Cook County Real Estate Transfer Tax Declaration Form

What is the Cook County Real Estate Transfer Tax Declaration

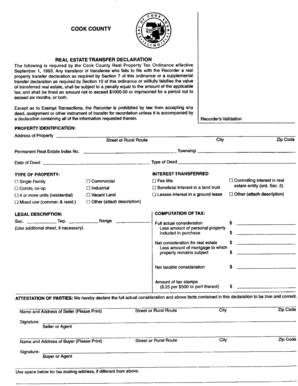

The Cook County Real Estate Transfer Tax Declaration is a mandatory form required when real property is sold or transferred within Cook County, Illinois. This document serves to report the details of the transaction, including the sale price, property description, and the parties involved. It is essential for calculating the transfer tax owed, which is based on the sale price of the property. Understanding this declaration is crucial for both buyers and sellers to ensure compliance with local tax regulations.

Steps to complete the Cook County Real Estate Transfer Tax Declaration

Completing the Cook County Real Estate Transfer Tax Declaration involves several key steps:

- Gather necessary information: Collect details about the property, including its address, legal description, and the sale price.

- Fill out the form: Accurately enter the required information in the designated fields of the declaration.

- Calculate the transfer tax: Use the sale price to determine the total transfer tax owed, based on the current tax rate.

- Review for accuracy: Double-check all entries to ensure there are no errors that could lead to delays or penalties.

- Submit the form: Follow the appropriate submission method, whether online, by mail, or in person, to ensure timely processing.

Key elements of the Cook County Real Estate Transfer Tax Declaration

The Cook County Real Estate Transfer Tax Declaration includes several critical elements that must be accurately reported:

- Property information: This includes the address and legal description of the real estate being transferred.

- Seller and buyer details: Names and contact information for both parties involved in the transaction.

- Sale price: The total amount for which the property is being sold, which is essential for calculating the transfer tax.

- Exemptions: Any applicable exemptions or deductions that may reduce the transfer tax owed should be clearly indicated.

How to obtain the Cook County Real Estate Transfer Tax Declaration

The Cook County Real Estate Transfer Tax Declaration can be obtained through several methods:

- Online: Access the form directly from the Cook County government website, where it is available for download in PDF format.

- In-person: Visit the Cook County Clerk's office to request a physical copy of the form.

- Mail: Request a copy of the form by contacting the Cook County Clerk’s office via mail or phone.

Legal use of the Cook County Real Estate Transfer Tax Declaration

The Cook County Real Estate Transfer Tax Declaration is a legally binding document that must be completed and submitted accurately to comply with local tax laws. Failure to submit this declaration or providing false information can result in penalties, including fines or additional taxes owed. It is important for all parties involved in a real estate transaction to understand their responsibilities regarding this form to avoid legal complications.

Quick guide on how to complete cook county real estate transfer tax declaration

Prepare Cook County Real Estate Transfer Tax Declaration effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It presents a brilliant eco-friendly substitute to conventional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, revise, and electronically sign your documents promptly without interruptions. Administer Cook County Real Estate Transfer Tax Declaration on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to edit and electronically sign Cook County Real Estate Transfer Tax Declaration with ease

- Locate Cook County Real Estate Transfer Tax Declaration and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Mark pertinent sections of the documents or obscure sensitive details using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal standing as a standard wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Cook County Real Estate Transfer Tax Declaration and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cook county real estate transfer tax declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax declaration of real property sample?

A tax declaration of real property sample is a document that outlines the assessed value of a property for taxation purposes. It serves as an official record used by local governments to determine property taxes. Understanding this sample can help property owners ensure that their taxes are accurately assessed.

-

How does airSlate SignNow assist with the tax declaration of real property sample?

airSlate SignNow provides a seamless platform for sending, signing, and managing tax declaration of real property samples electronically. This ensures that the documentation process is efficient, secure, and easy to track. By leveraging our eSignature capabilities, users can complete their tax declarations swiftly, without the hassle of physical paperwork.

-

Is the pricing for airSlate SignNow suitable for small businesses dealing with tax declaration of real property samples?

Yes, airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes, including small businesses. Our cost-effective solutions allow users to manage tax declaration of real property samples without breaking the bank. You can choose a plan that fits your needs and budget while enjoying premium features.

-

What features does airSlate SignNow offer for tax declaration of real property sample management?

airSlate SignNow provides a range of features tailored for the management of tax declaration of real property samples. Key functionalities include easy document creation, secure eSignatures, real-time tracking, and automated reminders. These features streamline the process and enhance productivity for businesses dealing with property tax declarations.

-

Can I integrate airSlate SignNow with other software for managing tax declarations?

Absolutely! airSlate SignNow offers multiple integrations with popular software solutions that enhance the management of tax declaration of real property samples. Whether you use CRM, accounting, or document management tools, our platform can easily integrate to create a seamless workflow for your business.

-

What are the benefits of using airSlate SignNow for tax declaration of real property samples?

Using airSlate SignNow for your tax declaration of real property samples provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Digital document management and eSigning save time, while ensuring compliance with legal standards. As a result, businesses can focus more on their core activities rather than getting bogged down with administrative tasks.

-

How secure is the information provided in the tax declaration of real property sample on airSlate SignNow?

Security is a top priority at airSlate SignNow. All information related to your tax declaration of real property sample is protected through advanced encryption and compliance with industry standards. Our platform also incorporates multi-factor authentication to ensure that only authorized individuals have access to sensitive documents.

Get more for Cook County Real Estate Transfer Tax Declaration

- Lease extension agreement renewal of current lease with form

- Placed on the real property listed herein form

- Consumer pamphlet probate in floridathe florida bar form

- Personal representative of this estate state the following form

- Codicilfree legal forms

- City of clinton ms paradeassembly application and permit form

- Complete form for each team competing registration amp payment due 1229

- Charter sightseeing license application chicago cityofchicago form

Find out other Cook County Real Estate Transfer Tax Declaration

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form