Transmitter Report and Summary of Magnetic Media IRS Gov Form

What is the Transmitter Report And Summary Of Magnetic Media IRS gov

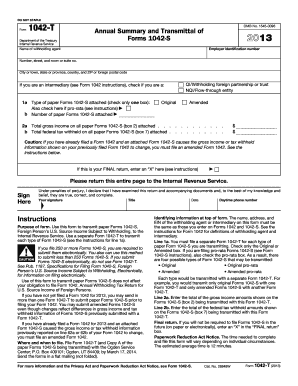

The Transmitter Report and Summary of Magnetic Media is a crucial document required by the Internal Revenue Service (IRS) for reporting certain types of information. This form is primarily used by businesses and organizations that submit data electronically, such as wage and tax statements. It serves as a summary of the magnetic media submissions, ensuring that the IRS receives accurate and comprehensive reporting from transmitters. Understanding this form is essential for compliance and to avoid potential penalties.

How to use the Transmitter Report And Summary Of Magnetic Media IRS gov

Using the Transmitter Report and Summary of Magnetic Media involves several key steps. First, ensure that you have the correct version of the form, which can be obtained from the IRS website. Next, gather all necessary information related to your electronic submissions, including details about the payees and the amounts reported. Once you have compiled this information, fill out the form accurately, ensuring that all data matches your electronic submissions. Finally, submit the form according to IRS guidelines, either electronically or via mail, depending on your filing method.

Steps to complete the Transmitter Report And Summary Of Magnetic Media IRS gov

Completing the Transmitter Report and Summary of Magnetic Media requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from the IRS website.

- Review the instructions provided with the form for specific requirements.

- Gather all relevant data from your electronic submissions, including payer and payee information.

- Fill out the form, ensuring that all entries are accurate and complete.

- Double-check your entries against your electronic submissions for consistency.

- Submit the completed form as per the IRS submission guidelines.

Legal use of the Transmitter Report And Summary Of Magnetic Media IRS gov

The legal use of the Transmitter Report and Summary of Magnetic Media is governed by IRS regulations. This form must be completed accurately and submitted on time to comply with federal reporting requirements. Failure to adhere to these regulations can result in penalties, including fines or interest on unpaid taxes. It is essential to ensure that the information reported is truthful and complete, as inaccuracies can lead to further scrutiny from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Transmitter Report and Summary of Magnetic Media vary based on the type of information being reported. Generally, the deadline aligns with the due dates for the corresponding tax forms. For example, if you are reporting wage and tax statements, the form is typically due by the end of January. It is important to stay informed about these deadlines to avoid late submissions, which can incur penalties.

Penalties for Non-Compliance

Non-compliance with the requirements for the Transmitter Report and Summary of Magnetic Media can lead to significant penalties. The IRS imposes fines based on the severity and duration of the non-compliance. For instance, failing to file the form on time may result in fines per form, while inaccuracies can lead to additional penalties. Businesses should prioritize compliance to avoid these financial repercussions.

Quick guide on how to complete transmitter report and summary of magnetic media irs gov

Accomplish Transmitter Report And Summary Of Magnetic Media IRS gov easily on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to access the required form and securely store it digitally. airSlate SignNow equips you with all the necessary tools to create, customize, and electronically sign your documents rapidly without delays. Handle Transmitter Report And Summary Of Magnetic Media IRS gov on any device using airSlate SignNow's Android or iOS applications and streamline any document-oriented task today.

The simplest way to edit and electronically sign Transmitter Report And Summary Of Magnetic Media IRS gov effortlessly

- Locate Transmitter Report And Summary Of Magnetic Media IRS gov and click on Obtain Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Finalize button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Transmitter Report And Summary Of Magnetic Media IRS gov and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transmitter report and summary of magnetic media irs gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Transmitter Report and Summary of Magnetic Media for the IRS?

The Transmitter Report and Summary of Magnetic Media for IRS.gov is a crucial document that businesses must file to summarize electronic submissions of information returns. It ensures accurate reporting and compliance with IRS regulations, helping to avoid penalties. Understanding this form is essential for businesses engaged in electronic tax filing.

-

How can airSlate SignNow assist with the Transmitter Report and Summary of Magnetic Media for IRS filings?

airSlate SignNow simplifies the process of documenting and eSigning the Transmitter Report and Summary of Magnetic Media for IRS.gov. With our user-friendly platform, you can easily prepare and manage your IRS forms. This ensures that your filings are timely and accurate, streamlining your compliance efforts.

-

Is there a cost associated with using airSlate SignNow for IRS filings?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when managing documents like the Transmitter Report and Summary of Magnetic Media for IRS.gov. Our cost-effective solutions provide excellent value while helping you stay compliant with IRS requirements. Sign up today to find a plan that suits your needs.

-

What features does airSlate SignNow offer for IRS document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, document tracking, and integration capabilities. These features are designed to enhance your efficiency when handling documents like the Transmitter Report and Summary of Magnetic Media for IRS.gov. With our platform, you can ensure a streamlined document workflow.

-

How does airSlate SignNow ensure the security of sensitive IRS documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the Transmitter Report and Summary of Magnetic Media for IRS.gov. We utilize industry-leading encryption and secure access protocols to protect your information. You can confidently manage your IRS filings knowing your data is safe with us.

-

Can airSlate SignNow integrate with other software for better document management?

Absolutely! airSlate SignNow offers a range of integrations with popular software solutions that help enhance your workflow. This means you can easily connect our platform with systems you already use to manage documents like the Transmitter Report and Summary of Magnetic Media for IRS.gov efficiently. Integration is seamless and enhances overall productivity.

-

What benefits can I expect from using airSlate SignNow for IRS document submissions?

Using airSlate SignNow for IRS document submissions like the Transmitter Report and Summary of Magnetic Media for IRS.gov offers numerous benefits, including time-saving eSigning, error reduction in document handling, and improved compliance. Our intuitive platform empowers businesses to stay organized and manage their IRS obligations effortlessly.

Get more for Transmitter Report And Summary Of Magnetic Media IRS gov

- General power of attorney form free download on upcounsel

- Rule 41 dismissal of actionsfederal rules of civil procedureus form

- Sd court reporter manual state of south dakota form

- General form of factoring agreement regarding the assignment of

- Agreement for home staging services form

- Affiliate program agreement how to create its terms and conditions form

- Agreement for work change form

- Sublease agreementuc berkeley division of student affairs form

Find out other Transmitter Report And Summary Of Magnetic Media IRS gov

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now