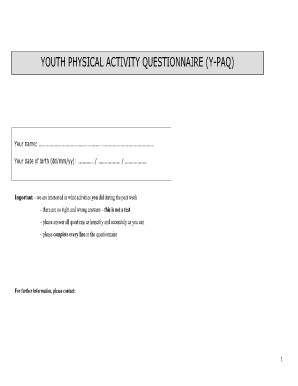

Ypaq Form

What is the Ypaq

The Ypaq form is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals or businesses to report certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and is often required for various financial transactions. Understanding the Ypaq is crucial for anyone involved in tax reporting, as it helps facilitate accurate and timely submissions to the IRS.

How to use the Ypaq

Using the Ypaq form involves several straightforward steps. First, gather all necessary financial information, including income details, deductions, and credits relevant to the reporting period. Next, carefully fill out the form, ensuring that all entries are accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the Ypaq form to the IRS through the appropriate channels, which may include online submission, mailing, or in-person delivery, depending on your preference and the specific requirements of the form.

Steps to complete the Ypaq

Completing the Ypaq form can be broken down into several key steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Fill out the form accurately, making sure to provide all required information.

- Double-check your entries for accuracy, ensuring there are no mistakes.

- Sign and date the form, as required, to validate your submission.

- Submit the completed Ypaq form to the IRS by the designated deadline.

Legal use of the Ypaq

The Ypaq form must be used in accordance with IRS guidelines to ensure its legal validity. This includes adhering to all filing requirements and deadlines set forth by the IRS. Proper use of the form helps prevent issues such as audits or penalties for non-compliance. It is essential to understand the legal implications of submitting the Ypaq, as any inaccuracies or omissions can lead to significant consequences for the filer.

Key elements of the Ypaq

Several key elements are crucial to the Ypaq form, including:

- Identification information: This includes the taxpayer's name, address, and Social Security number or Employer Identification Number.

- Financial details: Accurate reporting of income, deductions, and credits is essential for compliance.

- Signature: The form must be signed and dated by the taxpayer to validate the submission.

- Submission method: Understanding how and when to submit the Ypaq is important for meeting IRS deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Ypaq form can vary based on the specific tax year and the taxpayer's situation. Generally, individual taxpayers must submit their forms by April 15 of the following year. However, extensions may be available under certain circumstances. It is important to stay informed about these deadlines to avoid penalties and ensure compliance with IRS regulations.

Quick guide on how to complete ypaq

Prepare Ypaq effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Ypaq on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Ypaq without hassle

- Obtain Ypaq and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ypaq to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ypaq

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ypaq and how does it benefit my business?

Ypaq is an innovative tool offered by airSlate SignNow that streamlines the document signing process. By utilizing ypaq, businesses can enhance efficiency, reduce turnaround time, and simplify their workflows. This solution allows for seamless eSigning, which can signNowly improve productivity.

-

How much does ypaq cost?

The pricing for ypaq varies based on the specific needs of your business. airSlate SignNow offers flexible pricing plans that cater to different scales and functionalities. You can choose a plan that best fits your budget and requirements, ensuring you get the most value out of ypaq.

-

What features does ypaq offer?

Ypaq comes with a range of features designed to simplify eSigning and document management. Key features include customizable workflows, the ability to send documents for signing, and robust security measures. These features make ypaq an efficient choice for businesses looking to optimize their document processes.

-

Can I integrate ypaq with other software?

Yes, ypaq seamlessly integrates with a variety of other business software and applications. This includes CRM systems, cloud storage solutions, and productivity tools, making it easy to incorporate ypaq into your existing workflows. By integrating ypaq, you can enhance your team's efficiency and collaboration.

-

Is ypaq suitable for small businesses?

Absolutely! Ypaq is designed to meet the needs of businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal choice for smaller operations looking to streamline their document signing processes without compromising quality.

-

How secure is ypaq for eSigning documents?

Ypaq prioritizes security and compliance, ensuring that all eSigned documents are protected. The platform utilizes advanced encryption and verification methods to safeguard sensitive information. With ypaq, you can eSign documents confidently, knowing that your data is secure.

-

What are the benefits of using ypaq for document workflows?

Using ypaq can signNowly enhance your document workflows by improving efficiency and reducing manual errors. Businesses often experience faster turnaround times and better tracking of document statuses with ypaq. The overall benefit is a smoother, more organized process for managing and signing documents.

Get more for Ypaq

Find out other Ypaq

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template