Asset Depreciation Schedule Form

What is the Asset Depreciation Schedule

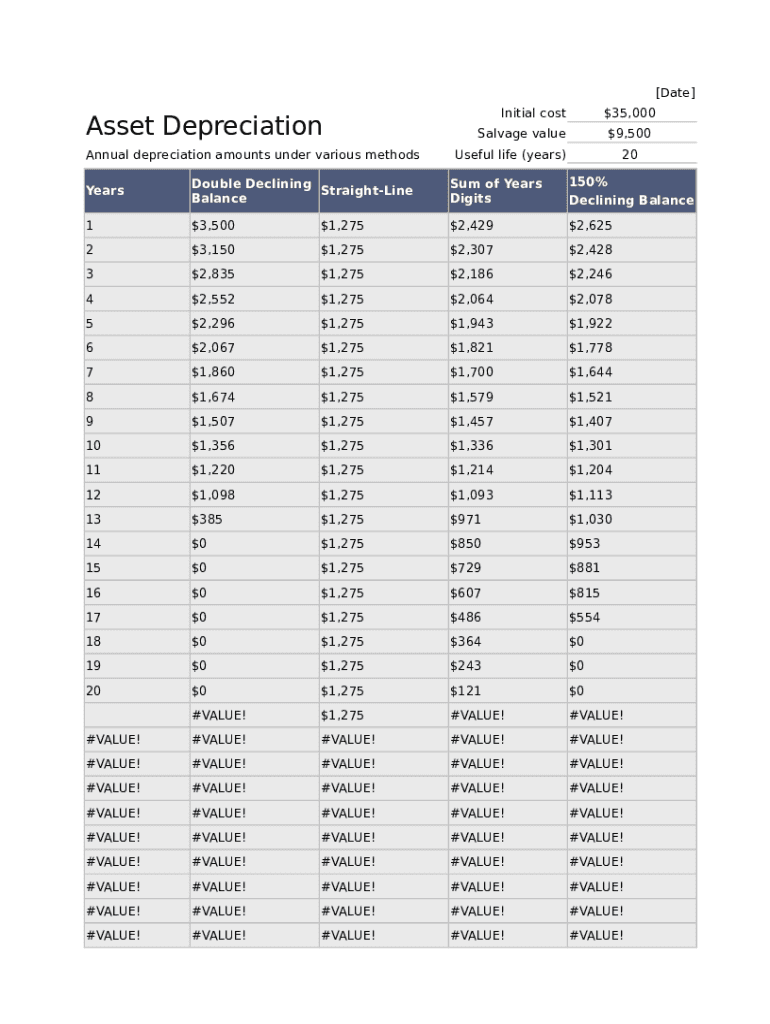

The asset depreciation schedule is a crucial financial document that outlines the depreciation of tangible assets over time. This schedule helps businesses track the reduction in value of their assets, which is essential for accurate financial reporting and tax compliance. The depreciation schedule provides a clear view of how much value an asset loses each year, allowing businesses to make informed decisions regarding asset management and replacement.

How to use the Asset Depreciation Schedule

Using the asset depreciation schedule involves several steps to ensure accurate tracking and reporting. First, identify the assets that require depreciation tracking, such as machinery, vehicles, or office equipment. Next, determine the useful life of each asset, which is the period over which the asset is expected to be used. Then, select a depreciation method, such as straight-line or declining balance, to calculate the annual depreciation expense. Finally, regularly update the schedule to reflect any changes, such as asset disposals or acquisitions, ensuring that your financial records remain accurate.

Key elements of the Asset Depreciation Schedule

An effective asset depreciation schedule includes several key elements to provide comprehensive information. These elements typically consist of:

- Asset Description: A brief description of the asset, including its type and purpose.

- Acquisition Date: The date when the asset was purchased or acquired.

- Cost: The initial cost of the asset, including any additional expenses related to its purchase.

- Useful Life: The estimated duration for which the asset will be in service.

- Depreciation Method: The method used to calculate depreciation, such as straight-line or declining balance.

- Annual Depreciation Expense: The amount of depreciation allocated to each year.

- Book Value: The remaining value of the asset after accounting for depreciation.

Steps to complete the Asset Depreciation Schedule

Completing the asset depreciation schedule requires careful attention to detail. Follow these steps for accurate completion:

- List all assets that require depreciation tracking.

- Gather necessary information, including acquisition dates, costs, and useful lives.

- Select an appropriate depreciation method for each asset.

- Calculate the annual depreciation expense based on the chosen method.

- Update the schedule regularly to reflect changes in asset status or value.

Legal use of the Asset Depreciation Schedule

The asset depreciation schedule must comply with various legal requirements to ensure its validity. In the United States, businesses must adhere to IRS guidelines regarding depreciation methods and reporting. Proper documentation of depreciation is essential for tax purposes, as it affects taxable income. Maintaining an accurate and up-to-date schedule can help avoid potential legal issues and penalties related to improper reporting.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines on how to handle asset depreciation. These guidelines outline acceptable depreciation methods, such as the Modified Accelerated Cost Recovery System (MACRS), which is commonly used for tax purposes. Businesses must also be aware of the limitations and requirements for claiming depreciation on their tax returns, ensuring compliance with federal tax laws. Regularly consulting IRS publications can help businesses stay informed about any changes in regulations.

Quick guide on how to complete asset depreciation schedule

Effortlessly complete Asset Depreciation Schedule on any device

Managing documents online has gained traction among enterprises and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Manage Asset Depreciation Schedule across any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to modify and electronically sign Asset Depreciation Schedule with ease

- Locate Asset Depreciation Schedule and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that function by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes merely seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method to deliver your form: by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Asset Depreciation Schedule to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the asset depreciation schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an asset template form in airSlate SignNow?

An asset template form in airSlate SignNow is a pre-designed document that streamlines the process of collecting signatures and important information related to assets. This feature allows businesses to efficiently manage asset-related paperwork while ensuring compliance. By utilizing an asset template form, users can save time and minimize errors in document handling.

-

How can I create an asset template form?

Creating an asset template form in airSlate SignNow is straightforward. You simply need to log into your account, navigate to the template section, and select 'Create New Template.' From there, you can customize the fields according to your asset management needs and save it for future use.

-

Is there a cost associated with using asset template forms?

airSlate SignNow offers various pricing plans, each providing access to asset template forms among other features. While you can start with a free trial to explore its capabilities, continuing use beyond that period will require selecting a suitable plan that fits your business needs. The investment is typically justified by the time savings and efficiency gained.

-

What are the benefits of using asset template forms?

Using asset template forms in airSlate SignNow offers numerous benefits including improved efficiency in document processing, error reduction, and enhanced compliance. These templates standardize the asset documentation process, making it easier to share and collect necessary information. Ultimately, they help businesses operate more smoothly and effectively.

-

Can asset template forms be integrated with other tools?

Yes, airSlate SignNow supports integrations with various tools and platforms, allowing asset template forms to streamline your workflow across different systems. Popular integrations include CRM software, cloud storage services, and more. This enables seamless access to your asset documents and enhances overall productivity.

-

Are asset template forms secure?

Absolutely! Security is a top priority for airSlate SignNow. Asset template forms are protected with industry-standard encryption and comply with legal regulations. Your sensitive asset information remains confidential and secure throughout the signing process.

-

Can I customize my asset template forms?

Yes, airSlate SignNow provides extensive customization options for asset template forms. You can tailor fields, layouts, and branding to suit your organization's needs. This level of personalization ensures that your asset documentation reflects your business identity and requirements.

Get more for Asset Depreciation Schedule

Find out other Asset Depreciation Schedule

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement