Idaho Dbs Multi Purpose Balance Sheet 2015-2026

What is the Idaho Dbs Multi Purpose Balance Sheet

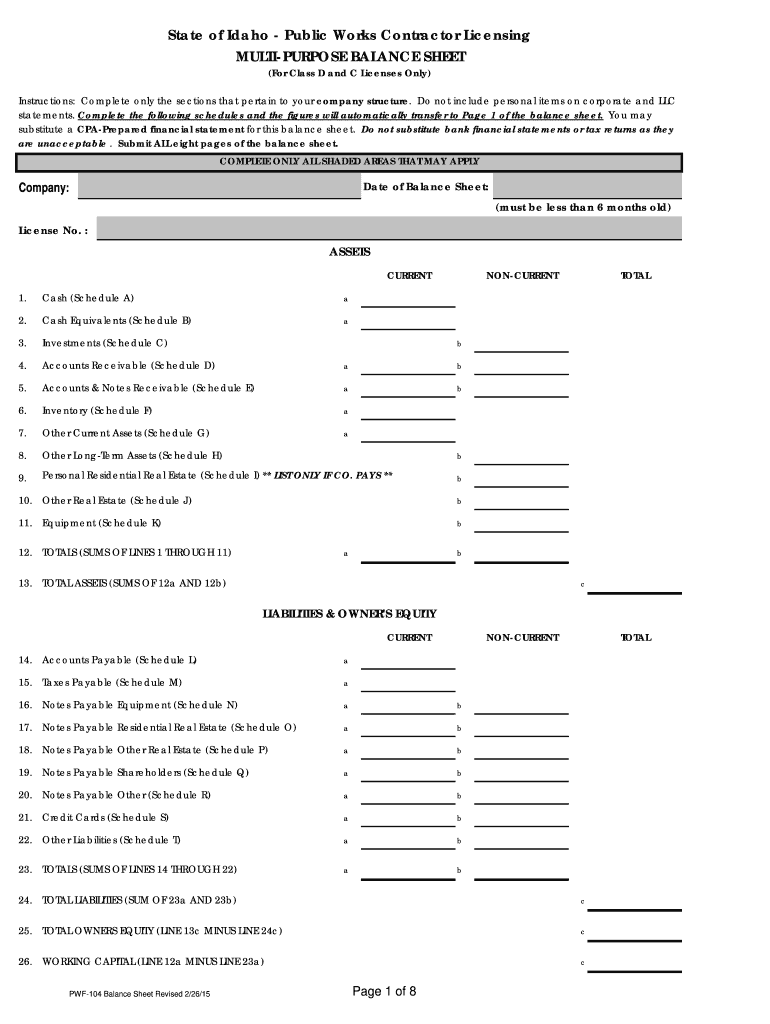

The Idaho Dbs Multi Purpose Balance Sheet is a comprehensive financial document used by businesses and organizations in Idaho to present their financial position at a specific point in time. This balance sheet includes details about assets, liabilities, and equity, providing a snapshot of the entity's financial health. It is essential for various purposes, including compliance with state regulations, securing financing, and providing transparency to stakeholders.

Key elements of the Idaho Dbs Multi Purpose Balance Sheet

Understanding the key elements of the Idaho Dbs Multi Purpose Balance Sheet is crucial for accurate preparation. The main components include:

- Assets: This section lists everything the business owns, such as cash, accounts receivable, inventory, and property.

- Liabilities: This includes all obligations the business owes, such as loans, accounts payable, and other debts.

- Equity: This represents the owner's interest in the business, calculated as total assets minus total liabilities.

Each element must be accurately reported to reflect the true financial status of the entity.

Steps to complete the Idaho Dbs Multi Purpose Balance Sheet

Completing the Idaho Dbs Multi Purpose Balance Sheet involves several important steps:

- Gather financial data: Collect all relevant financial information, including bank statements, invoices, and receipts.

- List assets: Document all assets owned by the business, categorizing them into current and non-current assets.

- List liabilities: Record all outstanding debts and obligations, ensuring to differentiate between short-term and long-term liabilities.

- Calculate equity: Determine the equity by subtracting total liabilities from total assets.

- Review for accuracy: Double-check all figures and ensure compliance with accounting standards.

Legal use of the Idaho Dbs Multi Purpose Balance Sheet

The Idaho Dbs Multi Purpose Balance Sheet must adhere to specific legal requirements to ensure its validity. It is essential to comply with state regulations regarding financial reporting. This includes accurate representation of financial data, proper signatures, and adherence to deadlines for submission. Failure to comply with these legal standards can result in penalties or legal repercussions.

How to obtain the Idaho Dbs Multi Purpose Balance Sheet

Obtaining the Idaho Dbs Multi Purpose Balance Sheet is straightforward. It can typically be accessed through the Idaho Division of Building Safety's official website or directly from their office. Businesses may also find templates and resources available online that can assist in preparing this document. Ensuring that the most recent version is used is important for compliance and accuracy.

Examples of using the Idaho Dbs Multi Purpose Balance Sheet

The Idaho Dbs Multi Purpose Balance Sheet can be utilized in various scenarios, including:

- Loan applications: Banks and financial institutions often require a signed balance sheet to assess the financial stability of a business.

- Tax preparation: Accurate financial reporting is essential for tax purposes, and a balance sheet provides necessary information for tax filings.

- Business evaluations: When seeking investors or partners, a signed balance sheet helps present a clear picture of the business's financial health.

Quick guide on how to complete multi purpose balance sheet state of idaho public works dbs idaho

Manage Idaho Dbs Multi Purpose Balance Sheet anytime, anywhere

Your daily organizational activities may need additional focus when handling region-specific business paperwork. Regain your working hours and reduce the costs related to document-based tasks with airSlate SignNow. airSlate SignNow provides you with numerous pre-loaded business documents, including Idaho Dbs Multi Purpose Balance Sheet, that you can utilize and share with your collaborators. Administer your Idaho Dbs Multi Purpose Balance Sheet effortlessly with powerful editing and eSignature features and forward it directly to your recipients.

How to obtain Idaho Dbs Multi Purpose Balance Sheet in just a few steps:

- Select a form pertinent to your region.

- Click on Learn More to view the document and confirm its accuracy.

- Press Get Form to begin working on it.

- Idaho Dbs Multi Purpose Balance Sheet will open instantly in the editor. No further actions are needed.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the form.

- Choose the Sign option to create your personalized signature and eSign your document.

- Once ready, hit Done, save changes, and access your paperwork.

- Send the document via email or SMS, or use a link-to-fill method with your associates or allow them to download the files.

airSlate SignNow signNowly conserves your time managing Idaho Dbs Multi Purpose Balance Sheet and allows you to find important documents in a single location. A comprehensive collection of forms is organized and tailored to fulfill critical business operations necessary for your organization. The sophisticated editor reduces the risk of errors, enabling you to swiftly amend mistakes and review your documents on any device prior to sending them out. Start your free trial today to explore all the benefits of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the multi purpose balance sheet state of idaho public works dbs idaho

How to create an eSignature for the Multi Purpose Balance Sheet State Of Idaho Public Works Dbs Idaho online

How to create an electronic signature for your Multi Purpose Balance Sheet State Of Idaho Public Works Dbs Idaho in Google Chrome

How to make an electronic signature for signing the Multi Purpose Balance Sheet State Of Idaho Public Works Dbs Idaho in Gmail

How to make an eSignature for the Multi Purpose Balance Sheet State Of Idaho Public Works Dbs Idaho straight from your smart phone

How to generate an eSignature for the Multi Purpose Balance Sheet State Of Idaho Public Works Dbs Idaho on iOS devices

How to create an electronic signature for the Multi Purpose Balance Sheet State Of Idaho Public Works Dbs Idaho on Android OS

People also ask

-

What is a signed balance sheet and why is it important?

A signed balance sheet is a financial statement that outlines a company's assets, liabilities, and equity, confirmed by authorized signatures. It is essential for auditing, securing financing, and enhancing credibility with stakeholders. Having a signed balance sheet reflects the accuracy of financial reporting and compliance with legal requirements.

-

How does airSlate SignNow help with signed balance sheets?

airSlate SignNow streamlines the process of signing and finalizing your balance sheets by providing a user-friendly platform for electronic signatures. It ensures that your signed balance sheets are stored securely and are easily accessible when needed. With real-time tracking and notifications, you can efficiently manage the signing process for your financial documents.

-

Is airSlate SignNow cost-effective for managing signed balance sheets?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing signed balance sheets. You can choose from various subscription options based on your organizational needs, ensuring you only pay for what you need while optimizing your operational costs. This flexibility allows you to manage your financial documentation without breaking the bank.

-

What features does airSlate SignNow offer for signed balance sheets?

airSlate SignNow includes multiple features tailored for signed balance sheets, such as customizable templates, secure storage, and advanced analytics. Its robust eSignature capability ensures compliance and authenticity, making your signed balance sheets legally binding. Additionally, the platform allows for easy document sharing and collaboration among team members and stakeholders.

-

Can I integrate airSlate SignNow with other tools for signed balance sheets?

Yes, airSlate SignNow offers seamless integrations with popular business applications, enhancing your workflow for signed balance sheets. You can connect with CRM systems, cloud storage services, and finance software for optimal data management. This integration capability helps maintain consistency and efficiency when handling financial documents.

-

What benefits can I expect from using airSlate SignNow for signed balance sheets?

Using airSlate SignNow for signed balance sheets brings numerous benefits, including faster document turnaround, reduced paper usage, and enhanced security. The platform's electronic signature solution ensures that your balance sheets can be signed promptly without delays. With its user-friendly interface, you will improve workflow efficiency, helping your team focus on critical financial tasks.

-

Is it secure to store signed balance sheets with airSlate SignNow?

Absolutely, airSlate SignNow prioritizes security and compliance for all documents, including signed balance sheets. The platform employs advanced encryption and secure cloud storage to protect your sensitive financial information. Regular audits and compliance checks ensure that your documents remain protected against unauthorized access.

Get more for Idaho Dbs Multi Purpose Balance Sheet

Find out other Idaho Dbs Multi Purpose Balance Sheet

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast