of any size. Check our pricing page for detailed information regarding the different plans.

-

What are the features of form 3cefa in airSlate SignNow?

Form 3cefa includes a variety of features tailored for effective electronic signing. Key features include customizable templates, secure storage, and automated reminders for signatories. These functionalities enhance efficiency and ensure timely completion of your documents.

-

Are there any benefits to using form 3cefa with airSlate SignNow?

Using form 3cefa with airSlate SignNow offers numerous benefits, such as faster turnaround times and improved document accuracy. It reduces manual errors and allows you to track the signing process in real-time. Consequently, this leads to a more organized workflow.

-

Can form 3cefa be integrated with other applications?

Yes, form 3cefa can be easily integrated with various applications and platforms. airSlate SignNow supports integrations with popular tools like Google Drive, Salesforce, and more. This capability streamlines the workflow and ensures a seamless experience across your tech stack.

-

Is form 3cefa secure for sensitive documents?

Absolutely! Form 3cefa is designed with security in mind, utilizing advanced encryption to protect sensitive documents. airSlate SignNow complies with industry standards and regulations, ensuring that your signed documents remain confidential and secure.

-

How can I customize form 3cefa for my business?

Customizing form 3cefa is straightforward with airSlate SignNow's intuitive interface. You can add your branding, modify fields, and set specific signing instructions to meet your business needs. This flexibility ensures that form 3cefa aligns perfectly with your organization's requirements.

Get more for Form 3cefa

- Parenting plan 12th judicial circuit manatee sarasota desoto counties florida parenting plan july 2008 page 1 of 25 in the form

- Od1 ansoegning eu opholdsdokument statsforvaltningendoc arctic au form

- Student petition medical support form florida international

- Hammerpoint quick repair estimator form

- Membership proposal form skal roma skalroma

- Ds 5525 2016 2019 form

- Forms department of land and natural resources hawaiigov dobor ehawaii

- Name your consultants name occupation date address phone h w c email do you use mk products form

Find out other Form 3cefa

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed