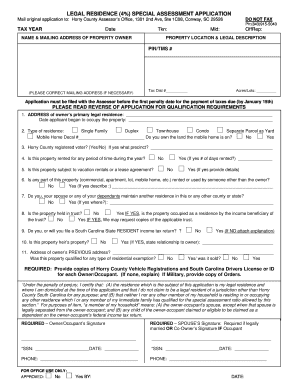

LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc Form

What is the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc

The LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc is a specific form used in the United States to apply for a special assessment based on legal residency status. This form is typically utilized by property owners seeking to qualify for reduced property taxes or other benefits associated with their legal residency. Understanding the purpose of this form is crucial for ensuring compliance with local regulations and for maximizing potential tax savings.

Steps to complete the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc

Completing the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc involves several key steps. First, gather all necessary documentation, including proof of legal residency, property ownership details, and any supporting financial information. Next, fill out the form accurately, ensuring that all fields are completed. It is important to double-check for any errors or omissions that could delay processing. Finally, submit the form through the designated method, which may include online submission, mailing it to the appropriate office, or delivering it in person.

Required Documents

When applying using the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc, certain documents are typically required to support your application. These may include:

- Proof of legal residency, such as a passport or residency card.

- Property deed or title to confirm ownership.

- Tax returns or financial statements to demonstrate eligibility.

- Any additional documents specified by the local assessor's office.

Having these documents ready can streamline the application process and enhance the likelihood of approval.

Eligibility Criteria

To qualify for the benefits associated with the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being a legal resident of the state where the property is located.

- Owning the property for which the special assessment is being requested.

- Meeting any income or asset limitations set forth by local regulations.

It is advisable to review the specific eligibility requirements outlined by the local assessor's office to ensure compliance.

Form Submission Methods

The LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission via the local assessor's website.

- Mailing the completed form to the appropriate office.

- Delivering the form in person to the local assessor's office.

Choosing the most convenient submission method can help ensure timely processing of your application.

Quick guide on how to complete legal residence 4 special assessment bapplicationb assessorcasc

Finish LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers a fantastic environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the accurate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and electronically sign LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc with ease

- Locate LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Pinpoint important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the legal residence 4 special assessment bapplicationb assessorcasc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc?

The LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc is a digital solution designed to streamline the process of applying for special assessments related to legal residency. It facilitates easy document submission and esigning, providing a user-friendly experience for applicants.

-

How can airSlate SignNow help with the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc?

airSlate SignNow simplifies the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc by enabling users to easily create, send, and eSign their application documents online. This reduces paperwork and accelerates processing time, making it more efficient for users.

-

What are the pricing options for airSlate SignNow for the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc?

Pricing for airSlate SignNow varies based on the features needed for the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc. We offer competitive plans that cater to different business sizes, ensuring you get the necessary tools without overspending.

-

What features does airSlate SignNow offer for the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc?

AirSlate SignNow includes features such as customizable templates, in-app notifications, and secure cloud storage. These capabilities assist in efficiently managing the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc and enhance collaboration among users.

-

Is airSlate SignNow compliant with legal standards for the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc?

Yes, airSlate SignNow adheres to industry-wide compliance standards, ensuring that the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc is legally binding and secure. Our platform employs advanced encryption methods and meets e-signature laws globally.

-

Can I integrate airSlate SignNow with other tools for the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc?

Absolutely! AirSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing your experience with the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc. Tools like CRM and project management software can be linked for improved efficiency.

-

What are the benefits of using airSlate SignNow for the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc?

The main benefits of using airSlate SignNow for the LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc include time savings and enhanced accuracy. By automating the application process, users can focus on more critical tasks while ensuring that their submissions are precise and timely.

Get more for LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc

- Field trip request birmingham city schools form

- Mt sac igetc certification form

- Observation form for student behavior

- Hinds community college transcript form

- 5th grade multisyllabic word list form

- Hts high school form

- State early childhood education certificate of proficiency form

- Oregon state university teleworking form

Find out other LEGAL RESIDENCE 4 SPECIAL ASSESSMENT BAPPLICATIONb Assessorcasc

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile