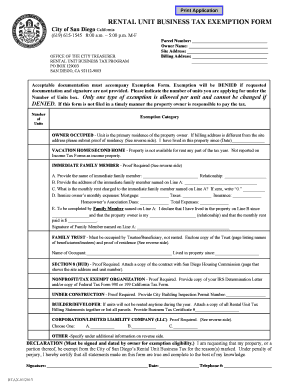

Rental Unit Business Tax Exemption Form

What is the Rental Unit Business Tax Exemption Form

The rental unit business tax exemption form is a crucial document that allows property owners to apply for tax exemptions on rental properties. This form is designed to help landlords reduce their tax liabilities by qualifying for specific exemptions based on local and state regulations. Understanding the purpose of this form is essential for anyone involved in rental property management, as it can lead to significant financial benefits.

How to Use the Rental Unit Business Tax Exemption Form

Using the rental unit business tax exemption form involves several steps. First, ensure that you meet the eligibility criteria set forth by your state or local jurisdiction. Next, gather all required documentation that supports your application for exemption. Once you have the necessary information, complete the form accurately, providing details about the rental property and your ownership status. Finally, submit the form according to the instructions provided, whether online, by mail, or in person.

Steps to Complete the Rental Unit Business Tax Exemption Form

Completing the rental unit business tax exemption form requires attention to detail. Start by filling in your personal information, including your name, address, and contact details. Next, provide information about the rental property, such as its location, type, and any relevant tax identification numbers. Be sure to include any supporting documentation that may be required, such as proof of ownership or previous tax returns. Review the form for accuracy before submitting it to ensure compliance with all requirements.

Eligibility Criteria

To qualify for the rental unit business tax exemption, applicants must meet specific eligibility criteria, which can vary by state. Generally, property owners must demonstrate that the rental unit is used for residential purposes and that they meet income limits or other financial qualifications. Additionally, some jurisdictions may require that the property be maintained in good condition and that the owner has no outstanding tax liabilities. Checking the local regulations is essential to ensure compliance.

Required Documents

When submitting the rental unit business tax exemption form, certain documents are typically required. These may include proof of ownership, such as a deed or title, previous tax returns, and documentation showing the rental income generated from the property. In some cases, additional forms or certifications may be necessary to support your application. It is important to compile these documents carefully to avoid delays in processing your exemption request.

Form Submission Methods

The rental unit business tax exemption form can usually be submitted through various methods, depending on local regulations. Common submission methods include online portals, where forms can be filled out and submitted digitally, as well as traditional methods such as mailing the completed form to the appropriate tax authority. In-person submissions may also be an option at designated offices. Understanding the available submission methods can help streamline the application process.

Quick guide on how to complete rental unit business tax exemption form

Complete Rental Unit Business Tax Exemption Form effortlessly on any device

Web-based document management has become increasingly popular among enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the correct format and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and sign your documents quickly without any delays. Manage Rental Unit Business Tax Exemption Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and sign Rental Unit Business Tax Exemption Form effortlessly

- Find Rental Unit Business Tax Exemption Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, be it via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your choosing. Edit and sign Rental Unit Business Tax Exemption Form and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rental unit business tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rental unit business tax exemption form?

The rental unit business tax exemption form is a document that allows property owners to apply for tax exemptions related to their rental units. This form helps in reducing the tax burden on rental businesses, ensuring that you can keep more of your earnings. Completing this form accurately is essential for maximizing your potential tax benefits.

-

How can airSlate SignNow help with the rental unit business tax exemption form?

airSlate SignNow streamlines the process of completing and eSigning your rental unit business tax exemption form. With its user-friendly interface, you can easily fill out, sign, and send the form electronically. This not only saves time but also ensures that you stay organized in your tax-related documentation.

-

Is there a cost associated with using airSlate SignNow for the rental unit business tax exemption form?

airSlate SignNow offers flexible pricing plans, making it accessible for businesses of all sizes looking to manage their rental unit business tax exemption form efficiently. While there may be subscription fees, the platform’s cost-effective solutions can lead to signNow savings through improved time management and error reduction in document handling.

-

Are there any features in airSlate SignNow that assist with tax exemption forms?

Yes, airSlate SignNow provides features specifically designed to assist with tax exemption forms like the rental unit business tax exemption form. These features include eSigning, templates for quick form generation, and status tracking, ensuring you have complete control over your documentation process and making it easy to comply with tax regulations.

-

Can I integrate airSlate SignNow with other software for managing my rental unit business tax exemption form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of other software tools, enhancing its functionality for managing the rental unit business tax exemption form. Whether you use accounting software or property management platforms, these integrations streamline your workflow, allowing you to manage your documents and processes more effectively.

-

What benefits can I expect from using airSlate SignNow for my rental unit business tax exemption form?

Using airSlate SignNow for your rental unit business tax exemption form offers several benefits, including faster processing time, reduced paperwork, and improved accuracy. The platform’s efficiency can lead to quicker approvals from tax authorities, and the option to store documents securely provides peace of mind. Additionally, you can easily access forms anywhere, anytime.

-

How do I get started with airSlate SignNow for the rental unit business tax exemption form?

Getting started with airSlate SignNow for your rental unit business tax exemption form is simple. You can sign up for a free trial to explore the features, then start creating and eSigning documents in minutes. The platform provides tutorials and customer support to help you navigate the process, ensuring you can utilize all the tools effectively.

Get more for Rental Unit Business Tax Exemption Form

Find out other Rental Unit Business Tax Exemption Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors