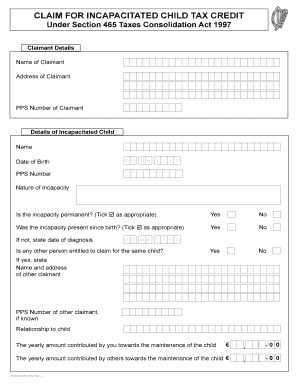

Child Tax Credit Form

What is the Child Tax Credit Form

The Child Tax Credit form is a tax document used by U.S. taxpayers to claim a credit for qualifying children under the age of seventeen. This credit aims to reduce the tax burden on families, providing financial relief for child-related expenses. The form allows taxpayers to report the number of qualifying children and calculate the amount of credit they are eligible to receive. Understanding this form is essential for families looking to maximize their tax benefits.

Steps to Complete the Child Tax Credit Form

Completing the Child Tax Credit form involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather necessary information, including Social Security numbers for each qualifying child. Next, determine eligibility based on income thresholds and the number of children. Fill out the form by entering the required details, ensuring that all information is correct. Finally, review the completed form for any errors before submission to avoid delays in processing.

How to Obtain the Child Tax Credit Form

The Child Tax Credit form can be obtained directly from the IRS website, where it is available for download as a PDF. Taxpayers can also access the form through tax preparation software or by requesting a physical copy from the IRS. It is advisable to ensure that you are using the most current version of the form to comply with any recent tax law changes.

Legal Use of the Child Tax Credit Form

To ensure the legal use of the Child Tax Credit form, it must be filled out accurately and submitted in accordance with IRS regulations. The form must reflect correct information regarding the taxpayer's dependents and income. Misrepresentation or errors can lead to penalties or audits. Utilizing reliable digital tools for completion can enhance compliance and security, ensuring that the form meets legal standards.

Eligibility Criteria

Eligibility for the Child Tax Credit is determined by several factors, including income level, filing status, and the number of qualifying children. Generally, a taxpayer must have a modified adjusted gross income below a specified threshold to qualify for the full credit. Additionally, the children must meet specific criteria, such as age and residency requirements. Understanding these criteria is essential for families to accurately claim the credit.

Form Submission Methods

The Child Tax Credit form can be submitted through various methods, including online filing, mail, or in-person submission at designated IRS offices. Online filing is often the most efficient method, allowing for quicker processing and confirmation of receipt. If mailing the form, it is important to send it to the correct IRS address and consider using certified mail for tracking purposes.

Quick guide on how to complete child tax credit form

Prepare Child Tax Credit Form effortlessly on any device

The management of online documents has gained traction among businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any delays. Manage Child Tax Credit Form on any device using airSlate SignNow's Android or iOS apps and enhance any document-centric process today.

How to modify and eSign Child Tax Credit Form with ease

- Obtain Child Tax Credit Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools specially provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, be it by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or incorrectly filed documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Child Tax Credit Form and guarantee excellent communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the child tax credit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a child tax credit form?

The child tax credit form is a document that allows parents to claim a credit for qualifying children on their tax returns. This form is essential for maximizing tax benefits and ensuring compliance with IRS regulations. You can easily create and manage this form using airSlate SignNow’s e-signature solutions.

-

How can airSlate SignNow help with the child tax credit form?

airSlate SignNow streamlines the process of filling out and sending the child tax credit form by providing easy-to-use templates. Our platform allows you to securely eSign and share the document, ensuring efficient communication and record-keeping. This helps you focus on maximizing your tax benefits without the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for the child tax credit form?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including features for managing the child tax credit form. You can choose from different subscription levels based on your requirements and budget. Our cost-effective solution ensures you have access to essential tools without breaking the bank.

-

What features does airSlate SignNow provide for managing the child tax credit form?

With airSlate SignNow, you can enjoy features such as customizable templates, secure eSigning, and automated document workflows for your child tax credit form. These tools enhance efficiency and simplify the process, allowing you to focus on what matters most. Additionally, real-time tracking ensures you stay updated on document status.

-

Can I integrate airSlate SignNow with other software for the child tax credit form?

Yes, airSlate SignNow offers integrations with various popular software tools that can help you manage the child tax credit form seamlessly. This integration allows you to streamline processes and enhance productivity by connecting your existing tools. Explore our API options to find the best fit for your business.

-

What are the benefits of using airSlate SignNow for my child tax credit form compared to traditional methods?

Using airSlate SignNow for your child tax credit form allows for faster processing, increased accuracy, and better compliance with tax regulations compared to traditional methods. Our digital solution eliminates the need for printing, scanning, and mailing, saving you time and resources. Enjoy peace of mind knowing your documents are signed and stored securely.

-

Is airSlate SignNow secure for handling sensitive information in the child tax credit form?

Absolutely! airSlate SignNow employs industry-leading security measures to protect sensitive information in your child tax credit form. Features such as data encryption, secure servers, and compliance with regulations ensure your documents are safe. You can trust us to keep your information confidential throughout the eSigning process.

Get more for Child Tax Credit Form

- Volleyball team roster amp lineup sheet wyoming whsaa form

- Form 8821 rev march 2015 tax information authorization irs

- Delta physician statement form

- Hwseta learnership agreement form

- District nominating form

- Az repossession affidavit form

- Registration application form af10 northern ireland social care

- Form ar application for administrative review the buzzards bay buzzardsbay

Find out other Child Tax Credit Form

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast