Idaho Nonresident Owner Agreement Pte Nroa Idaho State Tax Tax Idaho Form

What is the Idaho Nonresident Owner Agreement Pte NROA Idaho State Tax Tax Idaho?

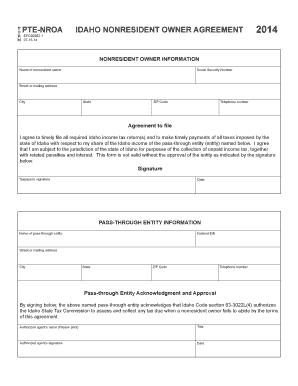

The Idaho Nonresident Owner Agreement, often referred to as the Pte NROA, is a legal document designed for nonresident owners of property or businesses in Idaho. This agreement outlines the responsibilities and rights of nonresident owners regarding state tax obligations. It is essential for ensuring compliance with Idaho tax laws and clarifying the tax responsibilities of individuals or entities that do not reside in the state but own property or conduct business there. Understanding this agreement is crucial for nonresidents to avoid potential legal issues and penalties related to state taxation.

Steps to Complete the Idaho Nonresident Owner Agreement Pte NROA Idaho State Tax Tax Idaho

Completing the Idaho Nonresident Owner Agreement involves several key steps:

- Gather necessary information, including your personal details and information about the property or business.

- Obtain the official form from the Idaho State Tax Commission or authorized sources.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed agreement for any errors or omissions.

- Sign the document electronically or in person, depending on your preference and the submission requirements.

- Submit the form to the appropriate state tax authority, either online or via mail.

Key Elements of the Idaho Nonresident Owner Agreement Pte NROA Idaho State Tax Tax Idaho

The Idaho Nonresident Owner Agreement includes several key elements that are vital for both the owner and the state:

- Identification of Parties: Clearly identifies the nonresident owner and the property or business in question.

- Tax Obligations: Details the specific tax responsibilities of the nonresident owner under Idaho law.

- Signature Requirements: Specifies the necessary signatures to validate the agreement.

- Compliance Clauses: Outlines the legal obligations and compliance requirements for the nonresident owner.

- Amendment Procedures: Provides guidance on how to amend the agreement if circumstances change.

Legal Use of the Idaho Nonresident Owner Agreement Pte NROA Idaho State Tax Tax Idaho

The legal use of the Idaho Nonresident Owner Agreement is essential for ensuring that nonresident owners comply with state tax laws. This agreement serves as a binding document that outlines the obligations of the owner regarding property taxes, income taxes, and any other relevant financial responsibilities. It is advisable for nonresidents to consult legal or tax professionals to ensure that the agreement is filled out correctly and that they understand their legal obligations under Idaho law.

State-Specific Rules for the Idaho Nonresident Owner Agreement Pte NROA Idaho State Tax Tax Idaho

Idaho has specific rules that govern the Idaho Nonresident Owner Agreement. These rules include:

- Nonresident owners must file tax returns for any income generated from Idaho sources.

- Property owned by nonresidents may be subject to local property taxes.

- Compliance with state tax regulations is mandatory to avoid penalties.

- Nonresidents may need to provide additional documentation to support their tax filings.

How to Obtain the Idaho Nonresident Owner Agreement Pte NROA Idaho State Tax Tax Idaho

Obtaining the Idaho Nonresident Owner Agreement can be done through several methods:

- Visit the Idaho State Tax Commission's official website for downloadable forms.

- Contact the Idaho State Tax Commission directly for assistance and guidance.

- Consult with a tax professional who can provide the necessary forms and advice on completion.

Quick guide on how to complete idaho nonresident owner agreement pte nroa idaho state tax tax idaho

Effortlessly Complete Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

The Simplest Method to Modify and eSign Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho with Ease

- Locate Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, link invitation, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or errors requiring the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho nonresident owner agreement pte nroa idaho state tax tax idaho

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho?

The Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho is a legal document required for nonresidents who own property in Idaho. This agreement outlines the tax obligations and rights for nonresident owners, ensuring compliance with Idaho state tax laws. Utilizing services like airSlate SignNow can streamline the process of signing and sending this important document.

-

How does airSlate SignNow assist with the Idaho Nonresident Owner Agreement?

airSlate SignNow provides an efficient platform for preparing, signing, and managing the Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho. With its user-friendly interface, users can easily upload documents, obtain electronic signatures, and ensure that the agreement is legally binding. This simplifies the management of your Idaho state tax responsibilities.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers several pricing plans to accommodate businesses of all sizes, ensuring access to the Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho. Plans vary based on features, such as the number of users and advanced document management tools. We recommend visiting their website for the most up-to-date pricing information.

-

Are there any features specifically tailored for nonresident property owners?

Yes, airSlate SignNow includes features that are beneficial for nonresident property owners dealing with the Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho. These features include customizable templates, automated reminders for signature requests, and secure storage of important documents. This ensures that tax obligations and agreements are managed effectively.

-

How secure is the signing process with airSlate SignNow?

The signing process with airSlate SignNow is highly secure, making it ideal for documents like the Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho. The platform uses industry-standard encryption and complies with various legal standards to ensure that your information remains confidential and protected. Users can sign documents with confidence knowing their data is secure.

-

Can I integrate airSlate SignNow with other software for better workflow?

Absolutely! airSlate SignNow allows integration with various third-party software applications, enhancing your workflow while managing the Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho. You can connect it with CRM systems, cloud storage services, and more, ensuring that your signing process seamlessly fits into your existing operations.

-

What are the benefits of using airSlate SignNow for tax-related agreements?

Using airSlate SignNow for tax-related agreements, such as the Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho, offers numerous benefits. It provides a quick and efficient method for document execution, reduces paperwork, and helps maintain a clear record of transactions. This is essential for meeting compliance and ensuring timely tax submissions.

Get more for Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho

- Ny ct 3 instructions form

- Filable ct 3 form

- St 100 form

- Form it 205 t2009 allocation of estimated tax payments to

- Rp 5217nyc ridge abstract form

- Form st 100619new york state and local quarterly sales and use tax returnst100

- July 2012 sales tax st 809 form

- Form mt 15 department of taxation and finance new york state tax ny

Find out other Idaho Nonresident Owner Agreement Pte nroa Idaho State Tax Tax Idaho

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe