Information About Form 2555EZ and Its Separate Instructions is at Www Irs

What is the Information About Form 2555EZ And Its Separate Instructions Is At Www Irs

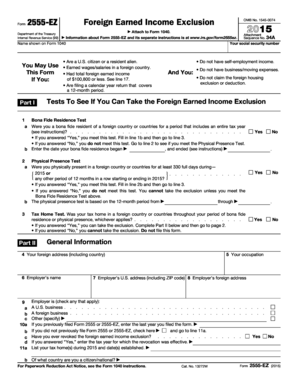

Form 2555EZ is a simplified version of Form 2555, used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This form allows eligible taxpayers to exclude a certain amount of their foreign earned income from U.S. taxation. The separate instructions for Form 2555EZ provide detailed guidance on how to complete the form, including eligibility criteria, necessary documentation, and specific line-by-line instructions to ensure accurate filing. Understanding these instructions is crucial for taxpayers wishing to maximize their tax benefits while complying with IRS regulations.

Steps to Complete the Information About Form 2555EZ And Its Separate Instructions Is At Www Irs

To successfully complete Form 2555EZ, follow these steps:

- Determine your eligibility by reviewing the criteria outlined in the instructions.

- Gather necessary documents, including proof of foreign earned income and residency.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the instructions for any specific calculations or additional information needed.

- Sign and date the form before submission.

Each step is essential to ensure compliance and to take full advantage of the benefits offered by the Foreign Earned Income Exclusion.

Legal Use of the Information About Form 2555EZ And Its Separate Instructions Is At Www Irs

The legal use of Form 2555EZ and its instructions is governed by U.S. tax law. When completed correctly, the form allows taxpayers to exclude qualifying foreign income from their taxable income. It is important to adhere to the guidelines provided in the instructions to avoid potential penalties for misreporting. The IRS recognizes eSignatures as valid, allowing taxpayers to file electronically while maintaining compliance with legal standards.

Eligibility Criteria

To qualify for the Foreign Earned Income Exclusion using Form 2555EZ, you must meet specific eligibility criteria:

- You must be a U.S. citizen or resident alien.

- You must have foreign earned income.

- You must meet the physical presence test or the bona fide residence test.

- Your foreign earned income must not exceed the annual exclusion limit set by the IRS.

Reviewing these criteria is essential to determine if you can benefit from filing Form 2555EZ.

Required Documents

When filing Form 2555EZ, certain documents are necessary to substantiate your claims. These may include:

- Proof of foreign earned income, such as pay stubs or tax returns from the foreign country.

- Documentation supporting your residency status, like a lease agreement or utility bills.

- Any additional forms required by the IRS for specific situations.

Having these documents ready can facilitate a smoother filing process and help ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for Form 2555EZ to avoid penalties. Typically, the deadline aligns with the standard tax filing date, which is April 15. However, if you are living abroad, you may qualify for an automatic extension until June 15. Always check for any updates or changes to deadlines on the IRS website to ensure timely submission.

Quick guide on how to complete information about form 2555ez and its separate instructions is at www irs

Complete Information About Form 2555EZ And Its Separate Instructions Is At Www Irs effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without interruptions. Handle Information About Form 2555EZ And Its Separate Instructions Is At Www Irs on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Information About Form 2555EZ And Its Separate Instructions Is At Www Irs with ease

- Locate Information About Form 2555EZ And Its Separate Instructions Is At Www Irs and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Information About Form 2555EZ And Its Separate Instructions Is At Www Irs and ensure superior communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the information about form 2555ez and its separate instructions is at www irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2555EZ, and why is it important?

Form 2555EZ is a simplified version of the standard Form 2555 used by U.S. citizens living abroad to claim the foreign earned income exclusion. The Information About Form 2555EZ And Its Separate Instructions Is At Www Irs provides crucial guidelines for correctly filing this form and maximizing tax benefits.

-

How can airSlate SignNow assist with filing tax forms?

airSlate SignNow assists users by allowing them to easily eSign and securely send their tax documents, including Form 2555EZ. The process is simple and efficient, enabling you to focus on understanding the Information About Form 2555EZ And Its Separate Instructions Is At Www Irs rather than cumbersome paperwork.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure document storage. These tools ensure that you can handle all the necessary documentation related to Form 2555EZ efficiently. For more details on related tax forms, the Information About Form 2555EZ And Its Separate Instructions Is At Www Irs can be consulted.

-

Is airSlate SignNow a cost-effective solution for businesses?

Yes, airSlate SignNow offers a range of pricing plans that cater to businesses of all sizes, and its affordability makes it a cost-effective solution for managing documents. This is particularly beneficial for businesses that frequently deal with forms like the Form 2555EZ. For complete guidance, remember that Information About Form 2555EZ And Its Separate Instructions Is At Www Irs is a valuable resource.

-

Are there any integrations available with airSlate SignNow?

airSlate SignNow integrates seamlessly with various business applications such as Google Drive, Salesforce, and Dropbox. This flexibility allows users to streamline their workflow when handling documents, including those related to Form 2555EZ. If you need further assistance, the Information About Form 2555EZ And Its Separate Instructions Is At Www Irs will provide additional context.

-

How quickly can I send and sign documents with airSlate SignNow?

You can send and sign documents in real-time using airSlate SignNow, making the process quick and efficient. This is especially crucial for urgent taxation documents like Form 2555EZ. You can refer to the Information About Form 2555EZ And Its Separate Instructions Is At Www Irs for timelines and submission guidelines.

-

What security measures does airSlate SignNow employ?

airSlate SignNow uses top-notch security protocols, including encryption and two-factor authentication, to protect your sensitive documents. This ensures that your tax-related forms, such as the Form 2555EZ, remain secure. For additional information on proper filing and handling, check the Information About Form 2555EZ And Its Separate Instructions Is At Www Irs.

Get more for Information About Form 2555EZ And Its Separate Instructions Is At Www Irs

- Procurement operations business card order form csusm

- Fitchburg state university transcript request fitchburgstate form

- Notice of violation of the policy on equal opportunity harassment and form

- Threshold program parent questionaire2015doc form

- Business minor declaration form

- Fort valley ga international application forms

- 2020 2021 federal verification worksheet form

- Annual resident reports american osteopathic college of form

Find out other Information About Form 2555EZ And Its Separate Instructions Is At Www Irs

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form