Inheritance Ira Beneficiary Distribution Form

What is the Inheritance IRA Beneficiary Distribution Form

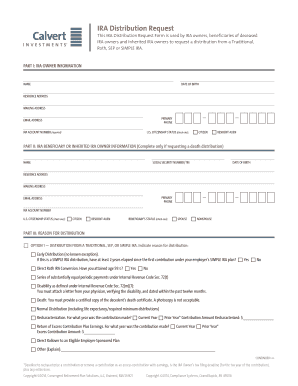

The inheritance IRA beneficiary distribution form is a legal document used to designate beneficiaries for an inherited Individual Retirement Account (IRA). This form is essential for ensuring that the assets in the IRA are distributed according to the wishes of the deceased account holder. It outlines the beneficiaries who will receive the funds and specifies how the distributions will be handled, which can significantly impact tax obligations and financial planning for the heirs.

How to Use the Inheritance IRA Beneficiary Distribution Form

Using the inheritance IRA beneficiary distribution form involves several steps. First, the account holder must complete the form with accurate information regarding the beneficiaries. This includes their names, Social Security numbers, and the percentage of the account each will receive. Once completed, the form should be submitted to the financial institution managing the IRA. It is important to keep a copy of the submitted form for personal records and to ensure that the beneficiaries are aware of their designation.

Steps to Complete the Inheritance IRA Beneficiary Distribution Form

Completing the inheritance IRA beneficiary distribution form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the IRA and the beneficiaries.

- Fill out the form with the required details, including the account number and beneficiary information.

- Review the form for accuracy to avoid any mistakes that could delay processing.

- Sign and date the form to validate it.

- Submit the form to the financial institution, either online or by mail, as per their guidelines.

Legal Use of the Inheritance IRA Beneficiary Distribution Form

The inheritance IRA beneficiary distribution form is legally binding once it is properly completed and submitted. It is crucial to comply with the legal requirements set forth by the IRS and the financial institution. This includes ensuring that the form is signed by the account holder and that it adheres to the institution's policies. Failure to follow these guidelines may result in disputes over the distribution of the IRA assets.

Key Elements of the Inheritance IRA Beneficiary Distribution Form

Several key elements must be included in the inheritance IRA beneficiary distribution form to ensure its validity. These include:

- The name and contact information of the account holder.

- The account number of the IRA.

- The names, Social Security numbers, and contact information of the designated beneficiaries.

- The percentage of the account each beneficiary will receive.

- Signatures of the account holder and, if required, witnesses or notaries.

Form Submission Methods

The inheritance IRA beneficiary distribution form can typically be submitted in several ways, depending on the policies of the financial institution. Common submission methods include:

- Online submission through the institution's secure portal.

- Mailing a physical copy to the designated address.

- In-person submission at a local branch office.

Quick guide on how to complete inheritance ira beneficiary distribution form

Effortlessly Prepare Inheritance Ira Beneficiary Distribution Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a seamless eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to generate, alter, and electronically sign your documents promptly without delays. Handle Inheritance Ira Beneficiary Distribution Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Alter and Electronically Sign Inheritance Ira Beneficiary Distribution Form with Ease

- Find Inheritance Ira Beneficiary Distribution Form and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or conceal sensitive data with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

No more missing or lost documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs within a few clicks from your chosen device. Modify and electronically sign Inheritance Ira Beneficiary Distribution Form to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inheritance ira beneficiary distribution form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an inheritance IRA beneficiary distribution form?

An inheritance IRA beneficiary distribution form is a legal document that allows beneficiaries to claim distributions from an inherited IRA. This form ensures that the assets are distributed according to the intentions of the deceased and complies with IRS regulations. Properly completing this form is essential to avoid tax penalties and ensure timely access to the funds.

-

How do I fill out the inheritance IRA beneficiary distribution form?

To fill out the inheritance IRA beneficiary distribution form, you will need to provide details such as the beneficiary's name, Social Security number, and their relationship to the deceased. Additionally, specify the type of distribution requested, whether a lump sum or periodic withdrawals. It’s crucial to review the form carefully to ensure accuracy and compliance.

-

What are the benefits of using airSlate SignNow for my inheritance IRA beneficiary distribution form?

Using airSlate SignNow to manage your inheritance IRA beneficiary distribution form offers several benefits. It ensures a streamlined signing process, reducing the time it takes to complete and submit the form. Additionally, our platform provides security and compliance features to protect sensitive information while facilitating easy collaboration among all parties involved.

-

Is there a cost associated with using airSlate SignNow for inheritance IRA beneficiary distribution forms?

AirSlate SignNow offers competitive pricing plans that cater to different business needs, including features for managing inheritance IRA beneficiary distribution forms. Depending on the plan you choose, you may access additional features such as custom branding, advanced integrations, and enhanced document tracking. We recommend checking our pricing page for detailed information on subscription options.

-

Can I integrate airSlate SignNow with other software to manage my inheritance IRA beneficiary distribution form?

Yes, airSlate SignNow provides integration capabilities with various software applications, making it easy to manage your inheritance IRA beneficiary distribution form alongside other financial tools. This integration can streamline workflow processes and enhance overall efficiency. Check our list of integrations to see if your preferred software is supported.

-

What should I do if my inheritance IRA beneficiary distribution form is rejected or contested?

If your inheritance IRA beneficiary distribution form is rejected or contested, it’s essential to review the reasons behind the rejection and consult with a financial advisor or legal professional. Common issues may involve incomplete information or discrepancies in beneficiary designations. Make sure to rectify any errors and resubmit the form as soon as possible to access the funds.

-

How long does it take to process an inheritance IRA beneficiary distribution form?

The processing time for an inheritance IRA beneficiary distribution form can vary depending on the financial institution and the completeness of the submitted documents. In general, it may take anywhere from a few days to several weeks. To avoid delays, ensure that you have filled out the form correctly and provided all required documentation.

Get more for Inheritance Ira Beneficiary Distribution Form

Find out other Inheritance Ira Beneficiary Distribution Form

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast