Ct 8379 Form

What is the Ct 8379 Form

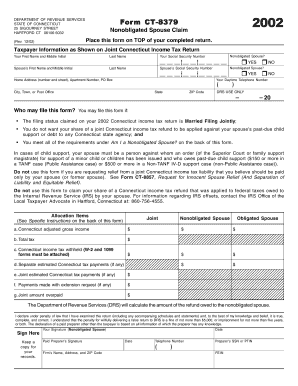

The Ct 8379 form, also known as the ct injured spouse form, is a tax document used by individuals who wish to claim their share of a joint tax refund that may be withheld due to their spouse's tax obligations. This form is particularly relevant for taxpayers who have a portion of their refund applied to their spouse's past due debts, such as child support or federal tax liabilities. By filing the Ct 8379, individuals can protect their rights to the refund they are entitled to based on their own income and tax contributions.

How to use the Ct 8379 Form

Using the Ct 8379 form involves several steps to ensure that the claim is processed correctly. First, you should gather all necessary information, including your and your spouse's tax returns, income details, and any documentation related to the debts. Next, fill out the form accurately, providing all required details about your filing status and income. After completing the form, submit it along with your tax return or as a standalone request if you have already filed your taxes. It is essential to keep copies of all documents for your records.

Steps to complete the Ct 8379 Form

Completing the Ct 8379 form requires careful attention to detail. Follow these steps:

- Obtain the form from the appropriate tax authority or download it from a reliable source.

- Fill in your personal information, including your name, Social Security number, and address.

- Provide your spouse's information, ensuring accuracy in spelling and numbers.

- Detail your income and any tax withholdings that apply to you.

- Sign and date the form, confirming that all information is correct.

Legal use of the Ct 8379 Form

The legal use of the Ct 8379 form is governed by specific regulations that protect the rights of individuals filing for their share of a tax refund. This form must be filed in accordance with IRS guidelines, ensuring that all information provided is truthful and complete. The form serves as a legal declaration that the individual is entitled to a portion of the refund based on their own earnings, separate from any debts incurred by their spouse. Misuse of the form can lead to penalties or denial of the claim.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 8379 form align with standard tax return deadlines. Typically, individuals must submit the form by the tax filing deadline, which is usually April 15 of each year. If you are filing for an extension, ensure that the Ct 8379 form is submitted by the extended deadline as well. Being aware of these dates is crucial to ensure that your claim is processed in a timely manner and that you receive any refund owed to you without unnecessary delays.

Form Submission Methods (Online / Mail / In-Person)

The Ct 8379 form can be submitted through various methods, depending on your preference and circumstances. You may file it online as part of your electronic tax return if you are using compatible tax software. Alternatively, you can print the completed form and mail it directly to the appropriate tax authority. In some cases, individuals may choose to deliver the form in person at designated tax offices. Each submission method has its own processing times, so consider your options based on urgency.

Quick guide on how to complete ct 8379 form

Manage Ct 8379 Form effortlessly on any device

Handling documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and without delays. Handle Ct 8379 Form on any platform with airSlate SignNow's Android or iOS applications, and simplify any document-related process today.

The simplest method to modify and electronically sign Ct 8379 Form with ease

- Obtain Ct 8379 Form and click Get Form to begin.

- Use our tools to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious search for forms, or mistakes that necessitate printing new document copies. airSlate SignNow covers all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Ct 8379 Form while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 8379 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 8379 in relation to airSlate SignNow?

CT 8379 refers to a specific form that airSlate SignNow users might need for their documentation processes. The platform simplifies the eSigning and document management of CT 8379, making it accessible and easy to use.

-

How much does airSlate SignNow cost for handling ct 8379 documents?

The pricing for airSlate SignNow varies depending on the plan selected, which includes features tailored for handling ct 8379 documents efficiently. Users can start with a free trial, and subsequent plans are designed to provide cost-effective solutions for businesses of all sizes.

-

What features does airSlate SignNow offer for ct 8379 form management?

airSlate SignNow offers several features for managing the ct 8379 form, including customizable templates, automated workflows, and secure cloud storage. These features streamline the eSigning process and ensure that your CT 8379 documents are handled with accuracy and security.

-

Can I integrate airSlate SignNow with other applications for ct 8379 processing?

Yes, airSlate SignNow can be integrated with various applications, which enhances the processing of the ct 8379 form. Popular integrations include CRM systems and file storage services, allowing for a seamless workflow when managing your documents.

-

What are the benefits of using airSlate SignNow for ct 8379 eSigning?

Using airSlate SignNow for eSigning ct 8379 documents offers numerous benefits including time savings, enhanced security, and improved compliance with legal standards. The platform facilitates quick document turnaround, which is essential for business efficiency.

-

Is airSlate SignNow user-friendly for completing ct 8379 forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete and eSign ct 8379 forms without extensive training. Its intuitive interface ensures that even those unfamiliar with digital documents can navigate the platform effortlessly.

-

How secure is airSlate SignNow for handling ct 8379 documents?

AirSlate SignNow prioritizes security, ensuring that all ct 8379 documents are encrypted and stored safely. The platform complies with industry standards, providing users peace of mind when eSigning sensitive documents.

Get more for Ct 8379 Form

- Libc 100 wc ampamp the injured worker pamphlet pa dli pagov form

- California code of regulations title 8 section 101655 form

- Workers compensation pa dli pagov form

- Or change in form

- Notice of claim against uninsured employer pa dli pagov form

- Notice of suspension for failure to return form libc 760 pa

- Work comp form notice of benefit reinstatement

- Notice of change of workers compensation disability justia form

Find out other Ct 8379 Form

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT