Form 5550 Sunamerica

What is the Form 5550 Sunamerica

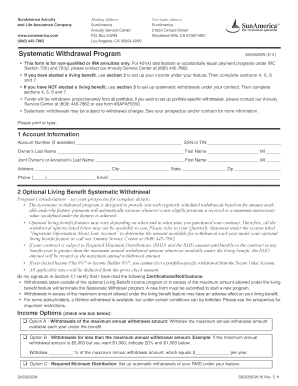

The Form 5550 Sunamerica is a specific document used for reporting and compliance purposes within the financial services sector. It is typically associated with retirement plans and is essential for ensuring that the plan meets regulatory requirements. This form helps organizations maintain transparency and adhere to the guidelines set forth by the Internal Revenue Service (IRS) and other regulatory bodies. Understanding the purpose of this form is crucial for businesses and individuals involved in managing retirement accounts.

How to use the Form 5550 Sunamerica

Using the Form 5550 Sunamerica involves several key steps. First, gather all necessary information related to the retirement plan, including participant data and financial details. Next, accurately fill out the form, ensuring that all sections are completed according to IRS guidelines. Once the form is filled out, it can be submitted electronically or via mail, depending on the specific requirements. Utilizing a digital platform can streamline this process, making it easier to manage and submit the form securely.

Steps to complete the Form 5550 Sunamerica

Completing the Form 5550 Sunamerica requires careful attention to detail. Here are the essential steps:

- Collect all relevant information about the retirement plan, including participant contributions and distributions.

- Access the form through the appropriate channels, ensuring you have the latest version.

- Fill in the required fields, including plan identification details and financial information.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods, either online or by mail.

Legal use of the Form 5550 Sunamerica

The legal use of the Form 5550 Sunamerica is governed by various regulations set forth by the IRS. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated timelines. Compliance with these legal requirements is essential for avoiding penalties and maintaining the integrity of the retirement plan. Additionally, using a secure platform for electronic submission can enhance the legal standing of the document.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5550 Sunamerica are critical to ensure compliance with IRS regulations. Typically, the form must be filed annually, and the deadline may vary based on the plan year. It is important to stay informed about these dates to avoid late penalties. Marking these deadlines on a calendar can help ensure timely submission and adherence to legal requirements.

Required Documents

To complete the Form 5550 Sunamerica, several documents may be required. These typically include:

- Financial statements of the retirement plan.

- Participant information, including contributions and distributions.

- Any prior year forms related to the retirement plan for reference.

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Quick guide on how to complete form 5550 sunamerica

Complete Form 5550 Sunamerica effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your papers quickly without delays. Manage Form 5550 Sunamerica on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The optimal method to modify and eSign Form 5550 Sunamerica effortlessly

- Locate Form 5550 Sunamerica and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form—via email, SMS, invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searching, or mistakes that require you to print new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 5550 Sunamerica to ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5550 sunamerica

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5550 Sunamerica and why is it important?

The Form 5550 Sunamerica is a critical document for businesses that need to ensure compliance with regulatory requirements. It helps organizations report and maintain their welfare benefit plans effectively. Understanding and properly managing the Form 5550 Sunamerica can save your business from potential penalties.

-

How does airSlate SignNow assist with the completion of Form 5550 Sunamerica?

airSlate SignNow provides an intuitive platform for eSigning and managing documents, including the Form 5550 Sunamerica. With its user-friendly interface, businesses can easily fill out, sign, and send this important form securely. This streamlines your paperwork process, allowing you to focus on your core business activities.

-

What are the pricing options for using airSlate SignNow to manage Form 5550 Sunamerica?

airSlate SignNow offers flexible pricing plans suited for businesses of all sizes. You can choose a plan that fits your needs, whether you're a small startup or a large organization dealing with multiple Form 5550 Sunamerica submissions. Pricing details are available on the website, ensuring transparency and value for your investment.

-

Can I integrate airSlate SignNow with other software to handle Form 5550 Sunamerica?

Yes, airSlate SignNow offers seamless integrations with various software applications that help manage your Form 5550 Sunamerica. These integrations simplify your workflow, enabling you to connect with your existing tools for enhanced efficiency. Check our integrations page for more details on compatible software.

-

What are the key features of airSlate SignNow for handling Form 5550 Sunamerica?

The key features of airSlate SignNow for the Form 5550 Sunamerica include eSignature capabilities, customizable templates, and secure cloud storage. These features help ensure your forms are completed correctly and securely, making the document process much simpler. You can also track the status of your documents in real-time.

-

What benefits does airSlate SignNow provide for businesses handling Form 5550 Sunamerica?

By using airSlate SignNow for your Form 5550 Sunamerica, businesses can improve efficiency, reduce processing times, and enhance compliance. The platform's reliable eSigning solutions help prevent errors and delays, allowing your team to focus on other important tasks. Additionally, it promotes environmentally-friendly practices by reducing paper usage.

-

Is airSlate SignNow secure for handling sensitive documents like Form 5550 Sunamerica?

Absolutely! airSlate SignNow takes document security very seriously, implementing advanced encryption and security protocols to protect sensitive information, including the Form 5550 Sunamerica. Our platform is designed to meet strict compliance standards, ensuring that your data remains secure and confidential.

Get more for Form 5550 Sunamerica

Find out other Form 5550 Sunamerica

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure