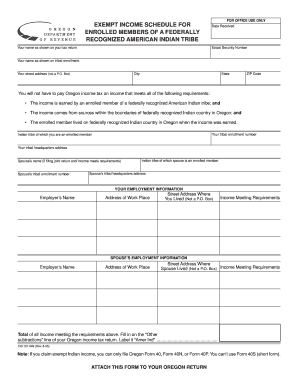

Exempt Income Schedule for Entrolled Members of a Federally Recognized American Indian Tribe, 150 101 049 Form

What is the Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049

The Exempt Income Schedule for enrolled members of a federally recognized American Indian tribe, identified as 150 101 049, is a specialized form used primarily for tax purposes. This form allows eligible tribal members to report income that is exempt from federal taxation under specific legal provisions. Understanding this form is essential for ensuring compliance with tax regulations while maximizing potential benefits related to tribal income.

How to Use the Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049

Using the Exempt Income Schedule involves several key steps. First, gather all necessary documentation that supports your claims of exempt income. This may include income statements, tribal enrollment verification, and any relevant legal documents. Next, accurately fill out the form by entering your exempt income details in the designated sections. Ensure that all information is clear and precise to avoid any issues during processing. Finally, submit the completed form according to the guidelines provided by the IRS or your tribal authority.

Steps to Complete the Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049

Completing the Exempt Income Schedule requires careful attention to detail. Follow these steps:

- Review the form thoroughly to understand each section.

- Collect all relevant income documentation, ensuring it aligns with the exempt income criteria.

- Fill out personal information, including your name, tribal affiliation, and any identification numbers.

- Detail your exempt income sources, ensuring accuracy in amounts reported.

- Double-check all entries for accuracy before submission.

Legal Use of the Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049

The legal use of the Exempt Income Schedule is governed by federal tax laws that recognize specific income types as exempt for tribal members. This form must be completed in accordance with IRS guidelines to ensure its validity. Misuse or incorrect reporting can lead to penalties or audits. It is advisable to consult with a tax professional familiar with tribal tax issues to ensure compliance and proper use of the form.

Key Elements of the Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049

Several key elements are crucial when completing the Exempt Income Schedule:

- Identification Information: Accurate personal details, including tribal affiliation.

- Income Reporting: Clear categorization of exempt income sources.

- Supporting Documentation: Required documents that verify income claims.

- Signature: Necessary for validating the form upon submission.

Filing Deadlines / Important Dates

Filing deadlines for the Exempt Income Schedule align with the general tax filing calendar. Typically, forms must be submitted by April fifteenth of each year unless an extension is granted. It is essential to stay informed about any changes in deadlines or requirements that may arise due to legislative updates or IRS announcements. Mark your calendar to ensure timely submission and avoid penalties.

Quick guide on how to complete exempt income schedule for entrolled members of a federally recognized american indian tribe 150 101 049

Complete Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049 effortlessly on any gadget

Digital document management has grown increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate template and securely keep it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049 on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest method to edit and eSign Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049 with ease

- Obtain Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exempt income schedule for entrolled members of a federally recognized american indian tribe 150 101 049

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Exempt Income Schedule For Enrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049?

The Exempt Income Schedule For Enrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049, outlines the conditions under which certain income is exempt from taxation for eligible members. This schedule provides clarity on income types that can be excluded, ensuring that tribal members can accurately report their financial information while maximizing their tax benefits.

-

How does airSlate SignNow help with the preparation of the Exempt Income Schedule?

airSlate SignNow offers tools for easy document creation and eSigning, which greatly aids in the preparation of the Exempt Income Schedule For Enrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049. With its user-friendly interface, users can efficiently compile necessary documents, making the tax filing process simpler and more organized for tribal members.

-

What features does airSlate SignNow provide for handling tax-related documents?

airSlate SignNow provides robust features such as customizable templates, secure eSigning, and cloud storage options. These features facilitate the management of important documents, including the Exempt Income Schedule For Enrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049, ensuring that all relevant information is easily accessible and properly managed.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan is designed to provide value for users looking to manage documents related to tax processes like the Exempt Income Schedule For Enrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049. Additionally, airSlate SignNow provides a free trial so you can explore the platform’s capabilities before committing.

-

Can airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow offers integrations with several popular software applications used for tax preparation. This feature ensures that users can seamlessly exchange information needed to complete the Exempt Income Schedule For Enrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049, and other tax-related documents, streamlining the entire process.

-

What are the benefits of using airSlate SignNow for tribal members?

For tribal members, airSlate SignNow provides the benefit of a secure and efficient way to manage important documents such as the Exempt Income Schedule For Enrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049. Its user-friendly interface, coupled with features like document tracking and reminders, ensures that users can stay organized and compliant with tax requirements.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow places a premium on security, employing advanced encryption protocols and security measures to protect sensitive documents. This ensures that all information submitted, including the Exempt Income Schedule For Enrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049, is safeguarded against unauthorized access.

Get more for Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049

- Psychology department required addendum pdf form psychology tamu

- Texas pork leadership camp is an intense progressive and thought provoking week full of activities tours and form

- 2016 texas pork leadership camp june 2025 2016 sponsored by texas pork producers association texas pork leadership camp is an form

- Sponsored by texas pork producers association form

- Backflow test report fort bend county wc amp id 2 form

- Texas military affidavit form

- Office offense form

- Application for food establishment complete hcphes form

Find out other Exempt Income Schedule For Entrolled Members Of A Federally Recognized American Indian Tribe, 150 101 049

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement