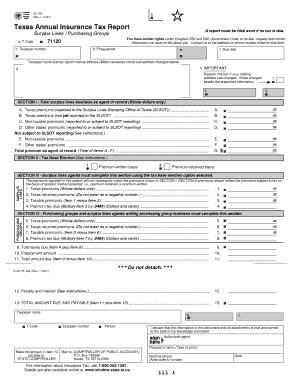

Texas Annual Insurance Tax Report Form

What is the Texas Annual Insurance Tax Report

The Texas Annual Insurance Tax Report is a mandatory document that insurance companies operating in Texas must submit annually. This report provides the state with essential information regarding the financial performance of the insurance entities, including details on premiums collected and claims paid. The data collected through this report is crucial for state assessments and helps ensure compliance with Texas insurance regulations.

How to use the Texas Annual Insurance Tax Report

Using the Texas Annual Insurance Tax Report involves several steps. First, businesses must gather financial data for the reporting period, including total premiums and claims. Next, they must accurately complete the report, ensuring that all required fields are filled out. Once the report is completed, it can be submitted electronically or via mail, depending on the preferences outlined by the Texas Department of Insurance. Keeping a copy of the submitted report for your records is also advisable.

Steps to complete the Texas Annual Insurance Tax Report

Completing the Texas Annual Insurance Tax Report involves a systematic approach:

- Gather all necessary financial documents, including premium statements and claims records.

- Access the official Texas Annual Insurance Tax Report form from the Texas Department of Insurance website.

- Fill out the form with accurate financial data, ensuring compliance with all state regulations.

- Review the completed report for accuracy and completeness.

- Submit the report through the designated method, either electronically or by mail.

- Retain a copy of the submitted report for your records.

Legal use of the Texas Annual Insurance Tax Report

The Texas Annual Insurance Tax Report is legally binding and must be completed in accordance with state laws. The report serves as an official record of an insurance company’s financial activities and is subject to review by regulatory authorities. Ensuring accuracy and compliance with all legal requirements is essential to avoid penalties and maintain good standing with the Texas Department of Insurance.

Filing Deadlines / Important Dates

Insurance companies must adhere to specific filing deadlines for the Texas Annual Insurance Tax Report. Typically, the report is due annually on April first. It is crucial for businesses to plan ahead and ensure that all necessary documentation is prepared well in advance of the deadline to avoid late fees or compliance issues.

Penalties for Non-Compliance

Failure to file the Texas Annual Insurance Tax Report on time or submitting inaccurate information can result in significant penalties. These may include fines, increased scrutiny from regulatory bodies, and potential legal repercussions. It is essential for insurance companies to prioritize timely and accurate filing to mitigate these risks.

Quick guide on how to complete texas annual insurance tax report

Effortlessly prepare Texas Annual Insurance Tax Report on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Texas Annual Insurance Tax Report on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign Texas Annual Insurance Tax Report with ease

- Locate Texas Annual Insurance Tax Report and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Texas Annual Insurance Tax Report and assure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas annual insurance tax report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas annual insurance tax report?

The Texas annual insurance tax report is a mandatory document that insurance companies must file to report their gross premiums and taxes owed to the state. Understanding this report is crucial for compliance and to avoid penalties, making it essential for Texas-based insurers.

-

How can airSlate SignNow help with the Texas annual insurance tax report?

airSlate SignNow streamlines the process of preparing and submitting the Texas annual insurance tax report by allowing businesses to easily eSign and share documents. This efficient workflow saves time and reduces errors, ensuring that your filings are accurate and timely.

-

What are the benefits of using airSlate SignNow for my tax reporting needs?

Using airSlate SignNow provides several benefits for your tax reporting, including cost-effectiveness and simplicity in document management. With the ability to eSign documents securely, you can ensure compliance with the Texas annual insurance tax report while enhancing productivity within your team.

-

Is airSlate SignNow suitable for all types of insurance companies in Texas?

Yes, airSlate SignNow is designed to accommodate various types of insurance companies in Texas, whether large or small. The flexibility of the platform allows all users to efficiently manage their Texas annual insurance tax report alongside their other essential documentation tasks.

-

Does airSlate SignNow integrate with other software I use for tax preparation?

Absolutely! airSlate SignNow offers integrations with widely-used software, allowing you to seamlessly streamline your workflow during the Texas annual insurance tax report process. This ensures that all your data is synchronized and up-to-date across various platforms, enhancing your tax preparation efficiency.

-

What security measures does airSlate SignNow provide for sensitive tax documents?

airSlate SignNow prioritizes security with features such as encryption, multi-factor authentication, and secure storage. These measures ensure that your sensitive documents, including those related to the Texas annual insurance tax report, remain confidential and protected from unauthorized access.

-

How can I get started with airSlate SignNow for my Texas annual insurance tax report?

Getting started with airSlate SignNow is simple! You can sign up for a free trial on our website, access tutorials, and leverage customer support to ensure your Texas annual insurance tax report is completed smoothly. Our user-friendly interface makes document management a breeze.

Get more for Texas Annual Insurance Tax Report

- Entry form rotary club of oil city scholarship program po

- Paramedic program application saddlebackedu form

- Income declaration form

- Parent household size inquiry 2014 15 portland community college pcc form

- Grayson county police academy form

- 3 4 practice systems of equations in three variables form

- Identifying x rays haspi answer key form

- Monthly resource amp expenditures mountwest community bb mctc form

Find out other Texas Annual Insurance Tax Report

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later