Form 940

What is the Form 940

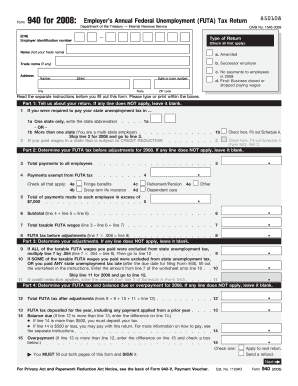

The Form 940, also known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a tax form used by employers in the United States to report and pay unemployment taxes to the federal government. This form is essential for businesses that pay wages to employees and are subject to FUTA tax. The form helps the Internal Revenue Service (IRS) monitor unemployment tax compliance and ensures that funds are available for unemployment benefits.

How to use the Form 940

Using the Form 940 involves several steps to ensure accurate reporting of unemployment taxes. Employers must first gather the necessary information, including total wages paid, any adjustments for state unemployment taxes, and the total FUTA tax owed. Once the form is completed, it must be filed with the IRS, typically by January 31 of the following year. Employers can use the form to calculate their tax liability and report any payments made throughout the year.

Steps to complete the Form 940

Completing the Form 940 requires careful attention to detail. Follow these steps:

- Gather payroll records, including total wages and any state unemployment taxes paid.

- Fill out the identification section with your business details, including your Employer Identification Number (EIN).

- Calculate the total taxable wages and determine the FUTA tax owed, using the current tax rate.

- Report any adjustments for state unemployment taxes on the form.

- Sign and date the form before submitting it to the IRS.

Legal use of the Form 940

The Form 940 is legally binding when completed accurately and submitted on time. Compliance with IRS regulations is crucial, as failure to file or pay the required taxes can result in penalties. Employers should ensure that all reported information is truthful and that any payments made are documented. Utilizing digital tools for eSigning can enhance the legal validity of the form, provided they comply with relevant eSignature laws.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form 940. The form is typically due by January 31 for the previous calendar year. If you have made timely payments throughout the year, you may have until February 10 to file. It is essential to keep track of these deadlines to avoid penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form 940 can be submitted in several ways. Employers may choose to file electronically using IRS-approved software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the appropriate IRS address, which varies based on your location and whether you are including a payment. In-person submissions are generally not available for this form.

Quick guide on how to complete form 940 100035706

Effortlessly Handle Form 940 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the essentials to create, edit, and electronically sign your documents promptly without holdups. Manage Form 940 on any device using airSlate SignNow’s Android or iOS applications and streamline your document-centric workflow today.

The easiest way to edit and electronically sign Form 940 with ease

- Obtain Form 940 and press Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details using features provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow takes care of your document management needs in a few clicks from any device of your choice. Edit and electronically sign Form 940 and ensure excellent communication at any stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 940 100035706

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2008 Form 940 and why is it important?

The 2008 Form 940 is the Employer's Annual Federal Unemployment (FUTA) Tax Return used by businesses to report their unemployment tax obligations. Understanding this form is crucial for compliance with federal tax regulations and to avoid penalties. Accurate submission of the 2008 Form 940 ensures that your business meets its legal responsibilities regarding unemployment taxes.

-

How can airSlate SignNow help with signing the 2008 Form 940?

airSlate SignNow simplifies the process of signing and sending the 2008 Form 940 by providing an easy-to-use interface for electronic signatures. With SignNow, you can securely manage your form signing process online, ensuring compliance and a quicker turnaround. This feature saves time and increases efficiency for both employers and employees.

-

Is airSlate SignNow cost-effective for handling the 2008 Form 940?

Yes, airSlate SignNow offers a cost-effective solution for managing the 2008 Form 940 and other essential documents. With various pricing plans tailored to different business needs, you can choose an option that best fits your budget while enjoying features that enhance productivity. This allows companies to allocate resources efficiently without sacrificing quality.

-

Can I integrate airSlate SignNow with other software for processing the 2008 Form 940?

Absolutely! airSlate SignNow offers integrations with a wide range of software applications, making it easy to streamline your workflow for the 2008 Form 940. Whether you use accounting software or human resources platforms, these integrations can help ensure that your form is completed and submitted efficiently.

-

What are the benefits of using airSlate SignNow for the 2008 Form 940?

Using airSlate SignNow for the 2008 Form 940 offers numerous benefits such as enhanced security features for digital signatures, reduced paperwork, and quicker processing times. It improves overall efficiency in handling tax returns and helps keep your business compliant with federal regulations. Additionally, users appreciate the user-friendly interface that simplifies the signing process.

-

How does airSlate SignNow ensure the security of my 2008 Form 940?

airSlate SignNow prioritizes the security of your documents, including the 2008 Form 940, by employing advanced encryption and secure data storage. This means that your sensitive information is protected during transmission and while stored in the cloud. Users can rest assured knowing their documents are secure while being processed.

-

What features does airSlate SignNow offer for managing the 2008 Form 940?

airSlate SignNow provides features designed to streamline the management of the 2008 Form 940, including reusable templates, automated reminders, and tracking tools. These features help ensure that you never miss a deadline and that all necessary parties can review and sign the form without hassle. This simplification of document handling is appreciated by many users.

Get more for Form 940

Find out other Form 940

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast