Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application Form

What is the Wells Fargo Mortgage Assistance Application?

The Wells Fargo Mortgage Assistance Application is a crucial document designed to help homeowners facing financial difficulties manage their mortgage obligations. This application allows borrowers to request assistance programs offered by Wells Fargo, which may include loan modifications, payment plans, or other forms of relief. Understanding the purpose and function of this application is essential for those who may be struggling to keep up with their mortgage payments.

Steps to Complete the Wells Fargo Mortgage Assistance Application

Completing the Wells Fargo Mortgage Assistance Application involves several key steps to ensure accuracy and compliance. Here is a general outline of the process:

- Gather necessary documentation, such as income statements, tax returns, and details of your current mortgage.

- Access the application form through yourwellsfargomortgage.com or by contacting Wells Fargo directly.

- Fill out the application with accurate and complete information, ensuring all required fields are addressed.

- Review the application for any errors or missing information before submission.

- Submit the application electronically or via mail, depending on your preference.

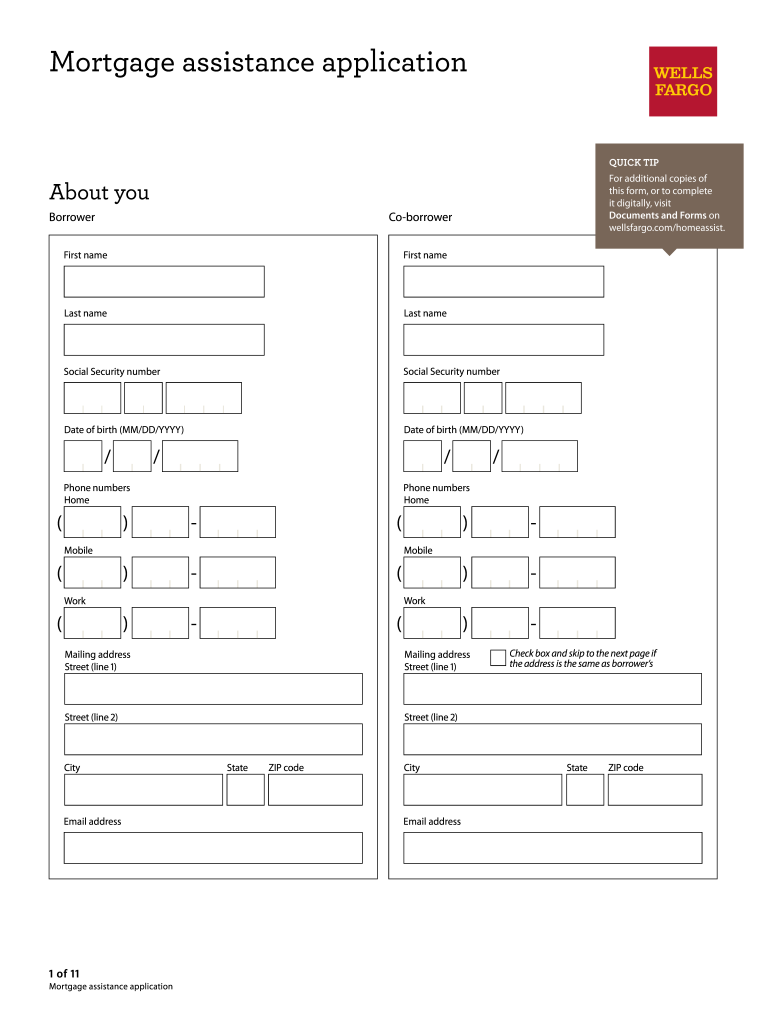

Key Elements of the Wells Fargo Mortgage Assistance Application

Several key elements are essential to include in the Wells Fargo Mortgage Assistance Application. These elements help Wells Fargo assess your situation and determine the appropriate assistance options:

- Personal Information: Full name, address, and contact details.

- Financial Information: Current income, employment status, and monthly expenses.

- Mortgage Details: Information about your existing mortgage, including the loan number and payment history.

- Reason for Assistance: A brief explanation of your financial hardship and how it has impacted your ability to make mortgage payments.

Eligibility Criteria for the Wells Fargo Mortgage Assistance Application

To qualify for assistance through the Wells Fargo Mortgage Assistance Application, borrowers must meet specific eligibility criteria. Generally, these criteria include:

- Demonstrating a financial hardship that affects the ability to make mortgage payments.

- Providing documentation that supports the claim of hardship, such as job loss or medical expenses.

- Being the primary borrower on the mortgage in question.

- Meeting any additional requirements specified by Wells Fargo based on the assistance program being requested.

Legal Use of the Wells Fargo Mortgage Assistance Application

The Wells Fargo Mortgage Assistance Application must be used in compliance with relevant legal standards to ensure its validity. This includes:

- Adhering to federal and state regulations regarding mortgage assistance programs.

- Providing accurate and truthful information to avoid potential legal repercussions.

- Understanding that submitting false information can lead to penalties, including denial of assistance or legal action.

Form Submission Methods for the Wells Fargo Mortgage Assistance Application

Borrowers have multiple options for submitting the Wells Fargo Mortgage Assistance Application. These methods include:

- Online Submission: Completing and submitting the application directly through yourwellsfargomortgage.com.

- Mail: Printing the completed application and sending it to the designated Wells Fargo address.

- In-Person: Visiting a local Wells Fargo branch to submit the application with assistance from a representative.

Quick guide on how to complete wells fargo mortgage assistance application wells fargo mortgage assistance application

Prepare Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and without delays. Manage Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application with ease

- Obtain Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Edit and eSign Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many days does it take to change my status application on Wells Fargo?

Is this for a career opportunity? I am not sure, you may need to contact the bank if you have questions. I am sure there is a number listed on the career section of the Wells Fargo page.

-

Wells Fargo rejected my personal loan & line of credit application due to low income. How and where can I get a personal loan with low interest & no hassle?

A lot of this will depend on your credit score. If you do have a good credit score *(FICO over 700, ideally over 730), something may be possible, especially from a non bank lender. SoFi and Prosper have become quite popular over time, but there are many others. I suggest researching at NerdWallet: Personal Loans | Compare Rates and Pre-Qualify - NerdWalletKeep in mind that with low income, the amounts you can borrow are low. If you are looking for a loan that would stretch the upper bounds of what you can afford, that is going to be challenging. With good credit, however, you can get a loan of some size, at a decent interest rate.

-

How do I write and fill out the application form for the MER exam (for a soldier nursing assistant)?

Check this link;http://career.webindia123.com/ca...https://www.brainbuxa.com › Exams

-

How do I fill out the educational qualification section of the assistant commandant application form in coast guard (01/2019 batch)?

U should be Bachelor of science hieght166 wt 50 and pass ur exams

-

I had qualified in the UGC NET under the OBC as well as the general category. In the application form, I filled it up with the OBC category. May I apply as an assistant professor in the general category?

As you have qualified as a general category student, you are also eligible to apply for assistant professorship as a general category student. To my knowledge, it is mentioned in the UGC NET certificate that whether you have qualified as a general category or any reserved category student along with the type of category, the candidate had applied for. So, you can check your certificate and you should definitely be eligible to apply as a general category student.

-

How do real estate auctions work?

Real Estate auction provides a number of buyers together to bid up for a property until a single bidder remains. At this point the auctioneer will close the auction and award the property to the winning bidder. Real estate auction are held either by the government agency or by the professional company. Buyers and sellers have the benefits in the auction process. The buyer is one who determines the purchase price by competitive bidding. Auction reduces both the long negotiation period as well as the time to purchase the property.Auction can take place in two ways. There are live auction and virtual auction. Live auction are held in person and open to public which makes any people to attend. Virtual auctions are held in online. Either it can occur in the live time or else for a course of days. So participating people has the opportunity to bid until the action listing closes. There are many online real estate auction sites. The live auction listing can be found through this website or else you can also get the details from the professional real estate agents.

Create this form in 5 minutes!

How to create an eSignature for the wells fargo mortgage assistance application wells fargo mortgage assistance application

How to generate an electronic signature for the Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application in the online mode

How to make an electronic signature for the Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application in Chrome

How to generate an electronic signature for signing the Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application in Gmail

How to generate an eSignature for the Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application straight from your mobile device

How to generate an eSignature for the Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application on iOS devices

How to make an eSignature for the Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application on Android OS

People also ask

-

What is yourwellsfargomortgage and how does it work?

Yourwellsfargomortgage is a streamlined solution for managing your mortgage documents securely and efficiently. With airSlate SignNow, you can electronically sign and send all necessary documents, making the entire process quicker and easier. This user-friendly platform is designed to simplify your mortgage experience.

-

What features does airSlate SignNow offer for yourwellsfargomortgage?

AirSlate SignNow provides a variety of features tailored to enhance yourwellsfargomortgage experience. Key features include electronic signatures, document tracking, and customizable templates. These tools ensure that managing your mortgage documents is efficient and error-free.

-

How much does it cost to use airSlate SignNow for yourwellsfargomortgage?

The pricing for using airSlate SignNow with yourwellsfargomortgage is competitive and cost-effective. Plans are available to suit different business needs, and the platform helps save money by reducing paper usage and streamlining processes. Consider the pricing tiers that best fit your mortgage documentation needs.

-

Is airSlate SignNow secure for handling yourwellsfargomortgage documents?

Yes, airSlate SignNow prioritizes security for yourwellsfargomortgage documents. The platform employs advanced encryption and compliance measures to protect sensitive information. You can confidently manage and eSign your mortgage documents, knowing they are safe and secure.

-

Can I integrate airSlate SignNow with other tools for my yourwellsfargomortgage?

Absolutely! AirSlate SignNow offers integrations with a variety of applications, allowing you to connect your yourwellsfargomortgage to other essential tools. This enhances efficiency and ensures a seamless workflow across platforms, amplifying your overall experience.

-

How can airSlate SignNow enhance my experience with yourwellsfargomortgage?

AirSlate SignNow can greatly enhance your experience with yourwellsfargomortgage by simplifying the document management process. It allows for quick eSigning and sending, reducing turnaround time. This means you can focus on what matters most while keeping your mortgage documents organized.

-

Is customer support available for users of yourwellsfargomortgage?

Yes, airSlate SignNow offers dedicated customer support to assist you with yourwellsfargomortgage needs. Whether you have questions about features, pricing, or troubleshooting, the support team is readily available to help ensure you have a smooth experience using the platform.

Get more for Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application

Find out other Wells Fargo Mortgage Assistance Application Wells Fargo Mortgage Assistance Application

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe