Garnishment Wages Form

Understanding Garnishment Wages

Garnishment wages refer to a legal process where a portion of an individual's earnings is withheld by an employer for the payment of a debt. This process typically occurs after a court judgment has been made against the debtor, allowing creditors to collect what is owed. The garnishment can apply to various types of income, including wages, salaries, and bonuses. It is essential to understand the implications of garnishment wages, as they can significantly impact an individual's financial situation.

Steps to Complete the Garnishment Wages

Completing the garnishment wages process involves several key steps:

- Obtain a court judgment: Before garnishment can occur, a creditor must secure a court judgment against the debtor.

- File the garnishment request: The creditor must file a request with the court to initiate the garnishment process.

- Notify the employer: Once approved, the creditor must notify the debtor's employer to begin withholding the specified amount from the debtor's wages.

- Maintain records: Both the creditor and employer should keep detailed records of the garnishment process for compliance and reporting purposes.

Legal Use of Garnishment Wages

The legal use of garnishment wages is governed by federal and state laws, which outline the procedures and limitations for withholding wages. Creditors must adhere to these regulations to ensure compliance. For example, federal law limits the amount that can be garnished to a percentage of disposable income, ensuring that debtors retain a portion of their earnings for living expenses. Understanding these legal frameworks is crucial for both creditors and debtors to navigate the garnishment process effectively.

State-Specific Rules for Garnishment Wages

Each state in the U.S. has its own rules regarding garnishment wages, which can affect the amount that can be withheld and the process for initiating garnishment. For instance, some states may have stricter limits on the percentage of wages that can be garnished or may require additional notifications to the debtor. It is important for both creditors and debtors to familiarize themselves with their state's specific laws to ensure compliance and protect their rights.

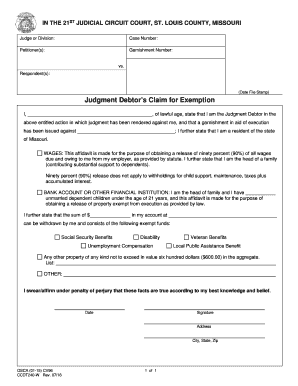

Required Documents for Garnishment Wages

To initiate the garnishment process, certain documents are typically required, including:

- Court judgment: Proof that a judgment has been obtained against the debtor.

- Garnishment application: A completed application form requesting the garnishment.

- Employer notification: Documentation to inform the debtor's employer of the garnishment order.

Penalties for Non-Compliance

Failure to comply with garnishment laws can result in significant penalties for both creditors and employers. Creditors may face legal repercussions, including fines or sanctions, while employers may be held liable for not adhering to the garnishment order. It is essential for all parties involved to understand their responsibilities and the potential consequences of non-compliance to avoid legal issues.

Quick guide on how to complete garnishment wages 443366384

Complete Garnishment Wages effortlessly on any device

Online document management has become widely embraced by organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Garnishment Wages on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Garnishment Wages with ease

- Find Garnishment Wages and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Obfuscate relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require fresh document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your selection. Edit and electronically sign Garnishment Wages and ensure smooth communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the garnishment wages 443366384

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Why might I need an attorney when using airSlate SignNow?

While airSlate SignNow is a powerful tool for eSigning and document management, there are scenarios where you might need an attorney. For instance, if you face legal disputes related to contracts or require specialized legal advice, consulting an attorney can provide the necessary guidance and protection.

-

What are the pricing options for airSlate SignNow for those who might need an attorney's services?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. If you need attorney services alongside, consider the investment in a robust document solution that allows for seamless collaboration with legal professionals and keeps your documents organized and compliant.

-

How can airSlate SignNow help if I need an attorney for my business?

airSlate SignNow helps streamline the document signing process, making it easier to manage contracts and agreements that may require attorney review. By digitizing and automating document workflows, you can save time and ensure that all legal documents are easily accessible whenever you need an attorney's input.

-

Can I integrate airSlate SignNow with legal management tools if I need attorney support?

Yes, airSlate SignNow integrates with various legal management tools and software that can enhance your workflow. This means if you need attorney services, you can seamlessly share signed documents and collaborate with your legal team, ensuring that everything remains efficient and organized.

-

What features in airSlate SignNow are beneficial if I need attorney input on contracts?

Key features in airSlate SignNow include customizable templates and document collaboration, which are invaluable when preparing contracts that may need attorney review. These functionalities allow different stakeholders, including attorneys, to engage in the signing process and ensure all legal terms are understood.

-

Is airSlate SignNow compliant with legal standards if I need an attorney?

Absolutely! airSlate SignNow is designed to meet legal standards, including eSignature laws, making it a reliable choice for businesses. Knowing that you’re using a compliant platform can offer peace of mind when you need an attorney to review or enforce your agreements.

-

How can I ensure document security using airSlate SignNow if I need attorney oversight?

Security is a top priority for airSlate SignNow, featuring multiple layers of encryption and authentication. If you need attorney oversight, you can rest assured that your sensitive documents are protected, allowing your legal counsel to focus on providing the best guidance without security concerns.

Get more for Garnishment Wages

Find out other Garnishment Wages

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF