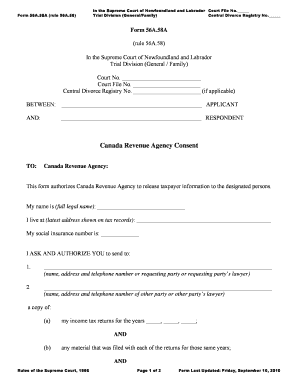

Form 56A 58A Canada Revenue Agency Consent

What is the Form 56A 58A Canada Revenue Agency Consent

The Form 56A 58A Canada Revenue Agency Consent is a document used primarily for tax-related purposes in Canada. It serves as a consent form that allows individuals or businesses to authorize the Canada Revenue Agency (CRA) to disclose specific information to third parties. This form is essential for ensuring that the necessary tax information is shared with authorized entities, such as tax professionals or financial institutions, facilitating smoother communication and compliance with tax regulations.

How to use the Form 56A 58A Canada Revenue Agency Consent

Using the Form 56A 58A Canada Revenue Agency Consent involves several straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from the CRA's official website or other authorized sources. Next, fill out the required fields, including your personal information and the details of the third party to whom you are granting consent. After completing the form, review it for accuracy and completeness before submitting it to the CRA. This ensures that your consent is valid and that the authorized party can access your tax information without issues.

Steps to complete the Form 56A 58A Canada Revenue Agency Consent

Completing the Form 56A 58A Canada Revenue Agency Consent requires careful attention to detail. Follow these steps:

- Download the form from an authorized source.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the details of the third party you are authorizing, including their name and contact information.

- Specify the type of information you are consenting to share.

- Sign and date the form to validate your consent.

- Submit the completed form to the CRA via the preferred submission method.

Legal use of the Form 56A 58A Canada Revenue Agency Consent

The legal use of the Form 56A 58A Canada Revenue Agency Consent is crucial for ensuring that your tax information is handled appropriately. This form must be filled out accurately and submitted in compliance with CRA regulations to be considered valid. It is important to understand that any unauthorized disclosure of information can lead to legal implications for both the individual granting consent and the third party receiving the information. Therefore, always ensure that the consent is granted to reputable and authorized entities.

Key elements of the Form 56A 58A Canada Revenue Agency Consent

Several key elements must be included in the Form 56A 58A Canada Revenue Agency Consent for it to be effective:

- Personal Information: Complete and accurate details of the individual granting consent.

- Authorized Party: Clear identification of the third party who will receive the information.

- Scope of Consent: Specific details about what information is being shared.

- Signature: The signature of the individual granting consent, confirming their authorization.

- Date: The date on which the consent is granted.

Form Submission Methods

The Form 56A 58A Canada Revenue Agency Consent can be submitted through various methods, depending on your preference and the CRA's guidelines. Common submission methods include:

- Online Submission: Many individuals opt to submit the form electronically through the CRA's online portal.

- Mail: You can print the completed form and send it via postal mail to the CRA.

- In-Person: Some individuals may choose to deliver the form in person at a local CRA office, ensuring immediate receipt.

Quick guide on how to complete form 56a 58a canada revenue agency consent

Complete Form 56A 58A Canada Revenue Agency Consent effortlessly on any gadget

Online document handling has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Manage Form 56A 58A Canada Revenue Agency Consent on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-centered process today.

How to edit and eSign Form 56A 58A Canada Revenue Agency Consent with ease

- Find Form 56A 58A Canada Revenue Agency Consent and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Modify and eSign Form 56A 58A Canada Revenue Agency Consent and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 56a 58a canada revenue agency consent

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 56A 58A Canada Revenue Agency Consent?

The Form 56A 58A Canada Revenue Agency Consent is a document that allows businesses to authorize the Canada Revenue Agency to disclose information to a third party. This consent form is essential for tax-related matters and ensures compliance with Canadian regulations.

-

How can airSlate SignNow help with completing the Form 56A 58A Canada Revenue Agency Consent?

airSlate SignNow simplifies the process of completing the Form 56A 58A Canada Revenue Agency Consent by providing an intuitive signing platform. Users can fill out, eSign, and share the consent form securely, making it easy to manage tax documents.

-

Is there a cost associated with using airSlate SignNow for the Form 56A 58A Canada Revenue Agency Consent?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of different sizes. Each plan provides access to features that facilitate the eSigning and management of documents like the Form 56A 58A Canada Revenue Agency Consent.

-

What features does airSlate SignNow offer for managing the Form 56A 58A Canada Revenue Agency Consent?

airSlate SignNow includes features such as customizable templates, automated workflows, and cloud storage. These features streamline the process of managing the Form 56A 58A Canada Revenue Agency Consent, ensuring efficiency and organization.

-

Can I integrate airSlate SignNow with other applications when handling the Form 56A 58A Canada Revenue Agency Consent?

Absolutely! airSlate SignNow supports integrations with various applications such as CRMs and productivity tools. This allows users to seamlessly handle the Form 56A 58A Canada Revenue Agency Consent alongside their other business processes.

-

How does using airSlate SignNow enhance the security of the Form 56A 58A Canada Revenue Agency Consent?

airSlate SignNow prioritizes security by employing advanced encryption technologies and authentication measures. This ensures that the Form 56A 58A Canada Revenue Agency Consent and other sensitive documents remain protected from unauthorized access.

-

What are the benefits of using airSlate SignNow for the Form 56A 58A Canada Revenue Agency Consent?

Using airSlate SignNow for the Form 56A 58A Canada Revenue Agency Consent provides benefits such as improved efficiency, cost savings, and enhanced compliance. Users can expedite the signing process and better organize their tax documentation.

Get more for Form 56A 58A Canada Revenue Agency Consent

- Statewide central register database check form 2009

- Ldss 3370 2003 form

- 125 worth street form

- Bnycb healthline fax authorization request empire blue cross bb form

- New hire form ohio new hire reporting

- Estate recovery form ohio

- Uniform employment application for nurse aide staff 2001

- Oklahoma form 06mp001e dated 9 22 15

Find out other Form 56A 58A Canada Revenue Agency Consent

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template