Drawdown Declaration and Income Form

What is the Drawdown Declaration And Income

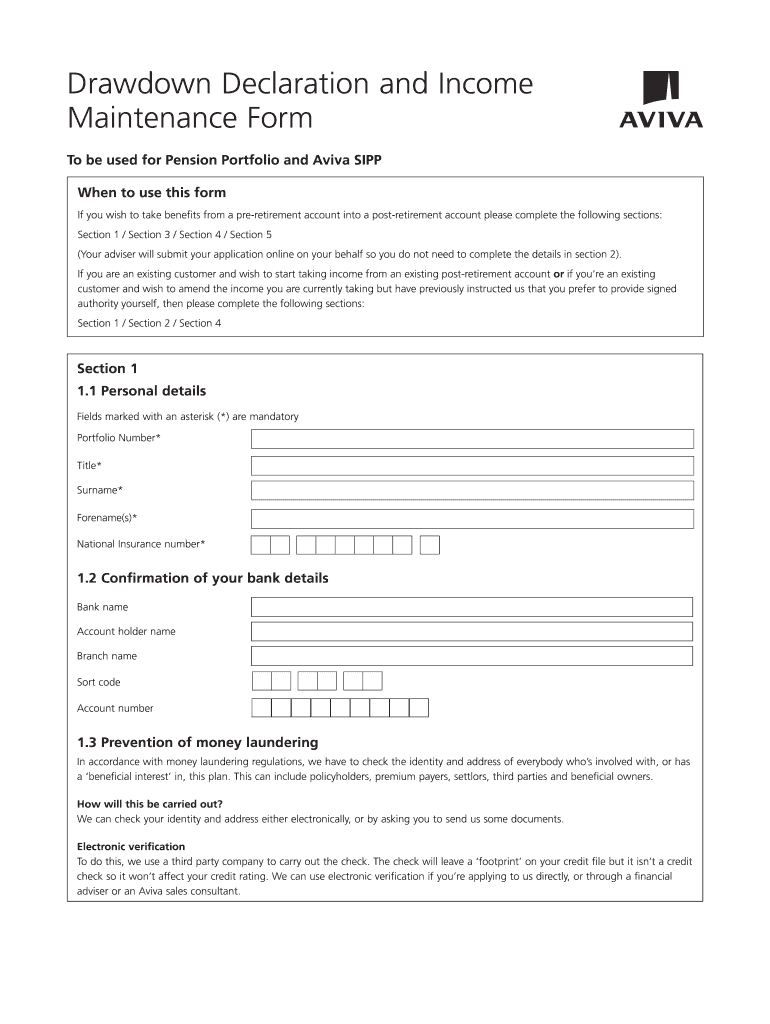

The Drawdown Declaration and Income form is a critical document used primarily in financial and retirement planning contexts. It is designed to declare the amount of income that an individual intends to withdraw from their retirement accounts, such as pensions or annuities. This declaration is essential for ensuring that the withdrawals comply with legal and tax obligations, as well as for maintaining the integrity of the retirement account. Understanding the specifics of this form helps individuals manage their retirement funds effectively while adhering to applicable regulations.

How to use the Drawdown Declaration And Income

Using the Drawdown Declaration and Income form involves several straightforward steps. First, gather all necessary financial information, including account details and income sources. Next, accurately fill out the form, specifying the amount you wish to withdraw and any relevant personal information. After completing the form, review it for accuracy to avoid any potential issues. Finally, submit the form through the designated method, which may include electronic submission or mailing it to the appropriate financial institution. This process ensures that your income declaration is processed efficiently.

Steps to complete the Drawdown Declaration And Income

Completing the Drawdown Declaration and Income form requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary documents, such as identification and account statements.

- Fill out the form with your personal information, including name, address, and Social Security number.

- Specify the amount of income you intend to withdraw from your retirement account.

- Review the completed form for any errors or omissions.

- Submit the form according to the instructions provided, ensuring it reaches the correct department.

Legal use of the Drawdown Declaration And Income

The legal use of the Drawdown Declaration and Income form is governed by various regulations that ensure compliance with tax laws and retirement account rules. When completed correctly, this form serves as a legally binding document that outlines your intentions regarding withdrawals. It is essential to adhere to the guidelines set forth by the Internal Revenue Service (IRS) and other regulatory bodies to avoid penalties or issues with your retirement account. Understanding these legal implications helps safeguard your financial interests.

Key elements of the Drawdown Declaration And Income

Several key elements are crucial to the Drawdown Declaration and Income form. These include:

- Personal Information: Name, address, and Social Security number.

- Withdrawal Amount: The specific amount you wish to withdraw.

- Account Information: Details about the retirement account from which funds will be withdrawn.

- Signature: A signature is often required to validate the form.

Ensuring that all these elements are accurately completed is vital for the form's acceptance and processing.

Eligibility Criteria

Eligibility to use the Drawdown Declaration and Income form typically depends on several factors, including age, account type, and retirement plan specifics. Generally, individuals must be of retirement age or meet specific conditions outlined by their retirement plan to withdraw funds legally. It is important to consult with a financial advisor or review your plan’s guidelines to confirm eligibility before completing the form. This step ensures compliance with all relevant regulations and helps avoid unnecessary complications.

Quick guide on how to complete drawdown declaration and income

Effortlessly Prepare Drawdown Declaration And Income on Any Device

Web-based document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Drawdown Declaration And Income on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

How to Edit and Electronically Sign Drawdown Declaration And Income with Ease

- Find Drawdown Declaration And Income and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choosing. Edit and electronically sign Drawdown Declaration And Income to ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the drawdown declaration and income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Drawdown Declaration And Income?

A Drawdown Declaration And Income is a document that outlines an individual's intent to draw from their pension funds while detailing the expected income. This declaration is essential for ensuring tax compliance and adhering to pension regulations. Properly managing your Drawdown Declaration And Income can enhance your retirement planning.

-

How does airSlate SignNow simplify the Drawdown Declaration And Income process?

airSlate SignNow streamlines the process of creating and signing your Drawdown Declaration And Income with an intuitive interface. You can easily create personalized documents, add your signature, and send them electronically. This automation not only saves time but also ensures that your documents are securely stored and accessible.

-

Is there a cost associated with using airSlate SignNow for Drawdown Declaration And Income?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for creating Drawdown Declaration And Income. Our plans are competitively priced, ensuring businesses of all sizes can take advantage of our eSigning solutions. You can also start with a free trial to determine if it's the right fit for you.

-

What features does airSlate SignNow offer for managing Drawdown Declaration And Income?

airSlate SignNow provides features like customizable templates for your Drawdown Declaration And Income, real-time status tracking, and secure cloud storage. Additionally, users can integrate with existing workflows and applications, making the document management process seamless. This ensures that your important financial documents are always organized and readily available.

-

Can airSlate SignNow be integrated with other software for managing Drawdown Declaration And Income?

Absolutely! airSlate SignNow offers various integrations with popular software solutions like CRM systems, accounting software, and more. This allows you to manage your Drawdown Declaration And Income alongside your other business processes smoothly. Integration enhances efficiency and reduces the chances of errors during document handling.

-

What security measures does airSlate SignNow use for Drawdown Declaration And Income documents?

Security is a top priority at airSlate SignNow. We implement robust encryption, secure access controls, and regular security audits to protect your Drawdown Declaration And Income documents. You can be confident that your sensitive financial information is handled with the utmost care and complies with legal standards.

-

How can I ensure my Drawdown Declaration And Income is compliant with regulations?

Using airSlate SignNow can help ensure your Drawdown Declaration And Income meets compliance standards. Our platform facilitates the inclusion of necessary legal language and provides templates that adhere to industry guidelines. Additionally, our eSigning process creates a secure audit trail, proving that all steps in your compliance journey were documented.

Get more for Drawdown Declaration And Income

- Hereinafter referred to as quotpurchaserquot whether one or more on the terms and conditions and for form

- Affidavit of marital status tdhcastatetxus form

- Default case with written agreement divorceor form

- Family special needs trust form

- Missouri power of attorney formsdurable us legal forms

- Land trust agreementgeneral form

- Dom of information foia city of auburn

- Vha 10 7959c form

Find out other Drawdown Declaration And Income

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word