Handyman Insurance Application Form

What is the handyman insurance application?

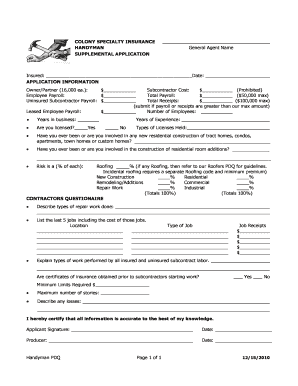

The handyman insurance application is a formal document used by individuals or businesses in California seeking to obtain insurance coverage tailored for handyman services. This application typically requires detailed information about the applicant's business operations, including the types of services offered, the number of employees, and the estimated annual revenue. The purpose of this application is to assess risk and determine the appropriate coverage needed to protect against potential liabilities that may arise during the course of providing handyman services.

Steps to complete the handyman insurance application

Completing the handyman insurance application involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including your business structure, services offered, and financial details. Next, fill out the application form carefully, ensuring that all sections are completed with accurate data. It is essential to disclose any previous claims or incidents, as this can impact your coverage options. After completing the form, review it for any errors before submitting it to the insurance provider.

Key elements of the handyman insurance application

The handyman insurance application includes several critical components that must be addressed. These elements typically consist of personal information about the applicant, a description of the services provided, and the business's operational details. Additionally, the application may require information regarding prior insurance coverage, any claims history, and the desired coverage limits. Understanding these key elements helps ensure that the application is comprehensive and meets the insurance provider's requirements.

Legal use of the handyman insurance application

The legal use of the handyman insurance application is governed by state regulations and insurance laws. In California, it is essential to ensure that the application complies with the California Department of Insurance guidelines. This includes providing truthful and complete information, as any misrepresentation can lead to denial of coverage or cancellation of the policy. It is also important to keep copies of the application and any correspondence with the insurance provider for future reference.

Eligibility criteria

To be eligible for handyman insurance in California, applicants typically need to meet specific criteria set by insurance providers. These criteria may include having a valid business license, maintaining a clean claims history, and operating within the legal framework of California's handyman regulations. Additionally, some insurers may require proof of training or certification in relevant skills. Understanding these eligibility requirements can streamline the application process and increase the chances of approval.

Form submission methods

The handyman insurance application can be submitted through various methods, depending on the insurance provider's preferences. Common submission methods include online applications, where applicants can fill out and submit the form electronically, and traditional methods such as mailing a printed application or delivering it in person to the insurance office. Each method has its advantages, and applicants should choose the one that best suits their needs and ensures timely processing.

Quick guide on how to complete handyman insurance application

Complete Handyman Insurance Application effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Handyman Insurance Application on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and eSign Handyman Insurance Application without hassle

- Locate Handyman Insurance Application and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize relevant sections of your documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Modify and eSign Handyman Insurance Application and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the handyman insurance application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is handyman insurance in California?

Handyman insurance in California is a specialized coverage designed to protect professionals who provide handyman services. This insurance typically includes general liability coverage, which shields you from claims of bodily injury or property damage. As a handyman in California, having the right insurance helps secure your business and build trust with your clients.

-

How much does handyman insurance cost in California?

The cost of handyman insurance in California varies depending on several factors, including the size of your business, the types of services you offer, and your claims history. On average, you can expect to pay between $300 to $1,000 annually for handyman insurance. Getting quotes from multiple providers will help you find the best price for your coverage needs.

-

What are the benefits of having handyman insurance in California?

Having handyman insurance in California offers several benefits, such as financial protection against lawsuits and claims resulting from accidents. It also boosts your credibility and professionalism, making clients more likely to hire you. Additionally, it can be a requirement for securing contracts with larger businesses.

-

What coverage is typically included in handyman insurance in California?

Handyman insurance in California often includes general liability, property damage, and workers’ compensation coverage. These protections ensure that you are shielded from common risks associated with handyman work. It’s essential to review your policy options to tailor the coverage effectively to your services.

-

Can handyman insurance in California cover tools and equipment?

Yes, handyman insurance in California can cover tools and equipment, but this is usually provided under a separate policy or rider. Equipment coverage protects you against theft, damage, or loss of tools necessary for your work. Always confirm with your insurance provider to ensure you have the right coverage for your tools.

-

Is handyman insurance required by law in California?

While handyman insurance is not legally required in California, it is highly recommended to protect yourself and your business. Many clients may request proof of insurance before hiring a handyman. Additionally, having insurance can be crucial if you are involved in an accident or face legal claims.

-

How do I choose the right handyman insurance policy in California?

To choose the right handyman insurance policy in California, assess your specific business needs, including the services you provide and the risks involved. Compare multiple insurance providers, review their offerings, and check customer feedback. Consulting with an insurance agent who specializes in handyman coverage can also help you make an informed decision.

Get more for Handyman Insurance Application

- 14144adoc dshs wa form

- Form 33ha utah department of workforce services utahgov jobs utah

- Download form ut1 ftc from the tribunals tribunalsgovuk

- Conditional waiver and release upon final payment jt wimsatt form

- Nyc uxs nycgov nyc form

- Ngb 4100 1b r e formpdffillercom

- Little caesars pizza job application pdf form

- Imm 5604 form

Find out other Handyman Insurance Application

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast