Nyc 245 Form

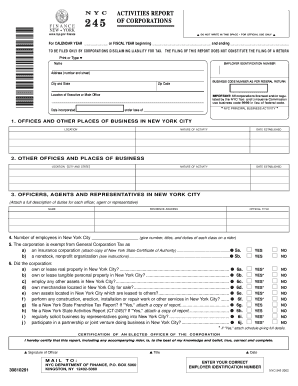

What is the NYC 245?

The NYC 245 form is a crucial document used in New York City for various administrative purposes, particularly related to tax and compliance. This form serves as a declaration for certain tax exemptions and is often required by businesses and individuals to ensure they meet local regulations. Understanding its purpose is essential for anyone navigating the legal landscape in New York City.

How to use the NYC 245

Using the NYC 245 form involves several steps to ensure proper completion and submission. First, gather all necessary information, including identification details and any supporting documentation required for your specific situation. Next, fill out the form accurately, ensuring that all fields are completed. Once the form is filled, review it for any errors before submission. Depending on your needs, you may submit the form electronically or via mail, adhering to the guidelines provided by the relevant authorities.

Steps to complete the NYC 245

Completing the NYC 245 form requires careful attention to detail. Follow these steps for a successful submission:

- Gather required information, such as personal identification and financial records.

- Download the NYC 245 form from the official website or obtain a physical copy.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for completeness and correctness.

- Submit the form according to the specified method, either online or by mail.

Legal use of the NYC 245

The legal use of the NYC 245 form is governed by local regulations and statutes. It is essential to ensure that the form is filled out in compliance with these laws to avoid any potential legal issues. The form must be signed and dated appropriately, as electronic signatures are accepted under certain conditions. Understanding the legal implications of the NYC 245 is critical for both individuals and businesses to maintain compliance with New York City regulations.

Key elements of the NYC 245

The NYC 245 form contains several key elements that are vital for its validity. These include:

- Identification information of the applicant, including name and address.

- Details about the specific exemption or declaration being requested.

- Signature and date fields to validate the form.

- Any additional information or documentation that may be required based on the applicant's circumstances.

Who Issues the Form

The NYC 245 form is issued by the New York City Department of Finance. This department is responsible for managing tax-related matters and ensuring compliance with local laws. It is important to refer to the official resources provided by the Department of Finance for the most accurate and up-to-date information regarding the form and its requirements.

Quick guide on how to complete nyc 245

Complete Nyc 245 seamlessly on any device

Digital document handling has become increasingly favored by businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Nyc 245 on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Nyc 245 with ease

- Find Nyc 245 and click on Get Form to initiate.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature using the Sign tool, which takes mere seconds and bears the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Nyc 245 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nyc 245

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYC 245 and how does it relate to airSlate SignNow?

NYC 245 refers to a signNow regulation in New York City that impacts document management and compliance in businesses. airSlate SignNow aligns with NYC 245 by offering solutions that enable organizations to efficiently manage and eSign documents while ensuring compliance with local regulations.

-

How much does airSlate SignNow cost for NYC 245 compliance?

airSlate SignNow provides flexible pricing plans suitable for businesses of all sizes. For organizations needing to comply with NYC 245, we offer competitive pricing that includes essential features to ensure your document processes align with the regulations of NYC 245.

-

What features does airSlate SignNow offer for NYC 245 document management?

airSlate SignNow offers a range of features specifically tailored for NYC 245 document management, including customizable templates, bulk sending, and advanced security measures. These features help streamline your document workflows while ensuring compliance with NYC 245.

-

Can airSlate SignNow integrate with other tools for NYC 245 compliance?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that you may already be using. This integration capability is essential for businesses meeting NYC 245 requirements, as it helps centralize document management and eSigning processes.

-

How does airSlate SignNow enhance the eSigning experience for NYC 245?

With airSlate SignNow, the eSigning experience is enhanced for NYC 245 compliance through its user-friendly interface and real-time tracking. Users can easily navigate the platform to sign documents while maintaining a transparent record of compliance for NYC 245.

-

Is customer support available for NYC 245 users of airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated customer support to assist NYC 245 users with any questions or challenges they may face. Our team is knowledgeable about the features needed for compliance with NYC 245 and is ready to help you maximize your experience.

-

What benefits does airSlate SignNow offer for businesses facing NYC 245 regulations?

airSlate SignNow offers numerous benefits for businesses navigating NYC 245 regulations, including increased efficiency in document handling and enhanced legal compliance. By utilizing our platform, companies can reduce turnaround times and ensure that their operations meet the standards set by NYC 245.

Get more for Nyc 245

- Oklahoma petition for change of name form

- Canadian county parenting schedule rev 05 13 14 form

- Examination criminal law form

- Free ohio name change forms how to change your name

- Petition for name change of a minor form 3 eforms

- Filing for dissolution divorce oregon judicial form

- Linn county oregon fapa form

- Notice of general judgment of name change form 6 eforms

Find out other Nyc 245

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online