City of Grand Rapids Form Gr1040 N

What is the City Of Grand Rapids Form GR1040 N

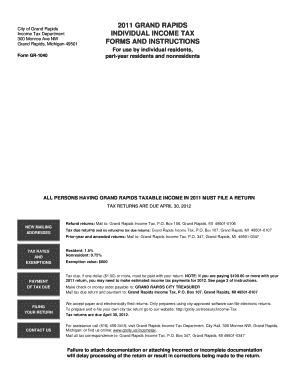

The City of Grand Rapids Form GR1040 N is a municipal income tax return form specifically designed for residents and businesses operating within Grand Rapids, Michigan. This form is essential for reporting income earned and calculating the appropriate city income tax owed. It is a key document for ensuring compliance with local tax regulations and helps the city maintain its revenue for public services.

How to use the City Of Grand Rapids Form GR1040 N

Using the City of Grand Rapids Form GR1040 N involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, complete the form by accurately entering your income details, deductions, and any applicable credits. Once the form is filled out, review it for accuracy before submitting it. The form can be filed electronically or printed and mailed to the appropriate city department.

Steps to complete the City Of Grand Rapids Form GR1040 N

Completing the City of Grand Rapids Form GR1040 N requires careful attention to detail. Follow these steps:

- Gather all necessary income documentation.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources.

- Apply any deductions or credits you qualify for.

- Calculate the total tax owed based on the provided tax rates.

- Sign and date the form to certify its accuracy.

Legal use of the City Of Grand Rapids Form GR1040 N

The City of Grand Rapids Form GR1040 N is legally binding when completed and submitted according to the city's tax regulations. It is important to ensure that the information provided is accurate and truthful, as any discrepancies may lead to penalties or legal issues. The form must be filed by the designated deadline to avoid late fees or additional charges.

Filing Deadlines / Important Dates

Filing deadlines for the City of Grand Rapids Form GR1040 N typically align with federal tax deadlines. Generally, individual taxpayers must submit their forms by April fifteenth of each year. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes to deadlines or specific requirements as announced by the city.

Form Submission Methods (Online / Mail / In-Person)

The City of Grand Rapids Form GR1040 N can be submitted through various methods to accommodate different preferences. Taxpayers can file the form electronically via the city’s online portal, which is often the fastest method. Alternatively, individuals may choose to print the completed form and mail it to the designated city office. In-person submissions may also be accepted at specific city locations during business hours.

Quick guide on how to complete city of grand rapids form gr1040 n

Prepare City Of Grand Rapids Form Gr1040 N effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage City Of Grand Rapids Form Gr1040 N on any device using the airSlate SignNow Android or iOS applications and elevate any document-related process today.

The easiest way to modify and eSign City Of Grand Rapids Form Gr1040 N without hassle

- Find City Of Grand Rapids Form Gr1040 N and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign City Of Grand Rapids Form Gr1040 N and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of grand rapids form gr1040 n

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of grand rapids form gr1040 n?

The city of grand rapids form gr1040 n is a tax form used by residents of Grand Rapids to report local income taxes. This form helps ensure compliance with local tax laws and provides a clear summary of income earned. Understanding how to correctly fill out and file this form can simplify your tax season signNowly.

-

How can airSlate SignNow help me with the city of grand rapids form gr1040 n?

airSlate SignNow offers a user-friendly platform for electronically signing and sending the city of grand rapids form gr1040 n. Our solution saves you time by allowing for quick digital signatures, ensuring that your paperwork is filed accurately and promptly. Additionally, you can store and access your signed documents anytime, anywhere.

-

Is there a cost associated with using airSlate SignNow for the city of grand rapids form gr1040 n?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective for individuals and businesses. We offer several plans that cater to different needs, ensuring you find the right one for managing your city of grand rapids form gr1040 n efficiently. Overall, the benefits you receive often outweigh the costs.

-

What features does airSlate SignNow provide for managing the city of grand rapids form gr1040 n?

With airSlate SignNow, you gain access to features like customizable templates, secure storage, and advanced tracking for your documents. Specifically for the city of grand rapids form gr1040 n, these features help you manage your tax documentation with ease and confidence. Our platform also ensures compliance with local regulations.

-

Can I integrate airSlate SignNow with other software for handling the city of grand rapids form gr1040 n?

Yes, airSlate SignNow integrates seamlessly with various software applications, ensuring streamlined workflows for documents like the city of grand rapids form gr1040 n. Whether you use accounting software or document management systems, our integrations help automate your processes. This compatibility facilitates easy sharing and filing of your forms.

-

How secure is the airSlate SignNow platform when using the city of grand rapids form gr1040 n?

Security is a priority for airSlate SignNow. When using the city of grand rapids form gr1040 n, your documents are protected with encryption and secure servers. We adhere to industry standards to ensure that your sensitive tax information remains confidential and safe from unauthorized access.

-

What are the benefits of eSigning the city of grand rapids form gr1040 n through airSlate SignNow?

eSigning the city of grand rapids form gr1040 n through airSlate SignNow provides a faster and more efficient way to handle your documentation. This method eliminates the need for physical signatures and mailing, expediting the filing process. Moreover, it provides an environmentally friendly solution to your tax documentation needs.

Get more for City Of Grand Rapids Form Gr1040 N

- Viewing a thread ruby buckle barrel racing forum barrel form

- Credit card vs debit card why you should choose one form

- Notice of changes to credit card agreement form

- Exclusive patent license agreement autm form

- An examination of liability duty and disclaimers for the form

- Fundraising request for support form

- Feasibility and inspection sow hud form

- The buy sell agreement buchanan law group form

Find out other City Of Grand Rapids Form Gr1040 N

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document