Dr 0563 Form

What is the DR 0563?

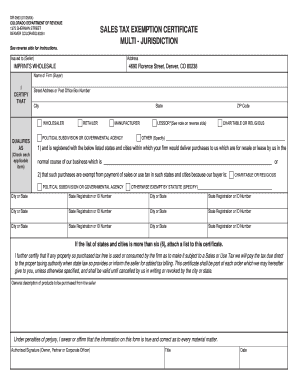

The DR 0563 form, also known as the Colorado DR 0563, is a document used primarily in the state of Colorado for specific tax-related purposes. It is essential for individuals and businesses to understand the nature and requirements of this form to ensure compliance with state regulations. The form typically involves reporting certain financial information, which may include income, deductions, and credits applicable to the taxpayer's situation.

How to Use the DR 0563

Utilizing the DR 0563 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Once completed, review the form for any errors or omissions before submitting it to the appropriate state authority. It is advisable to keep a copy of the submitted form for your records.

Steps to Complete the DR 0563

Completing the DR 0563 form involves a systematic approach:

- Gather necessary documents, including income statements and deductions.

- Carefully fill out the form, ensuring all required fields are completed.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

- Submit the form to the appropriate state agency, either online or via mail.

Legal Use of the DR 0563

The DR 0563 form is legally binding when completed and submitted according to state regulations. It is crucial to adhere to the guidelines set forth by the Colorado Department of Revenue to ensure that the form is recognized as valid. This includes using an authorized method for signing, such as digital signatures that comply with eSignature laws, ensuring that the completed form meets all legal requirements.

Who Issues the Form

The Colorado Department of Revenue is responsible for issuing the DR 0563 form. This state agency oversees tax collection and compliance, providing the necessary forms and guidelines for taxpayers. It is important to refer to their official resources for the most current version of the form and any updates to filing procedures or requirements.

Required Documents

To successfully complete the DR 0563 form, certain documents are required. These typically include:

- Income statements (W-2s, 1099s, etc.)

- Documentation of deductions and credits

- Previous tax returns for reference

- Any additional forms that may apply to your specific tax situation

Quick guide on how to complete dr 0563

Prepare Dr 0563 seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the proper form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Dr 0563 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Dr 0563 effortlessly

- Locate Dr 0563 and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Dr 0563 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0563

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0563 and how does it relate to airSlate SignNow?

dr 0563 is a reference code for a specific feature within the airSlate SignNow platform. This feature is designed to enhance document management and e-signature processes for businesses. By utilizing dr 0563, users can streamline their workflows and improve overall efficiency.

-

How much does airSlate SignNow cost for users looking to implement dr 0563?

Pricing for airSlate SignNow varies based on the plan chosen, with options suited for different business needs. Users interested in accessing the dr 0563 features can expect competitive pricing that reflects the robust functionality it offers. It's advisable to check the official website for the latest pricing details.

-

What are the main features of airSlate SignNow utilizing dr 0563?

The airSlate SignNow platform, including features associated with dr 0563, offers a range of tools for document management, e-signatures, and workflow automation. Key features include customizable templates, real-time collaboration, and integration with popular business tools. This makes it an ideal solution for organizations looking to digitize their document processes.

-

What benefits can businesses expect from using dr 0563 in airSlate SignNow?

By leveraging the dr 0563 feature in airSlate SignNow, businesses can expect increased efficiency and reduced turnaround time for document handling. It enables teams to collaborate seamlessly, ensuring faster approvals and enhanced productivity. Overall, utilizing dr 0563 can lead to more streamlined operations.

-

How can I integrate airSlate SignNow with other tools when using dr 0563?

Integrating airSlate SignNow with other business tools while using dr 0563 is straightforward. The platform supports a variety of integrations with popular applications like Google Drive, Dropbox, and Salesforce. This allows users to enhance their workflows and maintain a smooth document management experience.

-

Is there customer support available for users of dr 0563 in airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support for all users, including those utilizing the dr 0563 feature. Customers can access support through live chat, email, and a dedicated help center filled with resources. This ensures that users have assistance whenever they need it.

-

Can I access mobile features with dr 0563 on airSlate SignNow?

Absolutely! The airSlate SignNow platform, including the dr 0563 feature, is fully accessible on mobile devices. This allows users to send, sign, and manage documents on the go, providing flexibility and convenience for busy professionals.

Get more for Dr 0563

- Cc 188 new 0815 form

- Fillable online product name derma form chewable tablets

- Residential occupancy permit 12212018 form

- Buck hill waiver form

- Minneapolis police department victims domestic violence supplement bwjp form

- Worship team application form template

- Chaska dog registration form

- Form fca1 firearm certificate application m

Find out other Dr 0563

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors