Irs Form 5768 Printable Form PDF

What is the IRS Form 5768 Printable Form PDF

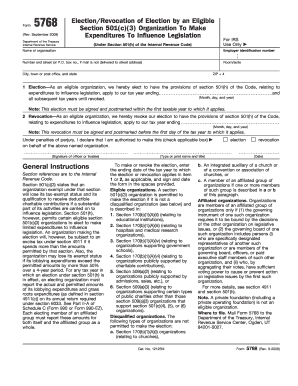

The IRS Form 5768, also known as the Election/Revocation of Election by an Eligible Section 501(c)(3) Organization to Make a Charitable Contribution, is a crucial document for organizations seeking to make tax-exempt contributions. This form provides the necessary framework for eligible organizations to elect or revoke their status under the IRS guidelines. Understanding this form is essential for compliance with federal tax regulations and ensuring that organizations can effectively manage their charitable contributions.

How to Use the IRS Form 5768 Printable Form PDF

Using the IRS Form 5768 involves several steps that ensure proper completion and submission. First, organizations must accurately fill out the required information, including their name, address, and tax identification number. Next, organizations should indicate their election or revocation choice clearly. It is vital to review the completed form for accuracy before submission. Finally, organizations can submit the form electronically or via mail, depending on their preference and IRS guidelines.

Steps to Complete the IRS Form 5768 Printable Form PDF

Completing the IRS Form 5768 requires careful attention to detail. Here are the steps to follow:

- Download the IRS Form 5768 printable form PDF from the IRS website.

- Fill in the organization’s name, address, and tax identification number.

- Select the appropriate election or revocation option.

- Provide any additional information requested on the form.

- Review the form for any errors or omissions.

- Sign and date the form as required.

- Submit the completed form to the IRS either electronically or by mail.

Legal Use of the IRS Form 5768 Printable Form PDF

The IRS Form 5768 is legally binding when completed correctly and submitted in accordance with IRS regulations. It is essential for organizations to adhere to the legal requirements surrounding this form to maintain their tax-exempt status. Proper use of the form ensures compliance with federal tax laws and protects the organization from potential penalties associated with improper filing.

Key Elements of the IRS Form 5768 Printable Form PDF

Several key elements must be included when completing the IRS Form 5768. These include:

- Organization Information: Name, address, and tax identification number.

- Election or Revocation Choice: Clear indication of the organization's intent.

- Signature: Authorized representative's signature and date.

- Additional Documentation: Any required supporting documents that may be necessary for the submission.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines associated with the IRS Form 5768 to ensure timely compliance. Typically, the form should be filed by the 15th day of the fifth month after the end of the organization’s tax year. Missing this deadline may result in penalties or loss of tax-exempt status. It is advisable for organizations to keep track of these important dates to avoid complications.

Quick guide on how to complete irs form 5768 printable form pdf

Accomplish Irs Form 5768 Printable Form Pdf effortlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to generate, alter, and electronically sign your documents swiftly without delays. Manage Irs Form 5768 Printable Form Pdf on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest method to alter and electronically sign Irs Form 5768 Printable Form Pdf with ease

- Locate Irs Form 5768 Printable Form Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to secure your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Irs Form 5768 Printable Form Pdf and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 5768 printable form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 5768 printable form?

The IRS Form 5768 printable form is a document used by organizations to apply for tax-exempt status as a private foundation under section 501(c)(3). This form helps organizations receive public charity status, which can benefit fundraising efforts. With airSlate SignNow, you can easily eSign and send this form securely.

-

How can I obtain the IRS Form 5768 printable form?

You can easily obtain the IRS Form 5768 printable form directly from the IRS website or through our platform at airSlate SignNow. Once you access the form, you can fill it out digitally and utilize our eSignature features to finalize and submit it. This simplifies the process and helps ensure accuracy.

-

Is there a fee to eSign the IRS Form 5768 printable form using airSlate SignNow?

Using airSlate SignNow to eSign the IRS Form 5768 printable form is part of our cost-effective solution. We offer various pricing plans based on your needs, providing access to essential features without breaking the bank. Check our pricing page for detailed options and get started today.

-

What features does airSlate SignNow provide for handling the IRS Form 5768 printable form?

airSlate SignNow offers robust features for managing the IRS Form 5768 printable form, including secure eSignatures, document templates, and the ability to track the signing process. You can also collaborate with team members in real-time and ensure compliance with legal standards. Our platform streamlines the entire document handling experience.

-

Can I integrate airSlate SignNow with other software for the IRS Form 5768 printable form?

Yes, airSlate SignNow supports various integrations with popular software, making it easy to manage the IRS Form 5768 printable form alongside your existing tools. Whether it's CRM systems or cloud storage, our integrations enhance productivity and efficiency in document management. Explore our integrations available to maximize your workflow.

-

What are the benefits of using airSlate SignNow for the IRS Form 5768 printable form?

Using airSlate SignNow for the IRS Form 5768 printable form streamlines the eSigning process, making it simpler and faster while ensuring compliance. The platform provides a secure environment for your sensitive documents and enables easy access from any device. It's designed to save you time and improve your organization's operational efficiency.

-

Is my data safe when I use airSlate SignNow to fill out the IRS Form 5768 printable form?

Yes, data security is a top priority at airSlate SignNow. When you use our platform to fill out and eSign the IRS Form 5768 printable form, your information is encrypted and stored securely. We comply with industry standards to ensure the protection of your personal and financial data throughout the document process.

Get more for Irs Form 5768 Printable Form Pdf

- Qualification continuity form

- Of the love and affection of our volunteers form

- Rf 1037e form

- Wp3 thailand form

- 2017 vacation bible school registration form eaganhillsorg

- Machakos county public service board form

- Waiver and release of liability barefoot tubing form

- 201516 season fall only spring only form

Find out other Irs Form 5768 Printable Form Pdf

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself