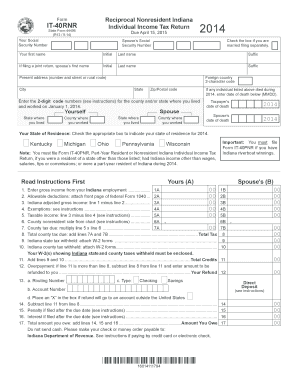

Reciprocal Nonresident Indiana Individual Income Tax Return in Gov Form

What is the Reciprocal Nonresident Indiana Individual Income Tax Return?

The Reciprocal Nonresident Indiana Individual Income Tax Return is a specific tax form utilized by nonresidents who earn income in Indiana. This form allows individuals from reciprocal states to file their Indiana income tax returns, ensuring they are taxed fairly according to the agreements between states. Understanding this form is crucial for nonresidents to comply with Indiana tax laws and avoid penalties.

Steps to complete the Reciprocal Nonresident Indiana Individual Income Tax Return

Completing the Reciprocal Nonresident Indiana Individual Income Tax Return involves several key steps:

- Gather necessary documentation, including W-2 forms and other income statements.

- Determine your residency status and ensure eligibility for the reciprocal agreement.

- Fill out the form accurately, providing all required information about your income and deductions.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the Reciprocal Nonresident Indiana Individual Income Tax Return

The Reciprocal Nonresident Indiana Individual Income Tax Return is legally binding when filled out correctly and submitted according to Indiana tax regulations. To ensure the form's legality, it is essential to comply with the eSignature laws, which recognize electronic signatures as valid. This compliance is crucial for the form to be accepted by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Reciprocal Nonresident Indiana Individual Income Tax Return typically align with federal tax deadlines. It is important to be aware of these dates to avoid late fees and penalties. Generally, the deadline for filing is April 15, unless it falls on a weekend or holiday, in which case it may be extended. Always check for any updates or changes to the tax calendar.

Required Documents

To complete the Reciprocal Nonresident Indiana Individual Income Tax Return, you will need several key documents:

- W-2 forms from employers showing income earned in Indiana.

- Any 1099 forms for additional income sources.

- Records of deductions and credits you plan to claim.

- Identification information, such as Social Security numbers.

Who Issues the Form

The Reciprocal Nonresident Indiana Individual Income Tax Return is issued by the Indiana Department of Revenue. This state agency is responsible for managing tax collection and ensuring compliance with Indiana tax laws. It is important to obtain the most current version of the form directly from the official state resources to ensure accuracy and compliance.

Quick guide on how to complete reciprocal nonresident indiana individual income tax return in gov

Complete Reciprocal Nonresident Indiana Individual Income Tax Return IN gov effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Manage Reciprocal Nonresident Indiana Individual Income Tax Return IN gov on any device using the airSlate SignNow Android or iOS applications and enhance any document-related activity today.

How to modify and electronically sign Reciprocal Nonresident Indiana Individual Income Tax Return IN gov with ease

- Obtain Reciprocal Nonresident Indiana Individual Income Tax Return IN gov and select Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or redact sensitive information with the specialized tools offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Change and electronically sign Reciprocal Nonresident Indiana Individual Income Tax Return IN gov and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reciprocal nonresident indiana individual income tax return in gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Reciprocal Nonresident Indiana Individual Income Tax Return IN gov?

A Reciprocal Nonresident Indiana Individual Income Tax Return IN gov is a tax form filed by nonresident workers in Indiana who are residents of states that have a reciprocal tax agreement. This allows them to avoid double taxation on income earned in Indiana. Understanding this tax form is essential for ensuring compliance and correctly handling your state tax obligations.

-

How can airSlate SignNow help with filing the Reciprocal Nonresident Indiana Individual Income Tax Return IN gov?

airSlate SignNow simplifies the process of preparing and filing the Reciprocal Nonresident Indiana Individual Income Tax Return IN gov by enabling you to electronically sign and send documents securely. Our platform provides templates and guidance that can help streamline your tax filing process, making it easier to manage your documentation.

-

What features does airSlate SignNow offer for managing tax documents like the Reciprocal Nonresident Indiana Individual Income Tax Return IN gov?

With airSlate SignNow, users can access robust features such as electronic signatures, document templates, and cloud storage. These features facilitate efficient document handling and ensure that your Reciprocal Nonresident Indiana Individual Income Tax Return IN gov is filed accurately and on time, reducing the risk of errors.

-

Is airSlate SignNow cost-effective for individuals needing to file a Reciprocal Nonresident Indiana Individual Income Tax Return IN gov?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals and businesses alike. With flexible pricing plans, you can access essential tools to manage your Reciprocal Nonresident Indiana Individual Income Tax Return IN gov without incurring high costs, making it an ideal choice for budget-conscious users.

-

Are there integrations available for airSlate SignNow that support tax filing, including the Reciprocal Nonresident Indiana Individual Income Tax Return IN gov?

airSlate SignNow offers various integrations that connect with accounting and tax software, enabling seamless management of your documents. These integrations allow users to streamline their processes when dealing with their Reciprocal Nonresident Indiana Individual Income Tax Return IN gov, enhancing overall efficiency and productivity.

-

What benefits can I expect from using airSlate SignNow for my Reciprocal Nonresident Indiana Individual Income Tax Return IN gov?

By using airSlate SignNow, you gain access to a secure e-signature platform that increases document turnaround times and reduces paper clutter. The ease of use and accessibility of airSlate SignNow help ensure that you can focus on filling out your Reciprocal Nonresident Indiana Individual Income Tax Return IN gov effectively and without hassle.

-

Can I track the status of my Reciprocal Nonresident Indiana Individual Income Tax Return IN gov using airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your documents, including your Reciprocal Nonresident Indiana Individual Income Tax Return IN gov. You’ll receive notifications when your documents are viewed or signed, ensuring you stay informed throughout the process.

Get more for Reciprocal Nonresident Indiana Individual Income Tax Return IN gov

- Direct deposit authorization mywcinfo form

- Mortgage payment receipt template form

- Patelco direct deposit form

- Cash intake form old dominion university

- Customer updation form for kyc

- Aflac benefit services request for reimbursement form

- Download form tiaa tiaa

- Authorized signer us bank credit wellness form

Find out other Reciprocal Nonresident Indiana Individual Income Tax Return IN gov

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement