Form ITR 1 Indian Tax Solutions

What is the Form ITR 1 Indian Tax Solutions

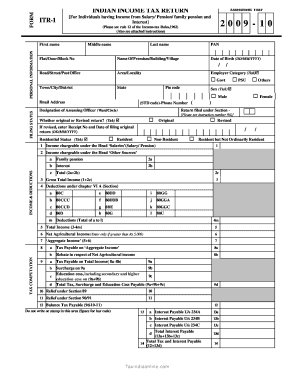

The Form ITR 1 Indian Tax Solutions is a simplified income tax return form designed for individuals in India who earn income primarily from salary, pension, or other sources. This form is suitable for taxpayers with a total income of up to INR 50 lakh and who do not have income from business or profession. It allows for straightforward reporting of income, deductions, and tax liabilities, making it an accessible option for many taxpayers.

How to use the Form ITR 1 Indian Tax Solutions

Using the Form ITR 1 Indian Tax Solutions involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including salary slips, bank statements, and details of any other income. Next, carefully fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form electronically through the designated online portal or in person at the relevant tax office.

Steps to complete the Form ITR 1 Indian Tax Solutions

Completing the Form ITR 1 Indian Tax Solutions requires a systematic approach:

- Gather all necessary documents, including Form 16 from your employer, bank statements, and proof of deductions.

- Log in to the tax filing portal or access the form offline.

- Fill in personal details such as name, address, and PAN (Permanent Account Number).

- Report your income from various sources, including salary and other income.

- Claim deductions under applicable sections, such as Section 80C for investments.

- Calculate your tax liability based on the income reported.

- Review the completed form for accuracy before submission.

Legal use of the Form ITR 1 Indian Tax Solutions

The legal use of the Form ITR 1 Indian Tax Solutions is essential for compliance with tax regulations. When completed correctly, this form serves as a formal declaration of income and tax liability, which is legally binding. It is important to ensure that all information provided is truthful and accurate, as discrepancies may lead to penalties or legal repercussions. The form must be submitted within the prescribed deadlines to avoid issues with the tax authorities.

Required Documents

To successfully complete the Form ITR 1 Indian Tax Solutions, certain documents are required:

- Form 16 issued by your employer, detailing your salary and tax deductions.

- Bank statements to report interest income.

- Proof of deductions, such as investment receipts for Section 80C claims.

- Any other relevant financial documents that support your income and deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Form ITR 1 Indian Tax Solutions are crucial to avoid penalties. Typically, the due date for filing the return for the financial year is July 31 of the following assessment year. However, it is advisable to check for any updates or changes to these deadlines, as they may vary based on government announcements or specific circumstances.

Quick guide on how to complete form itr 1 indian tax solutions

Streamline Form ITR 1 Indian Tax Solutions effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, adjust, and eSign your documents swiftly and without delays. Handle Form ITR 1 Indian Tax Solutions across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

Steps to modify and eSign Form ITR 1 Indian Tax Solutions with ease

- Obtain Form ITR 1 Indian Tax Solutions and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form ITR 1 Indian Tax Solutions to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form itr 1 indian tax solutions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ITR 1 Indian Tax Solutions?

Form ITR 1 Indian Tax Solutions is a simplified tax return form used by resident individuals earning a salary, pension, or income from other specified sources. It enables taxpayers to report their income and calculate their tax liability efficiently. By using airSlate SignNow, you can easily eSign and submit your Form ITR 1.

-

How do I use airSlate SignNow for Form ITR 1 Indian Tax Solutions?

Using airSlate SignNow for Form ITR 1 Indian Tax Solutions is simple. Once you prepare your tax documents, you can upload them to the platform, add necessary signatures, and send them securely. The user-friendly interface ensures that even those unfamiliar with electronic signing can complete their forms without hassle.

-

What are the features of airSlate SignNow for managing Form ITR 1?

airSlate SignNow offers several features for managing Form ITR 1 Indian Tax Solutions, including document templates, secure eSignature options, and audit trails for compliance tracking. These features streamline the process and make it easier for you to handle your tax documents efficiently. Additionally, you can collaborate with others directly within the platform.

-

Is airSlate SignNow cost-effective for Form ITR 1 Indian Tax Solutions?

Yes, airSlate SignNow is a cost-effective solution for handling Form ITR 1 Indian Tax Solutions. With various pricing plans tailored to meet different needs, you can select an option that fits your budget while ensuring compliance and security. The potential time and cost savings can signNowly outweigh traditional methods of eSigning.

-

Can I integrate airSlate SignNow with other tools for Form ITR 1?

Absolutely! airSlate SignNow offers seamless integrations with various applications and tools used in tax preparation and management. This allows you to efficiently transfer data and manage documents related to Form ITR 1 Indian Tax Solutions all in one place, enhancing your productivity and reducing manual entry errors.

-

What benefits does eSigning Form ITR 1 provide?

eSigning Form ITR 1 Indian Tax Solutions provides numerous benefits including faster processing times, enhanced security, and reduced environmental impact through paperless transactions. As a result, you can complete your tax obligations efficiently, while also ensuring your information remains secure and confidential.

-

How secure is airSlate SignNow for submitting tax documents?

airSlate SignNow takes security seriously, employing advanced encryption and compliance protocols to protect your data. When submitting your Form ITR 1 Indian Tax Solutions, you can be assured that all documents are securely stored and transmitted, keeping your sensitive information safe from unauthorized access.

Get more for Form ITR 1 Indian Tax Solutions

- Flep and elp agreement air force form

- Visiting artist invoice inside massart massachusetts college of art inside massart form

- Resignation formpdffillercom

- Metro mobility application form

- Lamar transcript form

- Ocps excused absence form orange county public schools ocps

- Cook county sheriffs office inmate work program credit verification request form

- Minnesota form ig260 2014

Find out other Form ITR 1 Indian Tax Solutions

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free