Fsa 2320 Example Form

What is the Fsa 2320 Example

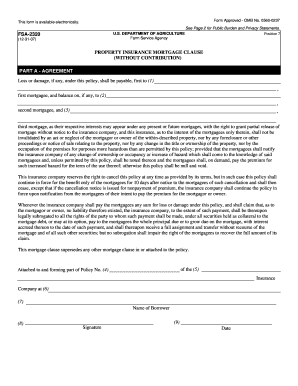

The Fsa 2320 example form is a crucial document used in various insurance contexts, primarily related to the submission of claims and the management of insurance policies. It serves as a structured template that helps individuals and businesses accurately report necessary information to insurance providers. Understanding its purpose and components is essential for effective communication with insurers and ensuring compliance with relevant regulations.

How to use the Fsa 2320 Example

Using the Fsa 2320 example form involves several key steps. First, gather all relevant information, including personal details and specifics about the insurance policy or claim. Next, carefully fill out each section of the form, ensuring accuracy to avoid delays in processing. Once completed, the form can be submitted to the appropriate insurance company, either digitally or through traditional mail, depending on the insurer's requirements.

Steps to complete the Fsa 2320 Example

Completing the Fsa 2320 example form requires attention to detail. Follow these steps for successful completion:

- Review the form layout to understand the required information.

- Collect necessary documentation, such as policy numbers and personal identification.

- Fill in personal details, ensuring all information is accurate and up to date.

- Provide specific details related to the insurance claim or policy.

- Double-check all entries for accuracy before submission.

Legal use of the Fsa 2320 Example

The legal validity of the Fsa 2320 example form hinges on compliance with relevant laws governing insurance documentation. It is essential that the form is filled out completely and accurately, as incomplete or incorrect information can lead to disputes or denial of claims. Additionally, when submitted electronically, the form must adhere to eSignature laws, ensuring that all signatures are legally binding and verifiable.

Key elements of the Fsa 2320 Example

Understanding the key elements of the Fsa 2320 example form is vital for effective use. Important components include:

- Personal Information: This includes the policyholder's name, address, and contact details.

- Policy Details: Information about the insurance policy, such as policy number and type.

- Claim Information: Specifics regarding the claim being submitted, including dates and descriptions of the incident.

- Signature Section: A place for the policyholder to sign, confirming the accuracy of the information provided.

Who Issues the Form

The Fsa 2320 example form is typically issued by insurance companies or regulatory bodies involved in the insurance sector. Each insurer may have its version of the form, tailored to meet specific requirements and regulations. It is essential to obtain the correct form from the relevant insurance provider to ensure compliance and proper processing of claims.

Quick guide on how to complete fsa 2320 example

Complete Fsa 2320 Example effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without interruptions. Manage Fsa 2320 Example on any platform using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Fsa 2320 Example with ease

- Locate Fsa 2320 Example and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive details using tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Fsa 2320 Example and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fsa 2320 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an FSA 2320 example and how does it relate to airSlate SignNow?

An FSA 2320 example refers to a specific form used in financial services for document management. With airSlate SignNow, you can easily upload, manage, and eSign documents, including FSA 2320 examples, streamlining your business operations and ensuring compliance.

-

How does airSlate SignNow enhance the use of FSA 2320 examples?

airSlate SignNow enhances the use of FSA 2320 examples by providing a user-friendly platform for eSigning and sharing documents securely. This allows businesses to minimize paperwork and expedite turnaround times, ensuring your FSA 2320 example is processed efficiently.

-

What are the pricing options for using airSlate SignNow for FSA 2320 examples?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. Whether you're a small company needing occasional use of FSA 2320 examples or a larger organization requiring bulk processing, you can find a plan that meets your needs.

-

Are there any specific features for managing FSA 2320 examples with airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for document management, such as templates, automated workflows, and real-time tracking. These functionalities make it easy to handle FSA 2320 examples effectively and keep your documents organized.

-

Can I integrate airSlate SignNow with other software while working with FSA 2320 examples?

Absolutely! airSlate SignNow provides integrations with various software applications, allowing you to enhance your workflow when dealing with FSA 2320 examples. This connectivity ensures that your data remains seamless across different platforms.

-

What are the benefits of using airSlate SignNow for FSA 2320 examples?

Using airSlate SignNow for FSA 2320 examples offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced security. With the ability to eSign documents quickly, your business can maintain productivity while ensuring compliance.

-

Is it easy to eSign an FSA 2320 example using airSlate SignNow?

Yes, eSigning an FSA 2320 example with airSlate SignNow is incredibly easy. The platform allows users to sign electronically in just a few clicks, enabling a hassle-free process that saves time and effort.

Get more for Fsa 2320 Example

Find out other Fsa 2320 Example

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself